Typical Properties For SMSF Loans

We’ve previously invited Colin O-Loughlin, Director and Mortgage Broker of Arch Brokerage on the topic, “Buying A Commercial Property In SMSF”.

In this video, he talks about typical properties for SMSF loans.

Here’s what he said –

What sorts of things usually get funding?

There are a few options:

- Shops

- Factories

- Warehouses

- Offices

People might be seeking funds for various reasons, like investing or finding a new space for their business.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Paid Family and Domestic Violence Leave

Effective 1 February 2023, employees working for non-small business employers (15 or more employees on February 1, 2023) are entitled to 10 days of paid family domestic violence leave. Both part-time and casual employees are also eligible for the leave.

For small business employers (less than 15 employees on February 1, 2023), paid leave will be accessible from August 1, 2023. Until then, they can still take unpaid family and domestic violence leave.

Per Fair Work, Family and domestic violence mean violent, threatening or other abusive behaviour by certain individuals known to an employee that both:

- Seeks to coerce or control the employee

- Causes them harm or fear

Please visit the Fair Work website for additional information on who can access paid Family and domestic violence leave.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

The Key To Mapping Your Vision

We recently invited Sean Soole to a webinar on the topic “How To Go From Stuck To Freedom In Your Business”.

In this video, he talks about the key to mapping your vision.

Sean says that your ‘Vision’ isn’t just a couple of lines or a quick blurb about what you want in life. When he looked at how we come up with these visions, he realised it’s often pretty messy. It doesn’t really give you a clear target. It’s like aiming for a summit, and everything has to fall into place perfectly to get there.

So, what he did is break these visions down into 12 different parts of our lives. Stuff like:

- How we see ourselves

- Money and wealth

- Investments

- Giving back

- Being charitable

- Hobbies and passions

- Health and well-being

- Our relationships, especially the intimate one

- Our kids, family, and friends

These are the big areas that matter most to people. We think six of them are kinda like the basics everyone should have. The other six, you get to pick and choose what you want to go with. See, if there are 12, you might already achieved six of them. So, what’s left is just figuring out the other six and what you need to do in your business and personal lives to be able to feel like you’re living your vision.

This vision thing isn’t just a checklist of goals. It’s more about how you feel and experience life and the world around you. But to make sense of it all, we break it down into pieces so it’s crystal clear.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

How Bookkeeping Can Save You Money, Time And Improve Your Business

The ATO will likely scrutinise business transactions in the event of an audit. If your business uses accounting software like Xero, you can attach a receipt/invoice to every transaction and leave a clear description of the expense. That’ll save you hours, including the accountant fees, which can easily range between $10,000 and $20,000 per audit event. Audit insurance will cover the accountant’s fees, but it doesn’t include the time you will spend providing evidence or information to your accountant or auditor.

In addition, when reconciling transactions, you want to avoid using generic account names such as General Expenses. You want to reconcile transactions to specific accounts that accurately reflect the type of expense. With a clear overview of your income and expenses, you can seamlessly review to cut costs, streamline operations, and, most importantly, maximise profit.

A well-organised financial record enhances your business’s credibility with lenders, investors, and potential business partners. Lastly, when it comes to tax time, you’ll have all the necessary information readily available, reducing stress and allowing your accountant to provide accurate advice.

We recommend most businesses have a good quality bookkeeper that can maintain a healthy set of books.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

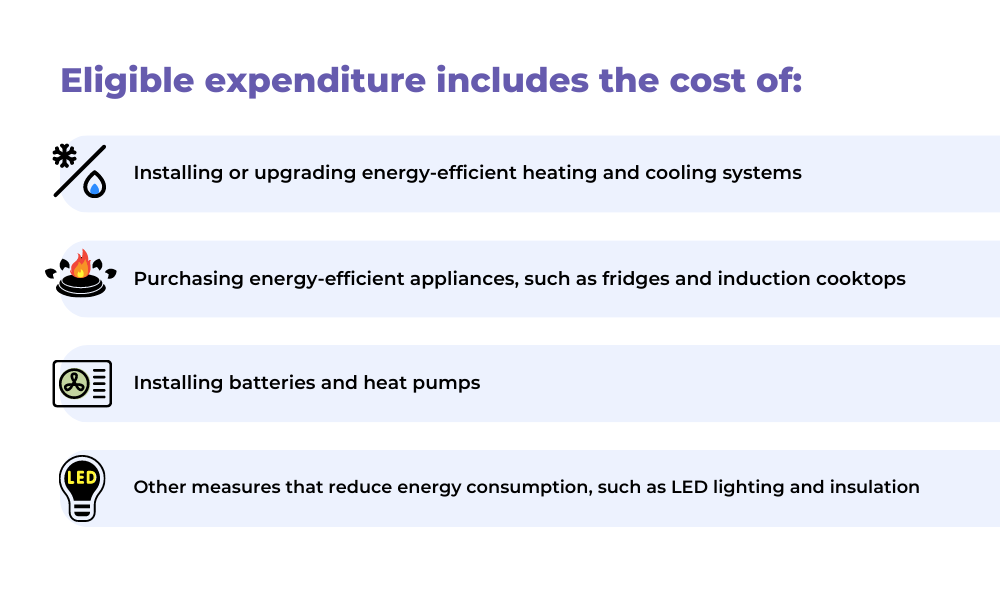

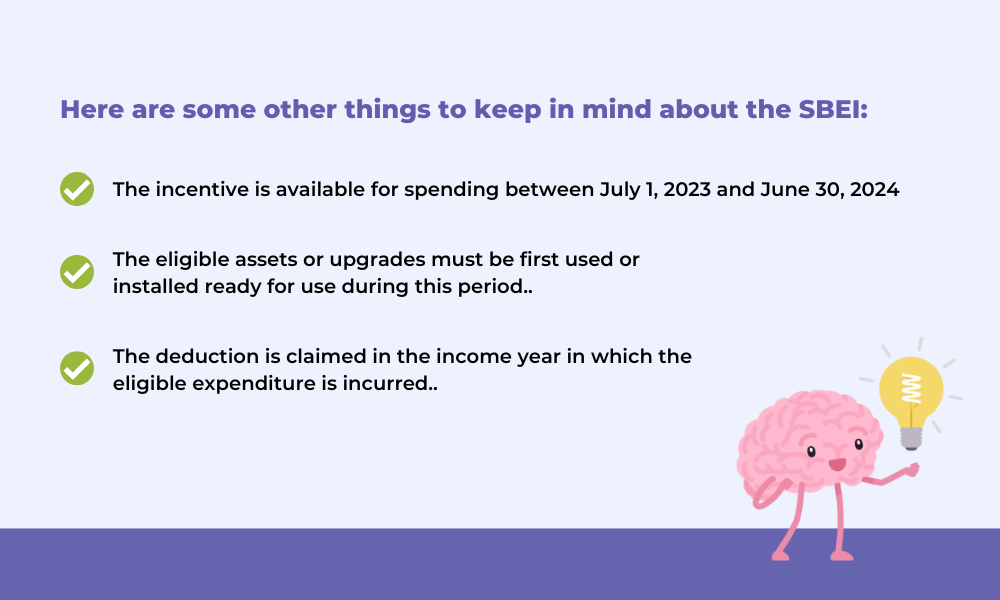

Small Business Energy Incentive

The Australian government is offering a new tax break for small businesses that make energy-efficient investments. The Small Business Energy Incentive (SBEI) provides a bonus 20% deduction for eligible expenditure on assets that support electrification and more efficient use of energy.

The SBEI is available to businesses with an aggregated annual turnover of less than $50 million. Eligible expenditure includes the cost of:

The maximum deduction is $20,000, so you could save up to $20,000 in tax if you spend $100,000 on energy-efficient items.

The SBEI is a great way to save money and reduce your environmental impact. So if you’re thinking about making your business more energy-efficient, talk to your accountant about the SBEI today.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Stop Wasting Time On $25 An Hour Tasks

On a recent webinar, we had the pleasure of hosting Sean Soole on the topic, “Transitioning from Stagnation to Empowerment in Your Business.”

Here’s what he said –

My favourite thing is to stop doing $25-an-hour tasks. And for those of you who rely on notifications, consider giving them a little break. Trust me, they can be a $25-an-hour distraction. Whether it’s your phone, computer, or any other device chiming in, those constant dings and buzzes have a way of pulling you away from the important stuff. So, think about switching off those alerts for a while and regain your focus. We should only use notifications for their intended purpose, which is to serve as tools that enhance our task-execution abilities.

There are a few people that I’ve come across, who have the time, but not enough money yet. And that’s great because you’ve got the time to invest in other things that can produce the money.

One of the issues people often face is that they don’t have any time and don’t have any money. That’s the worst scenario that you can be in. You’ve built this machine that you need to keep running, but it’s not producing enough money for you. That tipping point is where we need to apply some of the lessons such as stepping away from $25 an hour of work and doing the stuff that’s worth $500 an hour or more. What strategically could you do if you had more time?

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Why Lodging Your BAS On Time Is Important

We can appreciate that receiving a BAS from your accountant can be overwhelming, especially if you do not have the required funds to pay by the due date. You may opt not to sign the BAS because it’s less stressful than the ATO, knowing you have to pay $XXX, potentially adding to existing debt.

As tax agents, we work with the ATO daily, and they have a far softer approach with clients that lodge on time and have debt compared to late lodgers. Lodging your BAS on time demonstrates compliance and provides transparency to the ATO about your financial situation, making it easier to negotiate payment plans. It can also help you avoid additional penalties and interest charges for late lodgement.

This applies to BASs and other returns, so always opt to lodge your ATO obligations on time.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

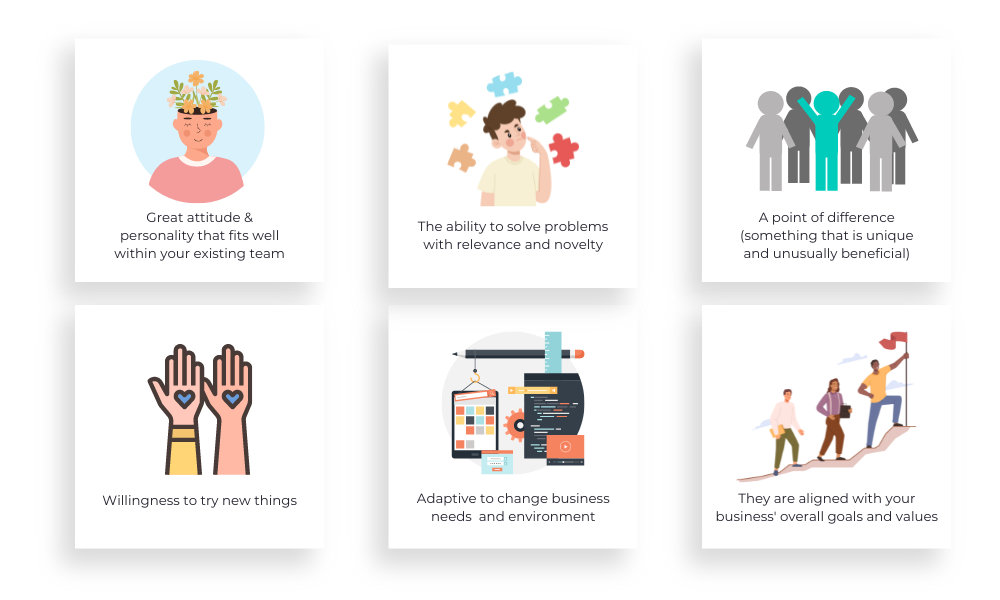

Choosing Right People In Your Business

Picking a winning team in business requires a combination of art and science. Selecting a team with diverse skill sets and experiences and individuals who can work well together and communicate effectively is vital.

Choosing individuals that are great in their roles will only take you so far.

Attributes you should consider when looking at hiring are:

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

In a few years, employers may be required to pay super at the same time as wages

The Federal Government has announced that it’s considering amending super laws to require super to be paid on payday. The change is set to take effect from 1 July 2026, and it will aim to stop disreputable employers from exploiting their employees and avoid liability building up on the books.

This change may affect your cash flow if you are paying super quarterly. We suggest a staggered approach to pay employees super in the next two years. Start by increasing the frequency of paying super from three months to two. Do this for six months, then increase frequency to one month until your pay cycle aligns with super payment.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Do You Have a HECS-HELP Loan?

The Australian Government indexes HECS-HELP loans each year on the 1st of June.

The Australian Government indexes HECS-HELP loans each year on the 1st of June. The percentage in which the debt amount will go up is directly linked to the cost of living (i.e. inflation).

On the 1st of June 2023, the HECS-HELP loans are predicted to increase by up to 7-8%. If you have a HECS-HELP loan, consider making an early payment before 1 June 2023 if cash flow permits. Individuals with low balances might be tempted to clear their HECS-LOAN balance altogether.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Get Cashed Up