To Increase Cash Flow: Know Your Working Capital Days

We all know that cash is king. And what is more necessary than optimal cash flow in your business?

While Revenue and Profit are a “must” to measure, neither of them give any insight into your business’ cash position. Working capital days gives us the context to Revenue and Profit.

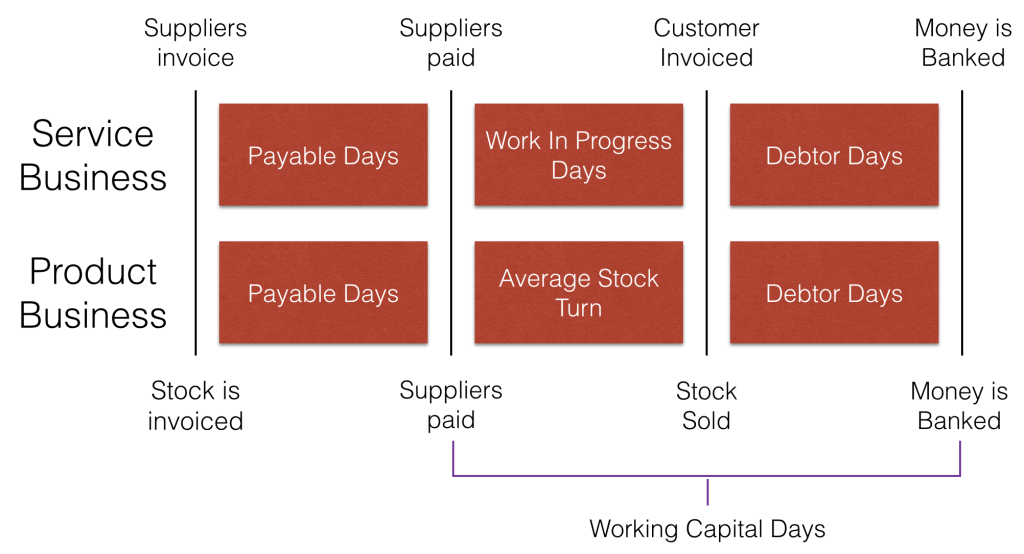

Working capital days is an interesting metric – and it can be broken down into a few components.

In short, working capital days measures the number of days between you paying for your cost of sales, and receiving payment from your customer.

The Goal is to Reduce Working Capital Days

The shorter or smaller the Working Capital Days are, the better the business’ cash flow, as the cash is “tied up” in working capital for the least amount of time.

So if we increase Payable Days, and reduce both Work in Progress Days and Debtor Days, this will reduce working capital days and improve our business’ cash flow.

And yes, it is possible (and desirable) to have negative working capital days!

Calculating Working Capital Days

As working capital is made up of other figures, we’ll need to work out what the following numbers are:

- Payable Days

- Work in Progress Days or Average Stock Days

- Debtor Days

Payable Days

Also called Creditor Days.

Although technically working capital days doesn’t include payable days, the date that you pay your suppliers is the ‘start day’ of working capital days.

So what that means is, if we extend our payment terms with suppliers, we’re shortening our working capital days if all else stays the same.

It’s an important lever to measure, as a few words of negotiating credit terms can reduce some pressure.

Work in Progress Days or Average Stock Days

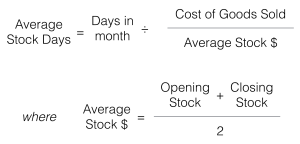

Depending on your business, whether service (WIP Days) or selling products (average stock days).

For the service business, I like to refer to WIP days as “turnaround time”. The time from when the job comes in the door, to when it is delivered to the client.

You can also use this formula as a service business if you put a dollar figure on your WIP.

For those without a dollar figure, please keep a track of your turnaround time using a visual scoreboard or workflow management system. Turnaround time is critical not only for cash flow, but in most cases it matters to your customers.

Debtor Days

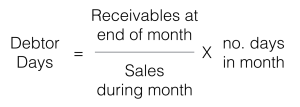

Debtor days is fairly similar in process to calculating payable days.

Debtor days is calculating using the following formula:

Improve all 3 to Help your Cash Flow

All in all, if you focus on improving all three of the above numbers, then it will have a dramatic effect on your overall cash flow.