Small Business Energy Incentive

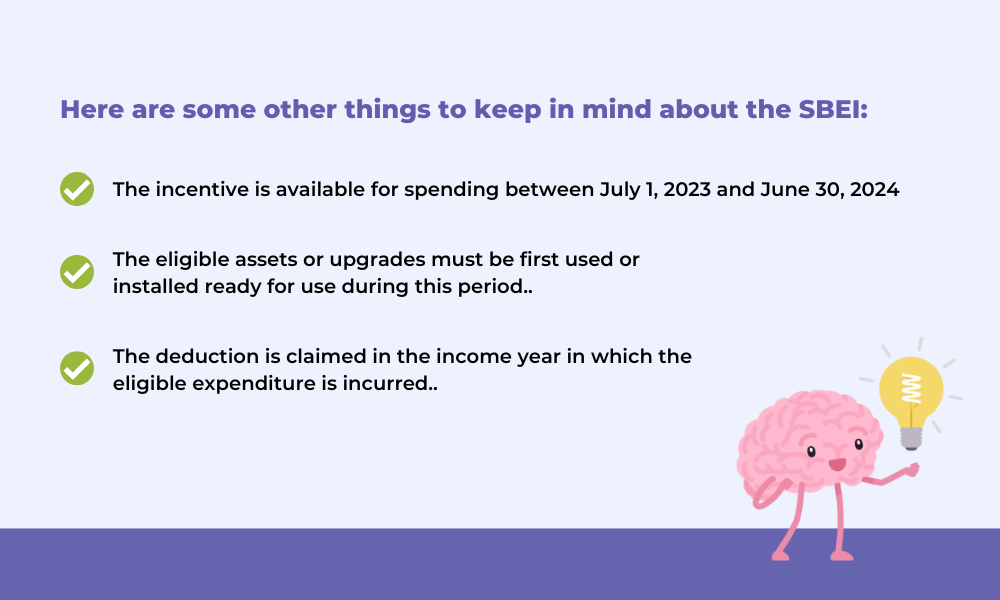

The Australian government is offering a new tax break for small businesses that make energy-efficient investments. The Small Business Energy Incentive (SBEI) provides a bonus 20% deduction for eligible expenditure on assets that support electrification and more efficient use of energy.

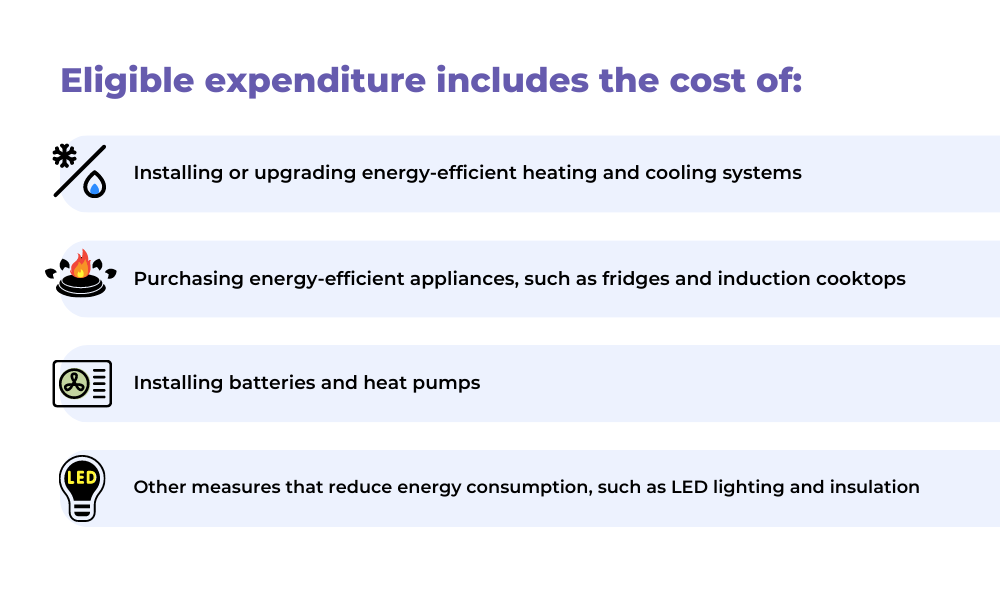

The SBEI is available to businesses with an aggregated annual turnover of less than $50 million. Eligible expenditure includes the cost of:

The maximum deduction is $20,000, so you could save up to $20,000 in tax if you spend $100,000 on energy-efficient items.

The SBEI is a great way to save money and reduce your environmental impact. So if you’re thinking about making your business more energy-efficient, talk to your accountant about the SBEI today.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.