7 Things Business Owners MUST Implement BEFORE June 30

We often find in business that many entrepreneurs and business owners are moments away from realising the potential that a few small changes in their modus operandi (or “method of operation”) can have on their business. This is without mentioning the amount of planning and strategy that can be used for significant tax savings if implemented before 30 June.

We recently put together a webinar with Paul Dunn of B1G1 into the “7 Things Business Owners MUST Implement Before 30 June”. Those seven things are:

Tax Planning Strategy

This is an opportunity where, when executed correctly, can save businesses tens of thousands of dollars. A tax planning strategy must be implemented before the financial year ends for the greatest effect. Correctly structuring distribution of profits, working out what expenses to pay this side of the financial year, or after – and many more opportunities are considered in a tax planning strategy.

Business Structure Review

Before the financial year ends is a perfect time to review your current business structure. Any changes that need to be implemented can be set up ready for the new financial year, and it also gives and opportunity to weigh in on the tax planning opportunities above. The correct business structure is essential in many aspects of running a business.

Real Time Accounting Software such as Xero

This is a must to get up to date with the changing times. If you haven’t already adopted real time accounting software, now is the time! Real time accounting software is best implemented at the start of a financial quarter, the next of which is 1 July. There is plenty to have ready by what we call the “conversion date”, so it is best to start planning for this at least two weeks prior to year end.

A 90 Day “Change Up” Action Plan

To set yourself up for the financial year, it’s best to break down the year into actionable 90 day quarters. The task then is to identify important numbers for each 90 days. In the book ‘The 4 Disciplines of Execution’, co-author Sean Covey talks about the “WIG”, or “Wildly Important Goal”. This is the key number or key metric that will have the greatest impact on your business. This kind of business-wide, laser focus has turned big businesses around from losing millions of dollars, to record breaking profits. Brainstorm some key numbers for the next 90 days, and write down the greatest one, with projects to implement to help you get there.

A One Page Strategic Plan

Another management and employee engagement tool is an effective business plan. Most businesses will have started with a 30 page plan, that has never been updated, let alone actually read through since is was established. Verne Harnish has introduced to the business world, his one-page plan. This is all of the key metrics, goals, SWOT analysis and many more strategies of a business on a single page. Each team member in the business also has a tailored section of the one-page plan, specific to their role in the organisation. This is a no-brainer to implement to set your business up for a successful financial year!

Budget & Cashflow Forecasts for FY 2015

If you don’t have a budget and cash flow forecast for the 2015 financial year, you’re going to have a bad time. Budgets and cash flow forecasts give you the ability to sleep easier at night, knowing in advance whether or not you’re going to be able to put food on the table. Not only this, it allows time in advance, if there is something coming up which you need additional cash to account for.

A Management and Accountability Schedule

Finally, once you’ve put together your strategic one-page plan, you have your budgets and cash flow forecasts ready, you’ve got your wildly important goal for the next 90 days, it is important to then set yourself some management and accountability rhythms. What we mean by rhythms, is meetings or certain dates that you will be accountable to your management team, or your advisers.

A lot of small business owners hold their team members to extraordinary levels of accountability. While this is great, the business owner often lacks accountability to someone else, which is a critical driver of business performance.

Before the financial year starts, identify an appropriate adviser who understands your business to keep you accountable on a regular, planned basis.

5 Ideas to Quickly Gain Credibility for Your Service Business

When you’re starting a new service business or offering a new service, it’s important to maximise credibility and confidence for your first customers or clients, whether through review sites, social media or word-of-mouth.

Unfortunately, people are often nervous about buying a product or service when they can’t find any positive feedback about it. And until someone is willing to “go first” and provide that feedback, you’re stuck in the classic catch-22 situation.

So how do you encourage people to give your product or service a go in the first place? Here are five ideas to help you out.

1. Discount or Waive Your First “Test Run”

While a lot of children want to grow up and be astronauts, I doubt many of them would have wanted to be the first person in space. Things can go wrong—and unfortunately have (e.g. Space Shuttle Challenger).

It’s the same with business. People will rarely pay full price to be the guinea pig for your product or service. So why not get a few friendly prospects or clients and offer them a discount in return for honest feedback? Tell them you are ‘in early release’ or ‘prototyping the service’ for example. And avoid use of the word ‘discount’ if you can. Instead, use ‘Foundation Member’, ‘Early Adopter Pricing’, or ‘First Mover Pricing’ for example. Just use words that ‘fit’ with your target market. Discount implies ‘cheap’ and affects peoples’ perception of your quality.

Be sure to educate your early users of what the normal price will be, so that they are fully aware of the price advantage they are getting. They won’t appreciate the value of what you are giving them, unless you educate them to it.

2. Create Absolute Transparency

This applies to all aspects of running your business, but especially in the early stages when you’re bringing new clients on board. They don’t want any stone left unturned. What’s the point of them signing up for your product or service only to find out it isn’t what they expected?

Brainstorm common questions your prospects may have, such as:

- What is the value for me?

- Where could it go wrong?

- What is my outcome?

- What are the non-tangible benefits?

- Has anyone else done this apart from you, and what were the results?

Once you’re done, put together a document that answers these questions or be sure to include it in your pitch or proposal. This will give your prospect a lot more certainty.

3. Offer a Guarantee

A simple idea, especially when you’re certain the client will benefit from it, is to offer a guarantee to reduce their level of risk. Just make sure your guarantee comes from a position of confidence rather than coercion.

Bad example: “If you don’t think this

will be great for you, we’ll give your money back if you go ahead and find it to be true.”Good example: “We believe in this

so much we’ll refund your investment if you don’t agree that it’s every bit as good as we say it is.”You can see that the good example uses positive words (believe, agree, good) and tries to limit the use of negative words or concepts. You want the message of your guarantee to be “we totally believe in how good it is” rather than, “we’re unsure and will refund you if that’s the case”.

4. Practice What You Preach

This is one of our favourite ideas, and for good reason. After all, if you’re not applying it to your business, then why would your clients?

For instance, we love Xero and implementing it for business owners who’ve used alternatives in the past and know of nothing better. It’s a big move for most people, and there are concerns at every turn.

How do we alleviate a lot of those concerns? By telling them:

- We use Xero every day in our own business

- Every client or prospect that has come on board has switched to Xero (and none has switched back).

In our coaching and growth program, the Inspire MBA, we also suggest that our clients implement many tools and processes we’ve already tried. That means we can answer their concerns from experience rather than just a textbook.

Would you trust a personal trainer who isn’t following their own advice? Make sure you’re using the product or the process you’re encouraging your clients and prospects to use whenever you can.

5. Over-Service and Include Supporting Products or Services

Another way to ‘sweeten the deal’ for those first few people taking the journey is to offer additional or supporting services you wouldn’t normally include. This could be as little or as much as you wish, depending on the scalability of those extras.

But be careful. You need to make it clear these extras aren’t part of your normal service and won’t be available forever. The last thing you want is to misalign your clients’ expectations and lower the value of your service offering.

There’s no easy path to getting your first few case studies or testimonials. You need to just give it a go, and learn from every interaction and outcome.

The good news is the better you get at this, the easier it will be to offer additional services. You’ll get great at launching, testing and adjusting your approach. And by doing that you’ll gain credibility quickly and grow your business much more effectively.

Planning to Profit: How the Best Businesses Set their Revenue and Profit Targets for Growth

“If you fail to plan, you are planning to fail” – Benjamin Franklin

Most small business owners know this quote (and the meaning behind it) all too well. But when it comes to business growth, you need to more than just plan what you want from your business. You need to know how to plan for it.

And that’s where a lot of small businesses get it wrong.

What do you base revenue and profit targets on? To achieve your lag indicators—such as revenue and profit—you work backwards to the lead indicators that will create these results. There’s no point setting a revenue goal of $x when you don’t know how to get to $x. The trick is to identify your lead indicators and then work out the numbers you need to achieve in these areas that will then automatically result in your target revenue and profit.

Setting Process Goals, not Product Goals

Product goals are where you set a target and work towards it without any real strategy behind it. You just keep working and hope you ‘get closer’ to it.

Process goals are where you work towards the inputs that create the goal. You break down the big goal into the processes needed to get to the product.

Revenue and profit are only the result of inputs or processes. For instance, your revenue consists of Average transaction value x Average number of transactions per client per year x Total number of clients.

You could go back even further and work out how to calculate total number of clients. Depending on the type of business, Total number of clients might result from (Existing clients x Retention rate) + (Sales meetings x Conversion rate). From there you can drill down further to determine the lead indicators that result in the number sales meetings, for example, Number of enquires x Conversion rate to sales meeting.

You can see that a focus on lead indicators like these allows you to focus your efforts and it makes it more achievable and predictable for you to hit your lag indicator results. You might, for example, identify that your marketing campaigns and systems are generating a sufficient number of enquiries, but that these enquires are not being converted into enough sales meetings. That allows you to then look at processes such as how the enquires are being handled and by whom, or perhaps looking at the quality of enquiries your style of marketing and promotion is generating.

We’ve seen cases where a business owner was unaware that a conversion rate in their business was low (for example, 20%) and that a focus on improving this then doubled the conversion rate, which doubled the number of sales meetings, which doubled the resulting revenue from new customers.

Nice. You don’t achieve improvements like this by focusing solely on lag indicators.

Drawing Your Profit Recipe

Just like a recipe, you need work out what makes up your revenue and profit. Take out a piece of paper or open up a new document on your computer, and map out the ingredients to your revenue and profit. (We gave some clues earlier as to what makes up revenue.)

Once you have that, it’s time to move onto your Profit and Loss Statement. Subtract from your revenue your Cost of Goods Sold (‘COGS’) and also your Overheads. The resulting figure is your profit.

What you need to do next is work out what your month-by-month revenue was across the last 12 months.

Setting Your Business’ KPIs

That’s looking to the past. The next step it to focus on the future: The next 12 months.

How many new clients will your marketing bring in each month? What will your average transaction value be? How many transactions on average will you provide to each client across 12 months? What will it cost to sell those services? What overheads will the business incur?

Write these numbers beside the correlating section on your recipe. You should be left with your profit, and a good idea of how to get there.

Yes, what you’re doing is ‘big picture’ stuff. But it’s important to realise your potential is usually higher than you think. You also have a documented process of how a certain revenue and profit figure is attainable. Now it’s time to drill down on these numbers.

Profit is Theory. Cash is Fact

This is a great start, and much more structured than what most business owners would have prepared. But remember: revenue and profit aren’t the be all and end all. What you need to be attentive to is cash. We’ll cover the difference between profit and cash when we talk about budgeting and cash flow forecasting in our next article.

How We Created a Warmth Within Inspire Cafe

It’s fairly commonly witnessed that we’re 50% more likely to share a bad experience on social media, than we are a good one.

To buck that trend is exactly why I’m sharing our experience with Li Wang, aka “CreativLi” in this short video.

[su_youtube_advanced url=”http://youtu.be/rpvvk1Q7M20″ height=”340″ controls=”no” autohide=”yes” showinfo=”no” rel=”no” modestbranding=”yes”]

We contacted Li early into our design and build stage of Inspire Cafe, back in October 2013. We’d known of Li through our partnership with global giving initiative, B1G1: Business for Good – and been really excited with the designs and branding that she’d put together for other businesses.

We needed something Inspirational, to fit in with our theme, events and culture here at Inspire CA & Inspire Cafe. Li looked after the vinyl print on that cover the glass of our meeting rooms and also extended this geometric design onto the back feature wall, where the “Inspire Cafe” logo is positioned.

From the first interaction with us, Li was extracting my thoughts and vision for what we wanted here at Inspire Cafe even though I couldn’t put it into words. The result was phenomenal. Months after the design had taken form, we are still getting great feedback that the cafe feels funky, fresh, vibrant and warm.

We are stoked with how it has all turned out!

Business Structuring Made Easy! Part 5: Family Trusts

A trust is a structure wherein a Trustee (either an individual or company) carries on the operations of the Trust on behalf of the beneficiaries. The actions of the Trustee are governed by the Trust Deed, which details the rights and obligations of all parties. Trusts are a common structure choice for family businesses as it enables the various family members to become beneficiaries of the Trust that is operating the business. While the trust is not a separate legal entity it is a separate entity for tax purposes. The trustee must apply for a Tax File Number (TFN) for the trust and lodge an annual income tax return.

If a company trustee is used, the trust offers all the same asset protection benefits as using a company structure, along with the additional benefits of using a trust. A trust that has individuals acting as trustees exposes the trustees (the individual, or individuals) to same levels of business risk as a sole trader.

Broadly speaking there are two common types of trusts that you will encounter when making your business structuring decision: Fixed Trusts and Discretionary Trusts.

Click Here to Download our eBook “Business Structures Made Easy”

Discretionary Trusts

A Discretionary Trust is the most flexible form of business structure for a family trust. No single beneficiary has a fixed interest in the trust’s property or the trust’s income. The trustee has complete discretion in the distribution of funds to each beneficiary. This makes the Discretionary Trust (with a corporate trustee) a strong and flexible option for a family business. The family members are protected from business risk and the trustee has the discretion to distribute the income in the most effective way possible.

It is important to remember that all of the benefits offered by a discretionary trust for a family business make it a poor choice for businesses where more than one family or group is involved, as neither group of beneficiaries retains a fixed entitlement to property or income.

Advantages of a Discretionary Trust:

- Flexibility with income and capital distribution;

- Broader Tax planning opportunities;

- Access to Small Business CGT concessions;

- 50% 12 month CGT discount;

- Asset protection (if a corporate trustee is used)

- Can pay salaries and wages as well as superannuation;

- Less regulatory requirements than trading as a company.

Disadvantages of a Discretionary Trust:

- Distributions must be in accordance with the Trust Deed;

- Risk of resettlement if changes are made to trust members or trust property without giving consideration to the rules outlined in the trust deed;

- Losses cannot be distributed;

- More of an investment to establish and maintain when compared to Sole traders or partnerships;

- Trustees can be personally liable for some debts of the trust (if individual trustees are used).

Fixed (Unit) Trusts

Fixed (or sometimes called “Unit”) Trusts are recommended when more than one family or group is involved in the business operation. The interest in the trust is divided into units, similar to shares in a company. The Trustee distributes income to the beneficiaries in accordance with their respective holdings in the trust. This is the key point of difference between Fixed and Discretionary Trusts: The units remove the Trustee’s discretion concerning the distribution of income.

Advantages of a Fixed (Unit) Trust:

- Fixed Interests provide protection where more than one family or group in involved in the business;

- Asset protection (where a corporate trustee is used);

- Access to Small Business CGT concessions;

- Access to 50% 12 month CGT discount;

- Easy to raise capital by issuing additional units;

- Can pay salaries and wages as well as superannuation;

- Less regulatory requirements than trading as a company.

Disadvantages of a Fixed (Unit) Trust:

- Sale of units can be a CGT event and attract stamp duty;

- Not as flexible as a Discretionary Trust;

- Trustees can be personally liable for some debts of the trust (if an individual trustee is used).

So should you use a family trust?

Business owners looking to shift their business operations into a trust structure can experience a number of benefits. We strongly recommend anyone interested in setting up a trust seek professional advice before doing so. Given the additional requirements of using a trust, we work closely with all clients that use this structure to ensure all their obligations are satisfied and it is used in the most efficient manner possible.

For more information about trusts or other structuring options please refer to our other articles in this series, or contact us for more a business structure review.

Business Structures Made Easy! Part 4: Companies

Unlike a sole trader who essentially is the business, a company is a separate legal entity with directors who run the business and shareholders who own it. When business owners are interested in restructuring their business operations, the most commonly considered option is a company. This is usually because they believe they understand the way this structure works. Business owners are generally aware that a company owns the business assets and provides protection for their personal assets against business risk. However, there is far more to consider when picking a business structure than asset protection. A brief summary of the Benefits and issues of using a company is outlined below.

Pro’s and Con’s of Structuring Your Business as a Company

Advantages of a Company Structure

- Companies can be owned and run by one person;

- Shareholders are not responsible for company debts unless they sign a personal guarantee;

- Easier to attract capital because of limited liability;

- Companies can operate globally and own properties;

- Companies pay a flat 30% tax on every dollar of profit regardless of how much money is earned.

Disadvantages of a Company Structure

- Relatively expensive to establish and register;

- Compliance costs are generally higher and record keeping requirements are more strict;

- Shareholders may have difficulties in recovering their investment because of limitations on who can buy shares;

- Funds taken out of the company as a salary or wage attract the usual PAYG withholding and superannuation obligations;

- Companies that hold CGT assets do not receive the 12 month 50% CGT discount on disposal.

Click Here to Download our eBook “Business Structures Made Easy”

Division 7A

Business owners who are considering operating through a company structure must give due consideration to Division 7A. Division 7A essentially seeks to prevent directors and shareholders of private companies from taking the company’s profits for personal use. Individuals or entities that take ‘Drawings’ from a private company have until the lodgement date of the company’s income tax return to either repay the funds in full or enter into a suitable loan agreement with the company. Failure to do so will result in the amounts being treated as an unfranked dividend which will need to be included in the shareholder’s income tax return for the year. As you can imagine if the sum taken from the company is significant, this can result is a substantial tax bill.

Considering Restructuring into a Company?

Business owners looking to shift their business operations from a sole trader structure into a private company can experience a number of benefits. However, there are also a number of key differences and potential issues that must be understood and carefully managed. We strongly recommend anyone interested in setting up a company seek professional advice before doing so.

For more information about other structuring options please refer to the other articles in this series, or contact us if you’re looking for more personalised advice.

Life’s Too Short: Four Types of Bad Clients That Don’t Belong in Your Business

A few weeks ago I was reading Firm of the Future, co-authored by Paul Dunn (one of my mentors) and Ronald Baker, which included this story.

A young and upcoming partner in a firm was appointed to Managing Partner. He knew there was some tension between team members and certain clients, and he decided to tackle the problem straight away.

He printed out the client list of the firm, handed it out to every team member, and asked them to highlight any client they didn’t enjoy working with. He then proceeded to fire every single client they’d highlighted.

The partners of the firm were horrified to watch $80,000 in recurring annual revenue disappear from their client base.

But three months later, they saw it replaced more than threefold as $300,000 in recurring revenue walked in the door.

The moral of the story? Bad clients drive out good ones.

Here are four types of bad clients who shouldn’t be part of your business

1. The Know-it-All

No matter how many times you suggest how to improve whatever you’re advising them on, they’ve always got a reason why it won’t work, or how their current solution is great. Even if they do become clients, it will be like ‘rearranging deckchairs on the Titanic’ trying to implement change.

The telltale signs:

- They like your ideas, but they say they won’t work in their business or industry

- They like to keep close to your business, but not engage you.

2. The Dairy Farmer

These ones love milking you for all the value you have, and will often expect a high service offering in your base package. In other words, they want a lot but are prepared to only pay a little. No comprende, amigo.

The telltale signs:

- Initial enthusiasm at your product or service offering, but simultaneously…

- Price-sensitive and heavy on negotiations

3. The Rude Dude

In William Swanson’s 33 Unwritten Rules of Management he includes The Waiter Rule: “If someone is nice to you but rude to the waiter, they are not a nice person.”

These tricksters might be engaging and polite to you, but rude to your team. So if you want good morale in your team, you don’t want this type of duplicitous client hanging around.

The telltale signs:

- They are polite to you but are disrespectful to your team

- Plenty of evidence in a social or networking setting.

4. Les Misérables

French for ‘the miserable ones’, and the name of a musical and subsequent film where Russell Crowe ends himself, this type of client or prospect has just survived some really tough times (e.g. the GFC). I’m not discrediting the trials they’ve faced, but rather how they then carry it as baggage into every aspect of their business and their opportunities. Not exactly a mindset you want infiltrating the ranks. If you can’t inspire change, then keep your distance.

The tells:

- They look for the ‘necessary evils’ in your service offerings, not the value they add

- Procrastination and a lack of energy are trademarks for them.

Our Final Reason to Create an Exit Strategy for Your Worst Clients

Having spoken to others who’ve done the same, removing clients who are more trouble than they’re worth is a satisfying and somewhat freeing experience. Not only can it improve morale, it can also improve your bottom line.

But getting rid of a client is never easy, particularly one you’ve had for a while. So if you’d like to know how to go about it, or maybe just a bit more encouragement, get in touch with us.

Business Structures Made Easy! Part 3: Partnerships

A partnership is a common and relatively inexpensive way to set up a business. It involves 2 or more co-owners (the partners) participating together in a business operation. In order for a partnership to exist the partners must have the intention of making and sharing profits, as well as an understanding that they will each act on behalf of the other in all business dealings.

When establishing a business under a partnership structure, a formalised partnership agreement spelling out the rights, responsibilities and obligations of each partner is a good idea, although it is not necessary for the partnership to exist. In the absence of a partnership agreement The Partnership Act of 1891 sets out the various rules that govern the conduct of partners. The act places joint liability on all partners for debts and obligations incurred by the business during their involvement in the partnership. Partners are obligated to keep their co-owners properly informed.

While a partnership is a separate business operation to the partners involved, having its own Australian Business Number (ABN) and Tax File Number (TFN), all the business profits are taxed in the hands of the partners at their respective marginal tax rates.

Pro’s and Con’s of Partnerships as a Business Structure

Advantages of a Partnership:

- Easy and inexpensive to establish and maintain;

- Fewer reporting requirements;

- Any losses incurred by the business may be offset against other income earned (such as investment income or wages) subject to satisfying certain conditions; Partners are not considered an employee of their own business and are free of any obligation to pay payroll tax, superannuation contributions or workers’ compensation on income drawn from the business;

- Relatively easy to change your legal structure if the business grows, or if you wish to wind things up.

Disadvantages of a Partnership:

- Unlimited liability which means all personal assets are at risk if the business operation gets into trouble; Some of the control of business assets and decisions is relinquished;

- Business debts and losses cannot be shared with anyone except the partners;

- Requirements to pay preliminary tax on business income which may not have been earned;

- Limited access to additional capital for business growth;

Click Here to Download our eBook “Business Structures Made Easy”

What do we think of Partnerships?

While a partnership can allow a business access to additional capital and knowledge (if the partners are both individuals rather than companies and trusts), each partner exposes their personal assets to an unlimited level of business risk. We recommend business owners avoid operating partnerships, especially involving two or more individuals. If you are currently considering a partnership as a business structuring option we recommend you read our later articles in this series that look at companies and trusts, or contact Inspire CA for assistance.

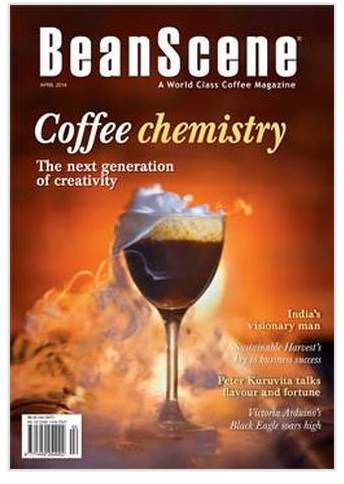

Inspire Cafe – Bean Scene

This article was originally published in the April 2014 issue of Bean Scene magazine. Article written by Sarah Baker.

Inspire Cafe

Inspire Cafe

32 Doggett Street, Newstead Queensland, 4006

Open Monday to Friday 7.20am – 2.50pm

1300 852 747

Ben Walker used to live the lifestyle of a typical Chartered Accountant – filing, calculating and staring at a computer screen day after day. The only daily relief would be the few cups of coffee he’d drink.

Now however, the accountant cafe cum coffee entrepreneur has set up what he is calling a world first – an accounting firm office set up in a cafe.

“A typical office job is quite dull and boring. But after speaking to a mentor Paul Dunn, who has been training accountants for more than 20 years, he said, ‘why not set up your firm in a cafe?'” recalls Ben. “At first I thought it was a joke. Then I realised it was actually a very good idea.”

Months later, with the support of crowd funding in addition to his own, Ben set up Inspire Cafe. “We’ve created a really relaxed setting where customers and business professionals can come to network, host informal meetings, work on your laptop or share ideas over a coffee or meal,” says Ben. “It’s a place for professionals to come together to work, rest and play. One customer told us after her visit that her time at Inspire Cafe was the most relaxed she’d been all day. That’s the reaction we want.”

In the mornings, Inspire Cafe is open to the public. Take away and dine-in Esprosini coffee is available with Chief Espresso Officer Cam Silk Sbusy at work on the cafe’s Synchro espresso machine. Cam describes the house blend, named the Roast Master’s blend, as “very smooth with hints of citrus and berry”. “It’s nice and strong on the palette and a great energy boost for our business customers,” he says.

Cam has spent 14 years honing his craft, and isn’t too keen to trade places with Ben anytime soon. “I’m happy to keep working behind the espresso machine,” he laughs. “It’s been a fun challenge to start this place from scratch with just an empty room and build it up to our dream cafe with a great customer base.”

Inspire Cafe invites business firms and clients come in and use the cafe’s meeting rooms and boardrooms, while the space also holds functions and events.

For their hard-working customers, brain food at Inspire Cafe comes in the form of an entire gluten-free breakfast and lunch menu. Favourite items include their bircher muesli, pizzas and egg and bacon rolls – which Cam says walk out the door faster than they can make them.

Inspire Cafe also has a liquor license so Friday night drinks for the business type are the perfect way to celebrate the weekend.

Through their partnership with Buy1Give1’s overseas aid program, for each coffee Inspire Cafe sells, a child in a Malawi village gets access to life saving water. And for each meal they sell, a child in an Indian school will receive a nourishing meal.

Inspire Cafe

Inspire Cafe