Property Tax Accountant

Your property tax accountant specialists that understand your numbers to growing your family’s wealth.

Australian’s love investing in bricks and mortar – and there’s a good reason to do it! Going into COVID was a bit of a mystery for a few people and we saw some weird things predicted by the banks and all sorts of people. We now see that COVID has reset our lives in some ways – creating new lifestyle trends to working from home, to expats returning and looking to lock in A grade real estate.

If you would like to explore working with us, then please book in for a Strategy Call with a Property Tax Accountant to see if we might be a good fit.

Advantages To Property Investments

If you look at the top 100 wealthiest families in Australia, you will always see property in some form in their journey. There’s several advantages of including property in your investment strategy Some advantages that come to mind are:

- Claiming depreciation;

- Negative gearing;

- Capital gains exemption (6-year rule);

- The banks will lend you money to purchase it, leveraging other people’s money and getting better return o yours;

- You can touch and feel it;

- Less exposed to stock market volatility;

- Set up right, can help you pay down you own home loans; and

- You could live in it if you wanted to

Who do we work with

At Inspire Accountants, we look after a variety of clients who are involved in property and have gone through the good and the bad times, with the many intricacies that follow. Some of the types of clients we look after are:

- Property developers

- Property investors

- Property managers

- Real estate agents

- Private investors who hold property in Self Managed Super Funds

Why do you need a property tax accountant

It’s important to find the right property tax accountant that has a strong focus on making sure that you understand the numbers that grow your wealth. At Inspire, some of our key numbers to focus on are:

Debt to equity ratio to ensure that the banks are satisfied with covenants

Amount of working capital for interest repayments, expenses and unexpected cash outflows

Net rental return percentage to benchmark your properties

Minimising the number of days that the properties are untenanted

Negative gearing effect on taxable income

How can a property tax accountant help with your investments

- Performing financial forecasting on transactions before they’re purchased

- Setting up cloud software that makes reporting for property investment a dream

- Ensuring that the property is owned in the correct structure

- Setting up appropriate structures of trusts and other entities to hold the properties

- Accounting and record keeping for the properties

- Setting up and running a self managed super fund to hold the properties

Free educational content to help you on your next property investment

We have an abundance of free educational content to help support you in your property journey.

WATCH

Funding Property Development

How to buy your office, warehouse or clinic using your superfund

Structuring Property Development in Trust, Companies and SMSF

READ

- The Process Of Buying Commercial Property

- 5 Things Business Owners Need To Know Before Getting Into Property Development

- High-Level Structures For Tax Efficient Property Development

- 3 Ways To Fund Property Development

- Buying Commercial Or Residential Property In Super?

- Is It Hard To Get Finance In An SMSF For Share Or Property Purchase?

- Why Property Development In Super Is So Attractive

- Is It Hard To Get Finance In An SMSF For Share Or Property Purchase?

- #Accounting Answers: How Can I Buy a Commercial Property?

- Give your Super a Boost! Buy a commercial property (via SMSF) and rent it from yourself.

LISTEN

EXPERIENCE

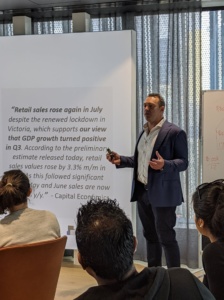

The Property Masterclass is an event that we host three times a year exclusively for our clients where we take them through their journey in property investment. We talk about:

- What makes a good property investment from a tax perspective

- Case studies on the Founder of Inspire – Ben Walker and his property purchases over the years.

- Debt Recycling strategy where we use our investment properties to pay off our own home loans.

- Update on the current real estate market. We work with experts who can share what’s happening in the last few months, trends, and show which areas are better to invest in at that time.

It’s an amazing opportunity to get an overview from three different advisors and to put a strategy in place for you and your family. If you’re looking to get some help with a Property Tax Accountant in your investment journey please book in a complimentary strategy chat (phone call or a zoom meeting). We can look at how you are reporting your numbers, check if it’s in the correct structure or if you need help with performing financial forecasting before your purchase

Get Cashed Up