QLD Flood Relief For Small Business Owners

February 2022

We’ve seen heavy rainfall and flooding affecting businesses across parts of South East Queensland and Northern New South Wales forcing businesses to remain closed due to property damage, damaged goods, equipment and more. Inspire Accountants has created this page to provide information relating to flood relief for small business owners and will continue to update this page as the government makes announcements over the coming days.

QUICK LINKS

Flood Relief For Small Business Owners – Government Support

First and foremost, If you are a small business that has been directly affected by the floods, you can now apply for the following grants:

Flood Relief For Small Business – QLD

Disaster Recovery Grant

The grant aims to help businesses with the clean up (hiring equipment, labour and materials), disposing of damaged goods, repairs to buildings and equipment, purchase or hire of equipment to resume business, payment to conduct safety inspections and conducting essential repairs that are not covered by insurance.

Up to $50K available through two applications:

An initial amount of up to $15,000 is available to support an initial claim. Evidence of the direct damage such as photographs, quotations, tax invoices and official receipts is required.

A subsequent amount of up to $35,000 is available to support subsequent claims for which full evidence of payment is required.

To be eligible, you must:

Be a small business owner;

Hold an ABN (and have held the ABN during the time of the disaster);

Own a small business located in the defined disaster area for the eligible disaster that has suffered direct damage as a result of the eligible disaster;

have been engaged in carrying on the small business when affected by the eligible disaster;

be primarily responsible for meeting the costs claimed in the application; and

intend to re-establish the small business in the defined disaster area for the eligible disaster.

For full details and to apply, please click on this link.

Let us know if you require further any assistance

Flood Relief For Small Business – NSW

Storm And Flood Disaster Recovery Grant

The NSW and Australian Government are packaging a grant to support businesses impacted by the recent storms and floods of January to March 2022.

To be notified when the storm and flood business support is available, please register your details here.

Meanwhile, primary producers impacted by the recent floods, might be eligible for Special Disaster Grant of up to $75,000. Please visit the Rural Assistance Authority website for eligibility criteria and to apply.

As always, if you need any assistance, please reach out to your dedicated accounting team.

Tips to claim on insurance for flood related damage

When recovering from a disaster, the first thing you need to do is to contact and notify your insurer. Here are some steps we recommend:

- Read your policy carefully to see if you are covered OR speak to your insurance broker

- Notify your insurance company in regards to the damage

- Make sure to take as many photos & videos of the damage (including stock, assets and property damage)

- Take reasonable steps to minimise your loss

How the ATO can help your business

Small businesses and individuals affected by the recent floods, who need to lodge a business activity statements and instalment notices, with an original due date of 28 February 2022 or 21 March 2022, automatically get an extension up until 28 March 2022.

If you are not able to lodge or pay the outstanding amount by the 28 of March 2022, please reach out to your tax agent so they can request a deferral or organise a payment plan.

Further more, flood impacted taxpayers that pay their Pay-As-You-Go Instalments quarterly will also be allowed to vary upcoming instalments and claim a refund of previously paid instalments.

Any GST refunds these taxpayers are entitled to will also be fast tracked to free up cash flow and help fund their recovery efforts.

Small businesses and individuals affected by the floods will be able to notify the ATO of their circumstances and discuss the numerous assistance measures available to help them get back up on their feet.

Additional assistance available for individuals & families

There is support for individuals who have been adversely affected by floods (February 2022)

Your gross (before tax) weekly income must be less than:

- individual: $988 ($51,398 per year)

- couple: $1,367 ($71,061 per year)

- sole parent, one child: $1,368 ($71,110 per year)

- couple, one child: $1,694 ($88,111 per year)

Flood Recovery Grants Available:

- Emergency Hardship Assistance

- Essential Household Contents Grant

- Structural Assistance Grant

- Essential Services Safety and Reconnection Grant

Flood Recovery Loans

Where can you find support?

Want to know the status of Brisbane flood maps near you? Click Here for the Interactive Flood Awareness Map

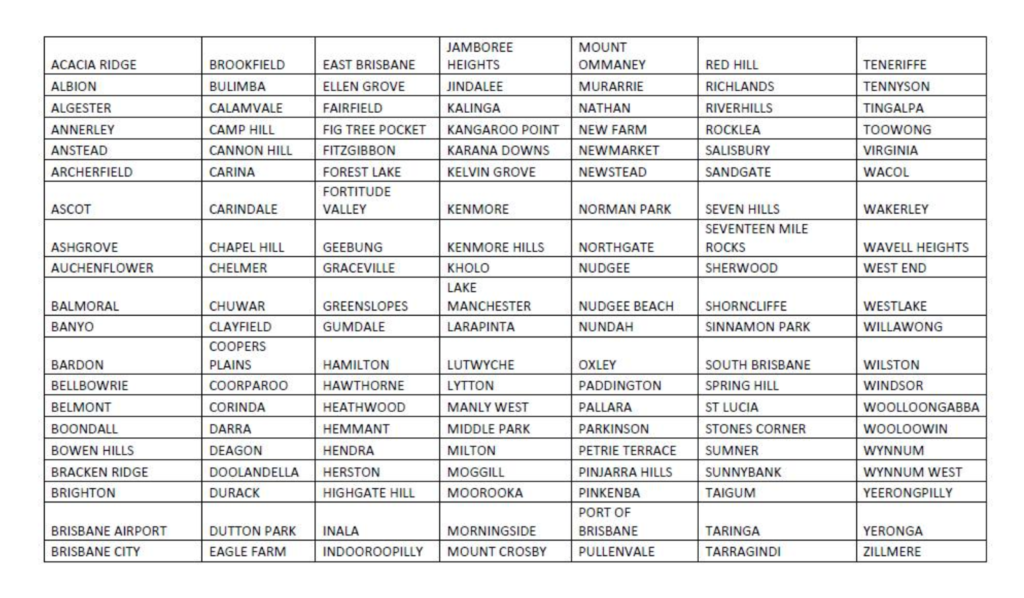

Here are the suburbs that have been issued an emergency alert by Brisbane City Council.

Moreover, if your safety is compromised or you require any flood assistance, please contact the SES on 132 500 or in the case of life threatening emergency, please dial 000 immediately.

Should you require any mental health and wellbeing support, here are some available resources you can access:

- Find mental health and wellbeing resources for businesses.

- Contact Lifeline on 13 11 14 should you require any online counselling and support.

- Information on personal and mental health support during and after a disaster.

We will continue to update this page if there is any other flood relief for small business owners announced.

In addition, if you’re in need of a helping hand with claiming grants, insurance or tax-related claims and more… book in a chat to speak with one of our senior accountants over the phone or on zoom here: inspire.accountants/chat

Get Cashed Up