The top 9 Tax Planning strategies for High Income Employees

We recently had a question from a client, not about structuring for his business, but what his wife could do from a tax planning perspective.

The scenario is the husband runs a business, and earns a good $130k profit. And through proactive tax planning, we ended up saving him over $35,000 in tax, keeping his average tax rate on the business income less than 20%.

Great! He loved that, so what about his wife?

His wife earns $250,000 as an employee. This means she’s paying 47% tax on a good portion of that income, but an average tax rate of about 37% on each dollar she earns.

Not cool.

Unfortunately there’s not as many things you can do to plan for tax as an employee then you can as a business.

And I would NEVER recommend spending $1 on something tax deductible to save 47 cents in tax just for the tax savings. (Although it sounds tempting – you lose 53% of what you’re spending money on)

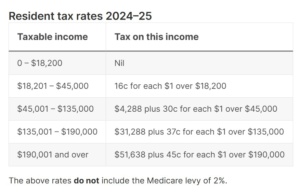

As a refresher, for 2025 FY, the individual tax rates (including medicare levy) are:

So, what are the top tax planning strategies for high income employees?

1. Contribute to your Superannuation Fund

The first way you can reduce your taxable income (and therefore your tax on that income) is through additional superannuation contributions.

Be careful to not exceed your ‘Contribution Cap’ for deductible superannuation contributions.

These deductible super contributions include both your employer minimum (mandatory 11.5% they have to pay on your salary) plus any salary sacrifice or additional contributions that you do.

From 1 July 2024, the general concessional contributions cap is $30,000 for all individuals regardless of age.

Going over the caps mean you pay an effective tax rate of 47% in tax. Ouch!

Crunching the numbers, let’s imagine that your employer already chipped in $25k so far in the tax year as the minimum they need to on your salary, you have $5k that you could contribute, taking you up to the cap.

You’d have to contribute $5000 of money into super, but it would save you $2,350 in tax by doing so (if you were paying 47% tax on your salary).

Always talk to a good Financial Adviser to make sure this is appropriate for your situation.

2. Negatively Gear an Investment Property

Another very common scenario is that high income earners have a negatively geared investment property.

What this means is that the tax deductions they get from renting out the property outweigh the rent they receive from the property.

This could be $25k in rent received, less $20k in expenses paid for during the year (like interests on loans, council rates, agent’s fees), and then a further deduction of $20k for depreciation on the property.

Under this scenario, while the property ‘made’ $5k net in positive cash flow, the property made a taxable loss of $15k.

If you’re paying tax at 47%, this ‘negative gearing’ would reduce your tax bill by $7,050.

3. Get Private Health Insurance

Having Private Health Insurance (hospital cover) means that you do not have to pay the ‘Medicare Levy Surcharge’.

There’s often confusion when clients have hospital cover, but they still pay Medicare Levy. That’s because there’s two types of Medicare payments on your tax:

- Medicare Levy (all individuals pay this, and it is calculated at 2% of your taxable income if you’re earning more than ~$27k)

- Medicare Levy Surcharge (additional 1% to 1.5% depending on your income)

You need to pay the Surcharge component if you’re single and earn over $90k, or have a spouse and together your income combined is more than $180k – and you don’t have private health insurance (hospital cover).

Of course if you, or you and your spouse do hold the hospital cover, you do not have to pay the surcharge component.

If you earn $300k, you’d be up for $4,500 in Medicare Levy Surcharge alone.

And Hospital Cover may only cost you $2,000 to take out!

On that maths, you’d be up $2,500.

So if you’re over the income threshold ($97k if you’re single, or $194k if you have a spouse, incomes combined), or are creeping toward it, it may be worth taking out cover.

And just as an FYI – Private Health Insurance (extras cover) does not remove the surcharge.

4. Salary sacrifice your vehicle

Some people salary sacrifice a vehicle that they use both for business and private use.

This usually looks like your employer organising a novated lease, operating lease, hire purchase or paying for your car.

There are many ways to structure it depending on what your employer is comfortable with – and we recommend getting advice on what option is best for you and your employer at the time.

This can usually shave a few hundred, or a few thousand off your tax bill.

5. Donate to Charity

If giving is something you do, or want to do, then consider making a tax deductible donation.

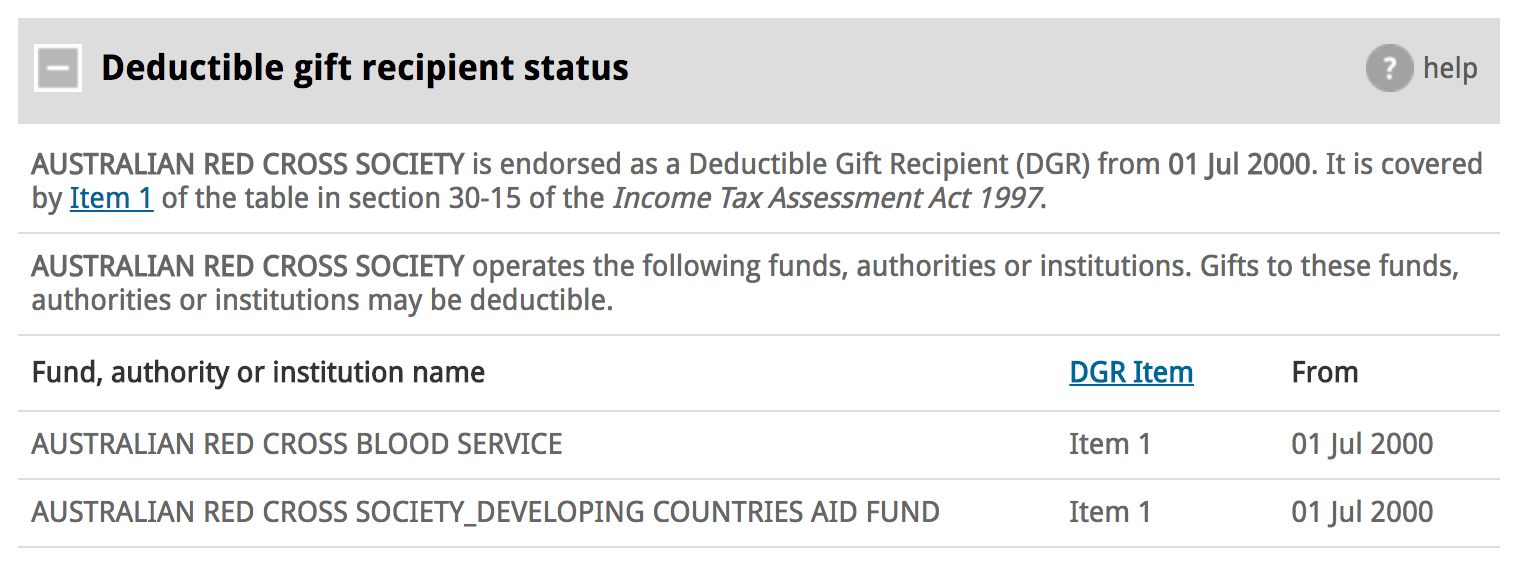

As an employee, you can claim a donation of anything over $2, to an Australian Deductible Gift Recipient (“DGR”), and as long as you get a tax invoice from them.

To work out if a charity is a DGR, you can check the Australian Business Register here: http://abr.business.gov.au/

Once you search for your charity and find it, you can look down the bottom of the search and the ‘Deductible Gift Recipient Status’ will show up:

Donating or ‘tithing’ to Churches cannot be claimed as a tax deduction on an individual tax return.

6. Income protection insurance

If you’re ballin’ on six figures or more of salary, it’s probably a good idea to protect your income.

Especially if you’re the sole earner in the family, or have loan repayment obligations each month that if you all of a sudden found yourself out of work, you’d have trouble paying.

You can do this through taking out income protection insurance.

While we do not offer advice on how much to take out and what cover you need, we know that if the policy is paid personally, we can claim the premiums as a tax deduction.

If you need help with this, reach out and we can put you in touch with some great people who can help.

7. Self-Education, Training or Executive Coaching

If extra study or developing your skills are of interest to you, then you can pay for self-education, professional development or training and claim this on your tax.

You could also hire an executive coach to help you perform better in your role.

Keep in mind that there has to be direct connection with the training and what you do as an employee.

For instance, if you have HR responsibilities at work, and want to do a training course on how to manage people better, then this would be deductible.

But if you’re in a sales roll, and want to learn how to fly a plane (which has nothing to do with your employment), then sorry, that’s not deductible.

8. Structure Investment Income Appropriately

We often see highly paid people build wealth over years.

It’s critical that the ownership of any investments (such as interest earning bank accounts, shares, investment properties) is carefully considered.

Whoever owns these assets and receives the income pays the tax on that.

So if the wife owned the assets, she’d pay 47% in tax on the investment earnings.

Compared with say the husband at a rate of 32% – a big difference.

Be careful with restructuring investments that you own at the moment, as shifting between family members or entities usually triggers capital gains tax, or stamp duty (or both!)… Best to chat with an accountant who understands this stuff!

9. Change the way you get paid

The biggest and best way we’ve seen highly paid, high functioning people reduce their tax is through changing the way they get paid.

Most common is to start a business consulting to other similar businesses who need their skill, knowledge or service.

To make this worthwhile and beneficial from a tax perspective, you would need two or more clients.

And one single client could not pay you more than 80% of your total income. For instance, if you earned a total of $300k gross from consulting, your biggest client could not pay you more than $240k (or 80%) of that total in a year.

It’s also worth noting that the two clients cannot be related parties. Even with two different ABN’s, if the businesses are related or associated, this cannot happen.

But if changing the way you get paid (such as starting a business) is a possibility, do let us know.

If you’d like a better understanding of how these strategies can work for you, feel free to book in a Test Drive – a rapid fire Q & A with a Chartered Accountant.