NSW COVID-19 Grants

JobSaver Grant

Key points:

- Purpose is to keep staff employed (headcount as at 13 July)

- Amount: 40% of weekly payroll (min 1.5k max 100k / week). Non employing businesses is 1k / wk.

- Use most recent BAS to calc normal payroll (before 26 June)

- Backdated payments, then fortnightly to cover costs incurred from Week 4 of lockdown (18 July 2021 onwards)

- Applications open 26 July, close 18 October

Eligibility

- ABN should be registered in NSW, if not, then evidence to support NSW operation as on 1 June 2021

- Revenue decline of 30% or more over min 2 week period between 26 June to 28 August*, compared with same period 2019 or 2020 or 2 weeks prior to lockdown (12 June to 25 June 2021)

- Turnover between 75k and 250m for 2020 FY

- Must maintain headcount from 13 July while the business continue to receive fortnightly JobSaver payments

- For non-employing business, the business receiving the payments must be the primary income source for associated person

- Employees can receive Commonwealth COVID-19 Disaster Payments if their employer is receiving JobSaver

- NOTE: Still potential eligibility “Contact Service NSW”

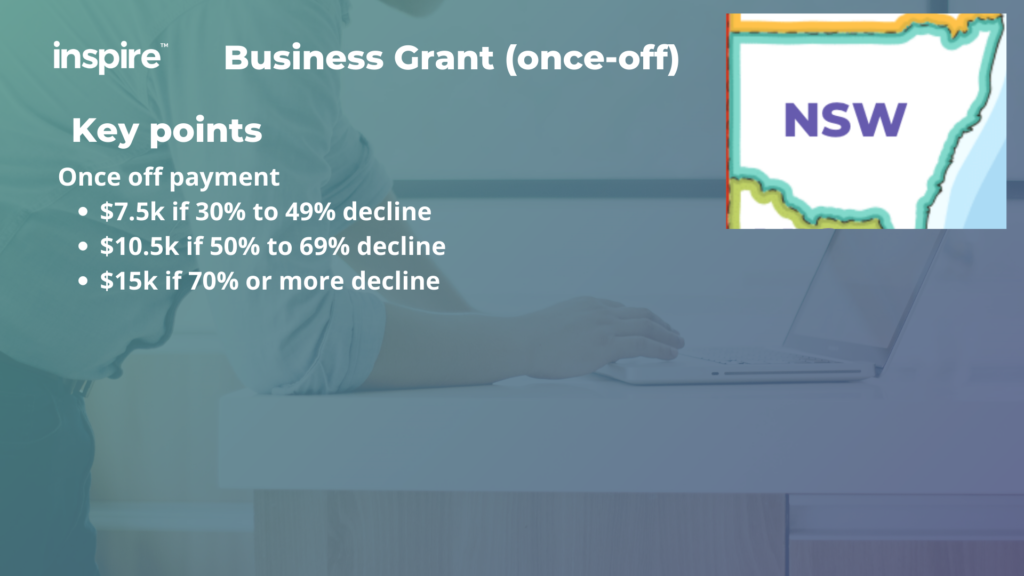

Business Grant (once-off)

Key points:

Once off payment

- $7.5k if 30% to 49% decline

- $10.5k if 50% to 69% decline

- $15k if 70% or more decline

Eligibility

- Wages of $10M or less as at 1 July 2020

- Turnover between 75k and 50m for 2020 FY

- ABN should be registered in NSW, if not, then evidence to support NSW operation as on 1 June 2021

- Revenue decline of 30% or more over min 2 week period between 26 June to 17 July, compared with same period 2019 or 2020 or 2 weeks prior to lockdown (12 June to 25 June 2021) [Southern border slightly difference]

- Must maintain headcount as at 13 July

- For non-employing business, the business receiving the payments must be the primary income source for associated person

- NOTE: Still potential eligibility “Contact Service NSW”

Micro Business Grant

Key points:

- Fortnightly payment of $1,500 to cover business expenses

- Turnover between 30k and 75k for 2020 FY

- Revenue decline of 30% or more over min 2 week period between 26 June to 28 August*, compared with same period 2019 or 2020 or 2 weeks prior to lockdown (12 June to 25 June 2021)

- They have business costs for which there is no other gov support

- Need to maintain headcount if employing business; otherwise needs to be main source of income for associated person

Other help

- Accomodation providers

- Payroll tax deferrals

- Land Tax Relief & Residential Tenancy Support package

- Free online mental health training

- Rebate for small Business fees & charges

- Voucher scheme for Tourism, Hospitality & Art businesses

For more information, visit the New South Wales Government website:

Service NSW (New South Wales Government ) COVID help

We are expecting a huge amount of businesses to be eligible just because of how flexible the eligibility criteria is, especially around the 30% drop.

There are two main grants, the JobSaver grant is a recurring grant and the purpose is to keep staff employed or the headcount in the business the same as it was on the 13th of July, moving forward throughout the lockdown. The amount of the grant is 40% of weekly payroll, a minimum of 1.5 grand a week up to a maximum of 100 grand a week and the limit was $10k a week, but it’s now gone up to $100k.

For non-employing businesses, such as sole traders, it is only one grand a week because there is technically no payroll to pay there, so it’s $1k.

How we work out what your weekly payroll is, we have to go back and have a look at the most recent BAS that was lodged before the 26 July. And there is a way we work out the weekly payroll from that BAS, but unfortunately, we can’t go and look at what the payroll was the week before lockdown. If you have hired people since your last BAS was lodged, and in most cases, that will be the March BAS, then you may not be getting 40% of your current wages; it will be 40% of what your wages were a few months ago when that BAS was lodged. It’s backdated payments, then fortnightly from then on, to cover costs incurred from week four of lockdown onwards, so 18 July 2021 onwards.

Applications are already open, and currently closes on the 18 October if lockdowns are not extended. The further we go into these lockdowns and the government requires shutting off our businesses, the more assistance that we are seeing in most cases. We do expect if things continue to be extended on the lockdown side of things, then the grants should also be continued.

The eligibility on the JobSaver Grant is the ABN should be registered in New South Wales. But if the ABN is not, and if you’ve got a Queensland headquarters, but you still operate in New South Wales, then you just need to provide evidence for that, whether it’s a signed lease or some sort of evidence that you have an operation in New South Wales.

A revenue decline of 30% or more over a minimum two-week period between 26 June to 28 August. The window’s changed about three times and it can change again if we get extended. We compare that same two-week window with a period in 2019 or 2020, or two weeks prior to lockdown so from 12 June to 25 June 2021.

When we get the ruler out to measure the numbers or the decline in turnover, The 1st to the 14th, we look at what that turnover decline has been. Then we go to the 2nd to the 15th and then the 3rd to the 16th, and then the 4th to the 17th. The great news is we have lots to compare it to. The bad news is it takes ages to work out.

If you have a weekly payroll of $20k a week, you probably got a couple million bucks of turnover. 40% of 20 grand is a decent amount and that is going to massively help your business cash flow out.

You don’t need a 30% reduction for the whole term of the JobKeeper or the JobSaver Grant but you just need to have a 30% drop in a two-week comparable period.

Turnover between $75k and $250m for the 2020 financial year. That range was $75k to $50m; it’s gone up to $250m. They must maintain head count at 13 July.

If you fire someone, you are dropping and not maintaining your head count but if they make a resignation voluntarily, that does not affect your eligibility because that is something you can’t control. For non-employing businesses, the business receiving the payments must be the primary income source for the person. If you are a sole trader, employees can receive Commonwealth COVID-19 Disaster Payments if their employer is receiving JobSaver.

Commonwealth Disaster Payment is run by the Department of Human Services, or Centrelink. An employee can go and get help from the federal government, at the same time your employer may be getting help from the New South Wales government. If you’re 29.5% down-turned, it may be that you could be eligible for some of this stuff.

Another grant called the Once-off Business Grant, this is a once-off payment of different kinds of tiers that they have. The reason for those different tiers is it depends on your turnover. So if your decline is within 30% to 49%, you are going to get a once-off payment of $7.5k, and $10.5k for 50% to 69%, and $15k if 70% or more. And to be eligible for this, your business needs to have a wage of $10 million or less. Turnover between $75k and $50 million. So, the other one, they increased it to $250m.

The big businesses won’t get it, but if you are a small business, you are going to get this grant. And your ABN should be registered in New South Wales, or you need other supporting documentation to show that you run a business in New South Wales,

Revenue decline of 30% or more over a minimum two-week period between 26 June to 17 July, compared with the same period in the last financial year or the year before, or the two-week period prior to lockdown and this is similar to the JobSaver Grant. You still could be potentially eligible if you have little minor nuances about your businesses that it wasn’t clear whether you will be eligible or not, If you generally have a reduction in turnover, and if your business really got hit hard because of the lockdown, reach out to Service New South Wales and try to get JobSaver and Business Grant.

Non-employing businesses are very similar. If it is the primary source, you can get this business grant and if it is someone who is a sole trader, they can get this grant as well. If you have three businesses in three different companies, you can only get it once for that primary source.

New South Wales does have a grant that is specifically designed for sole traders or the smaller businesses, they call it Micro Business. It is a fortnightly payment of $1,500 which is $750 a week to cover business expenses. It is for businesses with turnover between $30k and $75k for 2020, revenue decline of 30% or more.

You need to show that 30% or more decline. They have got business costs for which there is no other government support. If they waive your liquor licence, we can’t use it but there are heaps of business expenses that there is no government support for.

You need to maintain headcount if you are in an employing business; otherwise, it needs to be the main source of income for that sole trader or the associated person if you use another structure. Accommodation providers like hotels and motels have their own little thing going, and also payroll tax deferrals in New South Wales.

There are things like land tax concessions and other non-quantitative or funding help. They got a short-term eviction moratorium to make sure that you are not kicked out of your home if you can’t pay your rent. If you are getting hit hard, and you need every single help possible, dive into Service New South Wales website if you want to check out all that stuff.

Webinar Slides

Free E-book summary of business grants

Download this FREE ebook where we have summarised key details of the COVID-19 state government grants in 6 pages.

We note that this information was current to the best of our knowledge at the time of publishing. Please always confirm with each state’s grant department to ensure your eligibility for each of the COVID-19 Business Grants.

Get Cashed Up