Our Blog.

The Early Bird Catches the Worm

$20K Instant Asset Write-off bill has become law

Parental Leave Gets a Boost for New Parents (Starting 1 July 2025)

Do you have an upcoming business trip? Here’s a tax outlook to make it easier

Confused about whether you need to pay superannuation for your contractors?

Boost your Nest Egg: Super contribution caps are increasing from 1 July 2024

The Crucial Timing Aspect Of Restructures

Restructuring Discretionary Trusts: Key Facts

Has your business been impacted by the South Queensland Severe Storms and Rainfall?

The Worst Business Structure Revealed

Seize Cashbacks Before They Disappear

How To Avoid A Division 7A Loan Disaster

The Reason Why Division 7A Loans Exist

The Benefits Of Secured Division 7A Loans

Potential Good News For Mortgage Owners

Lenders’ Early Offers Vs. Brokers’ Tactics

How To Escape The Mortgage Prison

Additional tax compliance requirements for professional firms

Running a home-based business from a company or trust?

Typical Properties For SMSF Loans

Paid Family and Domestic Violence Leave

The Key To Mapping Your Vision

How Bookkeeping Can Save You Money, Time And Improve Your Business

Small Business Energy Incentive

Stop Wasting Time On $25 An Hour Tasks

Why Lodging Your BAS On Time Is Important

Choosing The Right People For Your Business

Pay Super At The Same Time As Wages

The Final ATO Ruling Affecting Trust Distributions

How To Cut Energy Waste And Save Money

Your Last Chance To Carry Back Business Losses

Finding Balance Within Profit Allocation Rules

Don’t Miss Out On These Tax Benefits

Tax Planning 2023: How to Keep More of Your Money with Legal Tax Strategies

The New Tax Strategy For EV Buyers

Eligibility Criteria For Training Tax Deductions

Family Business Distribution Rules Explained

Get 20% Extra Tax Deduction On Tech Expenses

Why I Will Probably Never Retire

Margin Scheme – A Brief Overview

Great Tax News For Businesses & Individuals

Write Off Bad Debts To Reduce Tax

Ben Walker Gives Tips For Sustainable Success

How Do Banks Calculate Buying Capacity?

Is A Budget The Same As A Forecast

Should I Put My Home Into A Trust?

The Company Business Structure Explained

How To Add Subscription Cost To Xero

What To Look For When Investing

Why Trusts Are Great For Tax Planning

Modernisation of PAYG instalments

The Impact Of Money Printing On Investors

Every Business Owner Should Have This

Save Tax With A Motor Vehicle Logbook

How To Make Your Employees Work Efficiently

How to convert Website traffic into leads?

Buying Commercial Property SMSF | Inside and outside Super

Tracking Crypto Transactions For Tax

Tax Warning For Crypto Hobbyists

Don’t Make This Crypto Mistake

Crypto: Capital Vs. Revenue Accounts

Can Your SMSF Invest In Crypto?

Can You Delay Crypto Tax Bills?

The 1st Step Of A Killer Digital Strategy

6 Tips To Reduce Your Crypto Tax

Why Your Business Needs Professional Photos

6 Steps To Research Your Competitors

Reasons Every Business Need A Website

The BAC Grant – What’s The Catch?

The Power Of Your Magic Number

How To Protect What You’re Building

FBT Exemptions For Work Christmas Parties

Work Christmas Parties and FBT – What You Need To Know

It’s Not What You Sell, It’s What You Stand For

What To Watch Out For With Family Funds

Pros & Cons Of Paying Insurance Through Super

How Your Super Compares To An SMSF

How To Create An SMSF Investment Strategy

5 Things To Know About Estate Planning

The 3 Key Aspects Of Incapacity Planning

The Cost of Setting Up A Company Structure

Risk-Takers & Asset Holders Explained

Why Division 7A Was Brought In

When Is A Bucket Company Worth It?

Taking Money Out Of A Company Vs A Trust

Short Term Solutions For Division 7A

Medium Term Solutions For Division 7A

Long Term Solutions For Division 7A

How Does An Offset Account Work?

What Are Your Lending Options Inside Super?

The Process Of Buying Commercial Property

4 Business Structures Explained

Distributing Money To Retired Parents

Tips To Pay Yourself From A Trust

The Secret To Hitting Your Weekly Magic Number

How to Distribute To A Loss-Making Entity

The 4 Bank Accounts Every Business Needs

Managing Multiple Bank Accounts In Xero

How To Save Tax & Boost Your Super

The Rules For Giving To Churches Vs. Charities

Minimise Tax With A Bucket Company

4 Categories Of Risks To A Business

Benefits Of A Self Managed Super Fund

The Pty Ltd Business Structure Explained

Draw Vs. Loan – What’s The Difference?

The Cons Of Being A Sole Trader

Are You Running A High-Risk Business?

Differences Between Dividends & Distributions

Can A New Business Sponsor A Visa?

How To Pull Money Out Of A Company

Should You Apply To Multiple Banks For Funding?

Why Growth Is The Most Vulnerable Stage

Will Banks Loan 100% Of The Purchase Price?

The 1st Thing Banks Look At When You Apply For Funding

The #1 Issue With Structure & Asset Protection

What Do Banks Think About Vendor Finance Agreements?

The 3-Step Process In A 482 Visa

How Do Finance Providers Approach Pre-Purchase Structuring?

Which Industries Have High Funding Potential?

5 Types Of Employer Sponsored Visas

Can You Get A Loan For A 6-Month Old Business?

Do This To Prevent Late Payments From Clients

The 2 Main Ways To Manage Purchase Structures

What You Must Know About CapEx

How To Reduce Personal Liability As A Director

How Border Closures Affect Workforce Participation

Time Frames For Funding Transactions

The Importance Of Protecting IP

What Do Bankers Look For In A Business Plan?

How Banks Determine Capacity For Funding

What Costs Are Involved In Acquiring A Business?

An Update On Our Big Hairy Audacious Goal

What Is The Fortify Methodology?

Most Lawyers Won’t Talk About This

The Risks Involved In Purchasing Business

Creditworthiness Vs. Business Value

Different Ways To Value A Business

Is A Novated Lease Right For You?

The 2 Main Ways To Purchase A Business

How To Approach Exclusivity In Acquisitions

This Is How Banks Look At Funding

The Importance Of Knowing Your Numbers In Detail

Winter Is The Season Where Millionaires Are Made

The Rules For Claiming Meal Expenses

The 5 Keys To Total Financial Control

The Acquisition Process – Deal Flow

How Does A Bucket Company Work?

The 3 Ways To Play The Game Of Business

Why 8-Figure Entrepreneurs Often Hate Their Business

Why You Have To Understand Your Cash Flow Days

3 Reasons For SMEs To Consider Acquisition

What You Need To Know About Car Allowances

What Are The New Criteria For Loss Carryback?

Do You Have Multiple “Teams” Of Income?

Chattel Mortgage Vs. Finance Lease

Can You Delay Assets If You’ve Only Made A Minimal Profit?

Interest Rates In Asset Finance Are On The Rise

Why Every Business Needs A War Chest

Why Businesses Stay Stuck In The Startup Phase

The #1 Challenge For Most Entrepreneurs

Let’s Talk About The Tax Impact Of Covid Stimulus Measures

How To Know If Your Product Will Sell

The Wrong Business Structure Will Eat Into Your Profits (Sharon Cliffe Podcast)

The 2 Ways To Treat Business Purchases

What Should You Track In A Logbook After Buying A Car?

Federal Budget: Key Details About Downsizer Contribution

Tax Tip: Pay Employee Super Early

Federal Budget: Low To Middle Income Tax Offset Extended

Tax Tip: Salaries Paid To Business Owners

Federal Budget: Can A Couple Sell Their 10+ Year Home Into Their SMSF?

Federal Budget: The Extension of the Company Loss Carry Back

Get Your Approval & Order Your Assets NOW

Federal Budget: Updates On The Temporary Full-Expensing Measures

Tax Tip: Keep A Motor Vehicle Logbook

Federal Budget: Important Changes To The Child Care Rebate Cap

Tax Tip: Ensure Family Members Are In The Same Tax Bracket

Federal Budget: This Superannuation Change Is Pretty Amazing

Federal Budget: Super Limits Are Changing

What’s A Good Rainy Day Number To Have?

Tax Tip: Repairs And Maintenance

We Want To Save Our Clients $2.1 Million In Tax In 2021

Tax Tip: Update Your Trust Deed

2021 Tax Rates For Individuals Vs. Companies

Tax Tip: Amazing Power Of Bucket Companies

Cut Your Tax Bill In Half With Tax Planning

The 4 Savings Accounts Every Entrepreneur Should Have

Practical Ways To Improve Your Cash Flow Days

The Importance Of Financial Forecasting

How To Increase Your Business Value

What The Plot Twist Of 2020 Really Taught Us

How To Avoid Trouble With The ATO

A Lot Of Businesses Make This Bookkeeping Mistake

The #1 Way To Keep Track Of Your Cashflow

Daily, Weekly, Monthly & Quarterly Reports

How To Calculate Your Magic Sales Number

What Is An Ungeared Unit Trust?

The Most Important Number To Know In Business

‘You Get What You Pay For’ Also Applies To Bookkeepers

Tax Structures Of Business vs Capital Developments

Watch This If You’re Afraid Of Doing Your Taxes

5 Things Business Owners Need To Know Before Getting Into Property Development

High-Level Structures For Tax Efficient Property Development

What You Need To Know About Land Tax

3 Ways To Fund Property Development

4 Key Points About Development In A Discretionary Trust

What’s The Maximum Number of Unit Holders We Can Have?

How Much Money Do You Need To Start An SMSF?

Hired a new employee since 7 October 2020? You could be eligible for $200 per week!

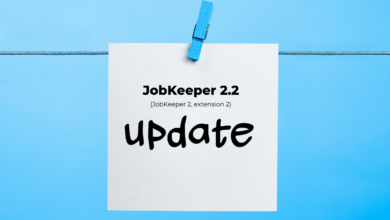

Update on JobKeeper 2.2 (JobKeeper 2.0, extension 2)

How We Track Our Marketing Results With The LAPS Method

The #1 Piece of Advice We Got From Gary Vee

Finding It Hard To Pay Your BAS On Time?

Do You Take 12 Weeks Off A Year From Your Business?

The Truth About How Much Time We Spend On Marketing

Track & Grow Your Wealth With The New Inspire App

The Documentation You Need To Pass On Your Wealth

How We Turn 1 Webinar Into 50 Pieces Of Content

How To Create An Automated Household Budget

Need To Change Accountants? Why Now Is The Best Time

4 Steps To An Effective Business Budget

The First Step In Creating Wealth for Life

How To Review Your Profitability In Xero

Our Daily Content Planning System Revealed

Why Estate Planning Is Not ‘Set and Forget’

3 Key Tips To Start Your Rainy Day Fund

Are You Making An Operating Profit Without The Stimulus Measures

Why You Don’t Have To Spend 10K on A Wealth Creation Course

How To Protect Yourself Against Health Incidents

The #1 Question To Ask At The End Of 2020

A Quick Overview Of The Federal Budget Update

4 Types Of Investments To Grow Your Wealth

Intellectual Property & The Immediate Asset Write Off

The 5 Bank Accounts You Need To Stay In Control Of Your Finance

Claiming Depreciation On An Office Fit-Out

Is there any tax on transfer of listed shares to the SMSF?

Why You Should Setup A Slush Fund

Can You Only Withdraw Profit From SMSF After You Turn 60?

Use Your SMSF To Become and Angel Investor

Buying Commercial Or Residential Property In Super?

Can You Access Part Of Your Super for Short Term Business Cashflow?

How to Save $5,500 A Year With One Simple Change

The Rules For Lending Money With Your SMSF

Why You Should Never Set Up An SMSF Without A Corporate Trustee

What You Need To Realise Before Setting Up An SMSF

Is It Hard To Get Finance In An SMSF For Share Or Property Purchase?

How To Get Your Business Ready for After JobKeeper

Can I contribute more money to my SMSF than my $25,000 annual contribution?

When Does It Make Sense To Set Up An SMSF?

FBT Red Tape Reduction Explained

Which Employees Are Eligible For the JobMaker Hiring Credit?

What You Need To Know About The JobMaker Hiring Credit

The Small Business Pool Write Off

Changes To The Immediate Asset Write Off

Is Your Company Eligible For Up To $200/wk/employee JobMaker Hiring Credit?

Can we operate a business from Super?

Practical Steps for JobKeeper 2.0 – to do before end of this month

What’s the difference between a salary and a drawing?

Why Property Development In Super Is So Attractive

Important Details About The 20-hour Test For Employees

Save Money With These Super Fund Strategies

Are JobKeeper Contributions masking concerning statistics in your business

Why You Need Separate Bank Accounts For Your Personal And Business Finance

What You Need To Consider When Setting Up A Family Trust

Do you have a seperate account for irregular bills to prevent financial strain?

How To Review Your Annual Leave Balances In Xero

Asset Protection Options For Business Owners

Set Up A System To Save Money On AutoPilot

JobKeeper 2.0 Payment Changes You Need To Know About

How To Claim Tax Deductible Donations With Churches or Charities

How To Cut Your Tax Bill Through Super

Interesting Statistics About The Impact Of JobKeeper

The Difference Between Businesses That Succeed And Those Who Fail

A Quick Self Assessment To Find Out How Your Business Is Doing Without The Stimulus Measures

Simple Tweaks To Your Business Can Have A Massive Financial Impact

JobKeeper 2.0 – Employment Date 1 July

JobKeeper 3.0 – Update 7 August

JobKeeper 2.0 – What’s changed?

JobKeeper 2.0 – Restructuring Your People For After JobKeeper

$7.5M worth of help – Client Success Stories From A Tough Quarter

Are you properly protecting your personal assets?

2 Key Pieces of Advice For SME Businesses in this Challenging Time

How To Cut Down Expenses In Your Business

JobKeeper: The Distinction Between Business Participants & Employees

Critical Reasons to Stay On Top Of Your Bookkeeping

Buying a car with the $150,000 instant asset write off

Can you appeal a knock back for Cashflow Boost if you believe you’re eligible?

Pass One of These Alternative Tests To Qualify For JobKeeper.

What Happens If You Get Bookkeeping Wrong

Penalties For Illegally Claiming JobKeeper Benefits

JobKeeper Monthly Reporting Requirements

Legal Options That Can Save Your Business

Should You Break Out Of Your Fixed Interest Rate?

The Employee Consultation Process – Is not just about ticking boxes

Mind-Blowing Bank Offers Available Right Now!

How To Get The Best Out Of Your Team During COVID-19

Don’t Make This Big Mistake When you apply for JobKeeper

Monthly Reporting Requirements for JobKeeper

Bucket Companies: The least known and most underutilised strategy to save thousands in tax

Bucket Companies: The least known and most underutilised strategy to save thousands in tax

JobKeeper: Do I Need to Pay Super?

JobKeeper Programme: Extensions Announced

JobKeeper: Do I Pay Employees I Stood Down?

JobKeeper: Do I Need to Pay Employees First?

JobKeeper: URGENT Before 30 May (updated)

Happiness is a number between 1 and 10. What’s yours?

Would you like to pay by the hour or by the result? Let’s focus on saving money not charging fees

The Real Cost of Cars – A CBD carpark, yours for $407K. It all counts…

Saying “No” to Necker? First World solutions to third world problems

5 Ways To Deal With An Unexpected Tax Bill

Setting Up Single Touch Payroll on Xero – Client Webinar

Paul Dunn: The 3 L’s That Determine Your Legacy, And How You Can Leverage it To Do Good

Sarah Riegelhuth On Helping Millennials Become Financially Free & How To Manage A Remote Team

7 mistakes keeping business owners struggling for cash

SAVE $500,000 TAX | Accounting that pays for itself

Tax on Bitcoin and Cryptocurrency

3 Steps to Transition to Cloud Accounting

5 Questions to Plan for Profit in 2016 qu. 2

5 Questions to Plan for Profit in 2016 1

5 Questions to Plan for Profit in 2016 qu. 3+4

5 Questions to Plan for Profit in 2016 qu 5

5 Questions to Plan for Profit in 2016 conclusion

Business’ Giving Insight Shedding light on the effect of sharing the wealth

Inspired to blur the line between the haves and the have-nots

Media Release 24 November 2016 Finally! Accounting is cool again

Plan for Profit in the New Year intro

Price doesn’t drive cost – Little Creatures $ pint

Why the Accounting Industry is headed for Disaster

5 x GAME CHANGING TOOLS TO HELP MAKE 2018 YOUR BEST YEAR YET

SAVING $8,000 A MONTH BY BUYING AN OFFICE (IN OUR SMSF)

Australia’s Most Impactful Accounting Firm

It’s my bet bigger businesses will overpay millions in tax this financial year

Are housekeepers Tax deductible?

$5M Profit Tax Free? | Selling your business without selling your soul to the ATO

50 ways to Save Tax & Keep More of Your Hard Earned Cash | Checklist

Paying little, less or no tax when you sell a business or large investment

The best tax outcome for Putting Money away for the Children

The top 9 Tax Planning strategies for High Income Employees

Lease Incentives: Should I take it as a fit out or rental reduction?

IS YOUR CURRENT ACCOUNTANT A DINOSAUR?

Could You Do With Some More Business?

Your online guide to making BAS work for you

Risks and assets – gotta keep ‘em separated! How to keep what’s yours

The truth about your P&L. Numbers never lie

Before you pay too much tax this year… A second opinion may save you

6 Reasons cash rich business owners take time out

Adam Houlahan – LinkedIn Secrets!

The answer is always Xero. Take this quick quiz to see if you could improve the way you work

Pay it again, Sam. The joys of recurring revenue

Is your Accountant making or taking your money? Cashed Up Business Q&A pt 2

Are you up or are you down? It’s time to check the scoreboard… if you have one

Knowing your number is one thing, here’s how to hit it. Cash Rich Business cash flow Q&A pt 1

Don’t be surprised by your profits. Plan to nurture and grow your earnings

Don’t spend it all at once. A cash rich business takes care of tomorrow, today!

Stop trying to squeeze blood from a stone. A cash rich business concentrates on creating value

Ah, well there’s your problem – you work too hard. It’s time to take a chainsaw to your workload

Build a business built to last. Cash Rich Business tip #2 – Get your structure right!

Building a Profit War Chest and save your Business

The 10 minutes that could save you hundreds every month. Get ready for the Autumn “spring clean”

3 reasons your original purpose can determine your future

Leading the way to more time with family. You can’t be all things to all people – so why try?

The accidental tax (over)payer. Are you really going to tip the ATO?

Ensure your risk pays off… regularly. Funding the founder is only fair

We’re going to save our clients, $1m in tax… again!

A lean business is a healthy business. Keep fit year round

Compound interest cuts both ways. Kill your debt before it kills you.

The Sheeran School of Business Success. Because talent is very rarely enough

Thinking BIG will save your business pt 1 – think structure, save $$$

Avoid the “vanity” lease and preserve your profits

Breaking even is the new Breaking Bad. It seems okay… until…

6 Reasons to book your holiday right now!

Share your brain or feel the pain. How to avoid insulting business valuations and low-ball offers

How much do you want for your business?

Profits are down soooo… do I take a pay cut? The “business $100 note” can save you from yourself

Stay focused on your area of focus

Numbers get bored too. Time to put them to work!

How to make a memorable weekend

The agony of almost making it to the end of the month. Cashflow catastrophes and how to avoid them

In Trusts we trust. Another way to make sure you pay enough tax and nothing more

Recognise! Celebrating milestones is not only fun but functional

The Magic that makes a better lifestyle

And now for the (very) good news. Wine is tax deductible

I have a pool so now I can buy an office – smsf magic trick #31

The motivational benefits of knowing your numbers

Before we go… You’re not a bank, so don’t act like one

(Facebook) friends don’t let friends pay through the nose

We liked this… Take your work home with you… and leave it there

Paleo, vegan or Proprietary Limited? Let the numbers be your guide

What does a healthy business look like?

Before we go… I’ll have the steak, extra fries, hold the tax

Protecting your home: What’s yours is yours – let’s keep it that way!

Stop what you’re doing and learn how to stop procrastinating

Simon says, “dopamine is dope”

BAS Webinar: How to turn a BAS Deadline into a Business Lifeline

Autumn’s coming – enjoy the sun, embrace the cloud

The horrors of getting your numbers wrong: Today’s BAS webinar can help you get it right

Will “Siri” get done for tax evasion?

Concentrate on Concentration: Deliver more value and you’ll earn dollars

Why didn’t coalmine canaries have fitbits?

…and here’s the other half of your success formula

Little (coffee) shop of horrors (part two)

Little (coffee) shop of horrors (part one): Numbers never lie

Saying No to Necker? (part one)

Things to think about when thinking about payment terms

WARNING: The more things change the more they stay the same unless…

How to avoid partnership PANIC!

Driving your business: A car for you or your business?

The art of making the weekends count

Make it Rain. Invest in Multiple Buckets. Create automatic cash flow.

Make it Rain. Get a Bigger Bucket. Generate repeat business

Make it Rain. Fill the bucket. Attract more customers.

Make it Rain. Control the tap. Get paid faster.

Make it Rain. Stop the leaks. Take back control of your money

Make it Rain – 5 step plan to make your business work for you

How a Baseball team used Numbers to Win

Self Managed Super Funds vs Retail Super? A Warning…

What’s Your One Number to Focus on in Your Business?

Opportunities can’t tell the time

Paying too much Tax? How to know and what to do about it.

Hiring your first employee – 6 Common Questions

The Bottom Line series – 5. Parkinson’s Law, Dinner Plates, & Toilet Paper.

The Bottom Line series – 4. Commonly asked questions Building a Cash Rich Business

The Bottom Line series – 3. Benefits of becoming a Cash Rich Business

The Bottom Line series – 2. How to build your Profit War Chest

The Bottom Line series – 1. Logic vs Human Behaviour

Creating a good culture starts with YOU.

The ugly truth about TIMESHEETS

How To Stay Motivated & Achieve Your BIG Goals

How To Set Company Goals That Your Whole Team Will Buy Into

4 Game-Changing tips on ‘How To Maintain Focus’

How To Create More Time In Your Day!

How To Use Facebook Groups To Increase Referrals And Retain Your Best Clients

Stop Procrastinating! 2 Quick Tips To Help You Stay On Task

Are Coffee Meetings Tax Deductible?

Increase your profit by mastering this little known economic principle…

Negative Profit – why this is bad, and what to do about it?

How much do I need in super to start an SMSF?

Risky business – Dangers of Sole Traders, Partnerships & ABNs as Business Structures ??

Are you smoking away all your profits?

Bookkeeping; how to know if you should be doing your own… ?⏳⌛️?⚖

How to build your ‘Numbers’ A-Team ??

Pay Less, Little and No Tax in SMSF. It’s legal.

9 New Financial Year Resolutions you should make today

Save $500,000 tax campaign – $1.26M saved, 62 Families, 3 months.

Why Business Owners Need To Take Holidays, 8 to 12 weeks a year ⛷⛵️

Why Business Owners Need To Take Holidays, 8 to 12 weeks a year ⛷⛵️

Welcome Jake to the Inspire Team

What’s difference between Salary and Profit? And how to get more of both…

Congratulations to the #InspireFamily aka clients of Inspire CA.

THANK YOU PHIL – A year of NEW beginnings!

12 STRATEGIES FOR BUSINESS OWNERS TO SAVE $20,000+ TAX

Entrepreneurs Of Brisbane – Ezra Taylor

Time Your Capital Gains – Hold for 12 months & Sell in a low income year.

Accelerated Asset Depreciation – 100% deduction NOW if it’s under 20 k.

Pay your employee super payments 1 month early to get 10 months of additional cashflow

Pay your Life Insurance premiums from Super – and get double tax benefits.

Top sales advice from one of top 5 Sales Professionals worldwide (fitness industry)

Make Additional Super Contributions – Tax Planning Strategies to action prior to 30 June

Distribute to your Children Under 18 – Tax Planning Strategies to action prior to 30 June

Write Off Bad Debts – Tax Planning Strategies to action prior to 30 June

DISTRIBUTE INCOME TO RETIRED PARENTS (& IN LAWS!)

Make it Rain by stopping the leaks

#AccountingAnswers What is a Car Fringe Benefit?

Ben Love, Father, Businessman and Hero

Introducing Pedro Alcobio, owner of The Health Place

Want to meet the man himself – Phillip Di Bella?

Collaboration Not Competition: a tale of 2 candles 07 Mar Uncategorized Author: Ben Walker

Accounting Answers: How Can I Buy a Commercial Property?

#Accounting Answers: Self Funded Retirees

#Accounting Answers: Review How You Pay Yourself

5 of the Most Powerful & Under-utilised Facebook Strategies (Brett Campbell)

Book Review: Legacy – What the All Blacks can teach us about the business of life.

SMSF Myths Busted! Self Managed Superannuation Funds

Book Review: The Four Hour Work Week – Escape the 9-5, Live Anywhere and Join the New Rich.

8 ways to know if you can afford to hire your next employee – Part 2 of 2

#AccountingAnswers – Is donating to charity tax deductible?

Famous Fashion Blogger opens Fashion Boutique

If 10x Business Growth is on the 2016 agenda, read this today.

8 ways to know if you can afford to hire your next employee – Part 1

#AccountingAnswers – Claiming GST on a new car

Collaboration queen makes career out of passion

[Book Review] Do Cool Sh*t: Quit your day job. Start your own business. Live happily ever after.

Book Review: Daring and Disruptive: Unleashing the Entrepreneur by Lisa Messenger.

Give your Super a Boost! Buy a commercial property (via SMSF) and rent it from yourself.

HAPPY BIRTHDAY INSPIRE! Our own start up story, told for the first time.

#AccountingAnswers – Help! My Cashflow is Killing Me

Book Review: BUILD TO SELL by John Warrillow – Create a business that can thrive without you

Book Review: The Virgin Way – How to listen, learn, laugh and lead

Book Review: REWORK – Change the way you work forever

Book Review: CREATIVITY INC: Overcoming the unseen forces that stand in the way of true inspiration.

Book Review: CREATIVITY INC: Overcoming the unseen forces that stand in the way of true inspiration

Hummingbird House: Supporting a Hospice, for Children

[Photo Diary] Inspiring Business Event: Meet & Greet with Top Entrepreneurs of Brisbane.

[Photo Diary] Inspiring Business Event: Meet & Greet with Top Entrepreneurs of Brisbane

The secret recipe to breaking down Big Scary (and Hairy) Audacious Goals into bite sized chunks!

How to set company goals that your whole team will buy into

Bring your game into the New Year: Michael Jordan knows his numbers

How to Plan for Profit in 2016

Benefits of having a trust own the shares in your company

Need to Improve Your Christmas Cashflow? Holiday in Peace!

Business Structure Advice: Are you in the Right One?

[infographic] What’s Your Working Capital Timeline telling you?

[infographic] What’s Your Working Capital Timeline telling you?

Brisbane Junior Chamber of Commerce Speaking Resources 19 March 15

Sick of being a ‘One Sale Wonder’? How else can you serve your customers?

Build your business on the rock vs on the sand

The Age of Engagement – Internet Marketing Evolution

5 Language Lessons all Businesses can Learn from Optus

5 Business Trends That Are Already Shaping Your Business and Determining Your Profits

3 Speaking Rituals Entrepreneurs can use before Public Speaking

CAANZ Brand Ambassador – A Hub for Innovation in Brisbane

Hiring Smart: How to build your team for growth

Chewing the Fat: When are Meals Tax Deductible to a Business

Choosing An Accountant: 10 Questions to ask when looking to Change Accountants

New Years Resolution: 5 Urgent Reasons to Change Accountants in 2015

Don’t Break the Chain: How Jerry Seinfeld measured success

You’re Killing Conversion: Why you should stop doing Quotes in Xero

Plan for Profit 2015 – Webinar Replay

Plan to Profit 2015 – Holiday Reading List

3 Numbers to focus on when it comes to Websites

Taking the ‘Numb’ out of Numbers – Brisbane Business News

[Award] Brisbane Young Entrepreneur of the Year 2014 Finalist

To Increase Cash Flow: Know Your Working Capital Days

Can I claim the kitchen sink? Do’s and Don’ts for Home Office Deductions

How Do I Pay Myself From My Company or Trust?

Why you should eat a GST Free Diet with one of Anthill’s 30 under 30, Mr Ben Walker – Bond Appetit

Business Structuring Made Easy! Part 6: The Dangers – What if I Get it Wrong?

"Leap of Faith" – Queensland Business Monthly

7 Impressive Marketing Blogs You Can Share With Your Clients

[Award] Anthill Online 30under30 2014

Smashing Sales – How to Create a Winning Sales Process

World’s first gluten free… accounting firm cafe? – bmag

Public Practice Innovation Case Study – Chartered Accountants Australia New Zealand

Announcing The Live Your Legend ‘Unofficial’ Music Video! – LiveYourLegend.net

7 Things Business Owners MUST Implement BEFORE June 30

5 Ideas to Quickly Gain Credibility for Your Service Business

Planning to Profit: How the Best Businesses Set their Revenue and Profit Targets for Growth

How We Created a Warmth Within Inspire Cafe

Business Structuring Made Easy! Part 5: Family Trusts

Business Structures Made Easy! Part 4: Companies

Life’s Too Short: Four Types of Bad Clients That Don’t Belong in Your Business

Business Structures Made Easy! Part 3: Partnerships

QBSA to QBCC: Just a Name Change? 10 Steps They’re Taking

CGT Main Residence Exemption – Tips, Tricks, and Traps

[Podcast] The accountant with a coffee shop in his office. – Pricing Power

Business Structures Made Easy! Part 2: Sole Trader

Business Structures Made Easy! Part 1: The Basics

Email Speed Dating: Tackling 50 emails in 50 minutes

Shoot to Thrill! How to Hit Your Business Targets Every Time

Don’t Drive Your Business with Crap on the Windscreen – Why Xero Keeps it Clean

Businesses for Good: Embedding the Concept of Giving into Everyday Life

De-Mystifying Superannuation Contributions and Bonus Structures

Ensure you Insure – The Golden Egg

Think you are a contractor? The ATO may disagree!

Why employees who take the day off actually get more work done!

The 21st Century Benefits of Online Signing Software

Sitting Back and Thinking Forward – B1G1: Business for Good

How Your Industry Rewards High Performance

5 Things For Business owners to Implement Now for a Successful Year Ahead

Trade Marks: What are they worth?

Your business, government grants and tax incentives. Are you cashing in?

3 Reasons Reducing Your Tax Refund Makes Weird Sense

The ATO, the Christmas Grinch, and your office party

Pushing the Envelope (with coffee??) – B1G1: Business for Good

Are You Using The 80/20 Rule? Or Is It Using You? 2 Simple Profit Improvement Business Ideas

Cashflow By Design: 3 Ways WorkflowMAX Creates ‘Cashflow MAX’ For Design And Creative Agencies

Zero Excuses: 4 Reasons Xero Rocks Your Business World

FAST CASH FLOW: Three Easy Ways To Get Paid Faster

Hobby or Business – Eight simple questions to ask yourself

Do you see an apple seed, or an apple tree?

Why use a Chartered Accountant?

Signup for inspire news + event invitations

"*" indicates required fields

Get Cashed Up