Get Paid Faster

It goes without saying that a business needs cash flow to keep operating. If too many customers forget, delay or refuse to pay, your business could end up in serious trouble!

Debt collection is an aspect of cash flow management where a lot of businesses underperform. However, it doesn’t have to be difficult. If you have the right person for the job and develop a workable protocol, the process of debt collection can be made easier and it will have a positive effect on your cash flow.

Employing the right person

Admittedly, the term ‘debt collector’ has a negative connotation. It conjures up images of harassment and fear! Not only that, many business owners might assume that because collecting money comes under the umbrella of finance or accounts, then their bookkeeper should be an expert and enjoy chasing up outstanding bills! That’s not always the case.

The responsibility of collecting money (known as ‘accounts receivable’) is likely to be suited to someone who is good with people – friendly and confident. They should be well-organised, have good time management skills and be able to keep handy records of customers’ habits and tendencies when it comes to paying their bills.

Measuring effectiveness

Generating a report showing outstanding debts broken down into 30, 60 and 90 days columns won’t show the average accounts receivable days, that is, how many days it takes on average for customers to pay their invoices. Businesses operating on payment terms of 30 days may not realise that in reality customers take much longer on average to pay their bills.

Working out the average accounts receivable days provides a useful indicator for your debt collector to measure their effectiveness, and can be calculated using this formula:

Accounts Receivable / Revenue x Time

For example, a business might have generated revenue of $95,000 for the first quarter of the year. The outstanding invoices, or accounts receivable, on record for that period total $65,000. Therefore, the days in accounts receivable are calculated as follows:

$65,000/$95,000 x 90 days

Monitoring this indicator from one quarter to the next, or over a 12 month period, will show whether debt collection efforts are improving, remaining the same or ineffective. These results are helpful both to the person responsible for collecting debts and the business owner.

YOUR ACTION PLAN

- Designate a well-organised and amiable employee to be in charge of debt collecting. Together develop a protocol for collecting debts and use the indicator to measure progress and performance.

- Schedule time in your calendar to review outstanding debts regularly!

3 x Debtor Collection scripts to cut, paste and send to your overdue debtors

20 October 2015

«ContactAddressee»

«PostalAddress»

«PostalCity» «PostalRegion» «PostalPostcode»

Hello «ContactSalutation»

Friendly Reminder – Overdue Invoice

This is a friendly reminder in relation to the overdue amount on your account for [$Amount].

We would appreciate your prompt attention to this matter and ask that you please arrange payment of your account as soon as possible.

Enclosed is a statement for your reference. Payment options are listed at the bottom of your statement.

If you have made the payment required within the last few days, please disregard this notice.

We look forward to hearing from you soon.

Kind regards

[Debtor Champion]

[YOUR BUSINESS NAME]

20 October 2015

«ContactAddressee»

«PostalAddress»

«PostalCity» «PostalRegion» «PostalPostcode»

Hello «ContactSalutation»

Urgent Attention – Overdue Invoice

We wrote to you on [Date] advising that your account of $[Amount] has been overdue since [Date].

We would appreciate your urgent attention to the payment of this account as it now exceeds our usual payment terms of 14 days.

Enclosed is a statement for your reference. Payment options are listed at the bottom of your statement.

If you have made the payment required within the last few days, please disregard this notice.

Kind regards

[Debtor Champion]

[YOUR BUSINESS NAME]

20 October 2015

«ContactAddressee»

«PostalAddress»

«PostalCity» «PostalRegion» «PostalPostcode»

Hello «ContactSalutation»

Final Notice – Immediate Payment Required

We have contacted you on numerous occasions requesting payment for the following outstanding debts:

- [Entity Name] – Invoice Number [Number] – $[Amount]

- [Entity Name] – Invoice Number [Number] – $[Amount]

Total Amount Payable: $[Amount]

It is unfortunate that you have not paid our Invoices on time, and you have not even proposed a payment arrangement with us.

Your lack of action has now resulted in us having to make a business decision. Unless payment in full is received no later than 7 days from the date of this letter, we will be engaging our Lawyers to commence immediate debt recovery procedures.

We have been more than accommodating in our previous requests, and therefore will be making no further extensions beyond this timeframe.

Enclosed are statements for your reference for each entity. Payment options are listed at the bottom of the statements.

Regards

[Debtor Champion]

[YOUR BUSINESS NAME]

Risks and assets – gotta keep ‘em separated! How to keep what’s yours

If you are planning to build, establish, grow and benefit from a small business, protecting your assets should be one of your primary considerations. Too many times you hear about people that have done brilliantly in business, only for something to go horribly wrong. Then you’re shocked to find them and their families enduring real financial hardship a little while later. How does this happen? How can business owners suffer such a dramatic and complete change of circumstances both commercially and personally? Protection or lack of it would be one answer – and an all too common one at that.

Certain things just don’t go together

Oil and water, cigarette lighters and petrol, your hard-earned assets and commercial risks within or around your business. All of these combinations have potentially explosive and very damaging consequences. Lives can be altered forever, there can be a tonne of damage to people and property. However, the separation and safeguarding of assets from risks can be managed with the sound advice of a good accountant.

They would tell you, as I am now, that if the point of owning a small business is to help build a wonderful life for your family, then once you’ve accrued assets, they should be protected. Protected from economic peaks and troughs in world and local markets, supply and demand fluctuations in your own or even poor decision making by you or someone within your business.

One of the simplest ways to make sure that your family home, vehicles, sports memorabilia and other assets aren’t brought into play if your business hits trouble is by selecting the right business structure.

If your business is set up as a sole trader, you are personally liable for consequences that may not be of your own creation. A disgruntled employee, a careless oversight or even just plain old bad luck could put your personal assets directly in the punitive firing line. The same can often be said for partnerships, which can be trickier still because there will be at least two but often more people making decisions that may well effect your assets.

Keep in mind, we’re not talking about the bonus you were hoping to earn, dividends you wanted to distribute or even future earning capacity. The potential tragedy lurking in the shadows of these business structures is that owners and/or partners can lose what they already own.

Protect what’s yours!

Okay, so due diligence is exactly that – it’s a must, it’s something you have to do and this by itself will keep you safe from a lot of the troubles that can beset businesses of any size. But a great deal of help comes in the form of the in-built protections offered by business structures such as Trusts and Companies. Here you have structures that recognise you (and your assets) and the risks associated with your business’s commercial activities as almost mutually exclusive (with just a few exceptions to muddy the waters). All in all, far safer than betting the family home that you won’t ever put a foot wrong, nor your associates and that no one will ever come after your business with ill intentions.

At the end of the day, you have, or will have, worked very hard for what your family enjoys. It’s worth protecting and can be, with the right advice and decisive action. If you want to talk about keeping risks at a safe and respectful distance from your assets, talk to us – we want to help.

The truth about your P&L. Numbers never lie

Those that do not learn from the past are doomed to repeat it. Heard that one before? Your P&L (profit and loss) statement is an honest-to-goodness, no holds barred account of how your business performed over a predetermined period. It is a record of fact and leaves very little room for ambiguity. After all. Number never lie. However, if you squint at them, in a certain light, you can fool yourself into thinking they are a little more favourable than what they really are. But that’s our fault, not theirs.

We always talk about understanding your numbers so that you can have a solid grounding in what has worked for you and what looks like it could have been done better. But the real beauty of the numbers that make up your P&L, is that in the right hands, they can map a path to where you could take your business, not just where it’s been. While it’s stressed in the pages of many an investment prospectus, that past performance is not a true indicator of future earnings, past performance is still a wonderful tool.

Give it to me straight P&L, how’d we do?

A P&L doesn’t sugar coat anything. That’s the first thing you need to realise – and appreciate. For the unvarnished truth, a mirror to hold up to your business, nothing really comes close to the P&L.

The assumptions and truths (real and imagined) you build upon that most honest of foundations, is where the fork in the road appears and self -deceit muddies the waters. You end up saying things like, “yeah sure, premium travel and massages represented a 25% increase in total costs BUT we’ll make that all back and more when our very impressed clients start queuing up for our services”. You are dreaming – and wasting money. That’s not how Cash Rich Businesses remain so, that’s how ego ends up sinking, or at the very least, hampering your profit-making potential. And your P&L will reflect the damage, poor decision-making has done… without blinking… and with no apologies – a true friend.

On the other hand, you will also see how a 25% increase in staff performance-based bonuses led to a 55% increase in new revenue. At first glance, the signs are all there, without additional noise or complication, terrific! Of course from here, due diligence dictates that you investigate the cause and effect relationship more closely to ensure that it is what you think it is. The good thing is that now, you’ll be fishing where the fish are as opposed to randomly dropping a line somewhere in the Pacific and hoping for the best.

Tell me, P&L, should I stay or should I go?

Thinking of expanding, making a play for a foothold in another territory or service offering? A well prepared, honest-as-the-day-is-long P&L will tell you when and how much.

For example, how much cash on hand did you have to get you through the lean winter period as an ice cream shop owner? What was your return on investment when you forked out additional advertising when the new apartments went up nearby last spring? How much tax did we end up paying? Really?! Maybe it is time to time to talk to the good people at Inspire.

So, your P&L may not tell you how many storeys high your empire will be, but it will tell you, in no uncertain terms, how strong the foundation is. Remember, your P&L is your pal and numbers never lie.

Before you pay too much tax this year… A second opinion may save you

We all have to pay our fair share of tax – correct! Whatever your accountant’s computer spits out, that’s what you have to pay – incorrect!

As the owner of a small business, you’re not dealing with the typical individuals’ single group certificate at the end of the tax year scenario. Your business, even if quite straightforward, is a collection of fairly unique elements and sets of circumstances. Different people, different reward structures and remuneration packages, diverse expenses that may be seasonal in nature or as regular as clockwork. It’s a lot and no two businesses are exactly alike, not even franchises. That’s why, tax files can be prepared a little differently and yield vastly different results for the very same business, in the very same tax year.

Acceptance is the enemy

So, if your business is so different to everyone else’s, your accountant and/or your numbers team, simply must treat your business differently – on its merits. If, however, your team takes the cookie-cutter approach and doesn’t consider what is best for your business, given your set of circumstances etc well, you are going to pay too much tax. You just are!

Knowing this, you now know, if you didn’t already, that you can and should take steps to ensure you’re paying only your fair share of tax and no more. Accepting a tax payable figure that seems a little (or a lot) too high is both ridiculous and unnecessary. It will end up biting you, your business and inevitably your family. That’s why acceptance is absolutely your enemy and why it is absolutely worth getting a second opinion.

I can get a second opinion? How?

Let’s start here, with three brief test cases. It’s no secret that we like a nice comfortable car to drive around in. We’re even more comfortable if it’s a company car because of the savings available to us when we purchase for the company, as opposed to adding to our own liability. Now imagine that you’ve had this car for say, 4 months. All of sudden, you’re hearing an expensive “knocking” sound coming from the engine. The mechanic agrees the car’s still under warranty but assures you that the sound really doesn’t mean anything and it’ll be fine. Get a second opinion!

What about if the car is not under warranty because it’s now 5 years old. The mechanic says it will cost $4,500 to fix. Hmmm. Get a second opinion.

Your accountant breezes through your BAS for the last financial year, hits the calculator and gives you a hefty figure to pay to the ATO. Get a second opinion.

If you feel like you could be doing better tax-wise, we at Inspire, would love to take a “look under the hood” of your business to let you know how much tax we could save you. The beauty of this is we guarantee you that we’ll find at least $500 worth of tax savings just by having a look. If not, we waive the $500 plus GST fee. That’s a win.

How big that win turns out to be can vary but it’s not unusual for in depth examinations and some remedial steps around business structure for example to yield tens of thousands of dollars in tax savings for our clients. Definitely worth a second look!

To get your second opinion rolling, book in a 10 minute chat at www.inspireca.com/TestDrive or call us on 1300 852 747.

6 Reasons cash rich business owners take time out

In the lead-up to the busiest time of the year, if you’re an accountant, we have been putting a significant amount of time, energy and resources into… chilling out. Yes, holidays, time out from the business, cultural immersion, all of that. Some would simply say, “half your luck” and leave it at that. Some would say, “awesome, have a good one” and wonder how we do it. Yet others might say, “with everything you guys have going on (aiming to save your clients $1million in tax, planning, end of financial year…), I don’t know guys, have you really thought this through?” Well the answer is yes.

One of the main reasons we committed to taking time away from the business is precisely because we business owners thought it through. As we see it, and we’re certainly not alone, there are at least a dozen compelling reasons to get away for an extended period of time, let’s run with our top 6:

Trust

We trust our team, we trust our systems. We give ourselves a solid 5/10 for saying it and a bonus point for actually writing it down. That’s good, but to be great you must actually demonstrate it. Leaving the team to their own devices and our carefully calibrated systems ticks that box – and they will be/are better for it. 10/10 – much more like it.

Efficacy

Knowing is better than guessing. Always has been, always will be. The final step before giving any product, service or even “way of working” is the old stress test or live test. This is where systems are tested in a live or near live environment. They are pushed and a number of different and sometimes unreasonable scenarios are thrown at them, just to see if they’ll hold up. When they do and all is well, you’re ready to (yes!) go on holiday. After all, when you know you’ve worked hard and got something right, take advantage.

Perspective

This is an easy one. We’ve all heard about the dangers or at least the disadvantages of operating down in the weeds for extended periods of time. One of those is the inability to see the opportunities for the issues. Time (right) away from the business allows you to think about it more objectively. Solutions to issues and dilemmas that you were just too close to back home, may now seem more clear-cut, accessible. That’s perspective working in your favour.

Clarity

I’ve just got to get away and clear my head”. You hear that so much in movies nowadays that it’s almost a cliché. Funny thing about that – clichés are usually based on an element of truth. Your mind may well have a load limit and without taking time to “clear your head”, you may not have room to manoeuvre around the big issues and formulate solutions. Clarity, work for it and it will work for you.

Opportunity

Placing yourself outside your normal workaday environment is necessary and useful but it can also open up new opportunities. We have to be careful here because you’re on holiday to holiday, not to mine for new business. That said, many a poolside conversation has opened many a door and it’s not unusual for business introductions to open with, “this is [insert name], we met last year in [insert holiday destination].” Don’t go looking for it, enjoy your holiday. Yet at the same time, understand that sometimes, opportunity knocks on the door of your beachside cabin too.

You deserve it and so do they

Always, always, ALWAYS remember why you decided to own your own small business. It’s a way to enjoy more time and happiness with your family. Yes, money is the vehicle but the reason surely is family first. You’ve worked hard, you approached your business the right way and you’ve paid everyone that needs to be paid. Don’t neglect yourself and your family at the bottom of that list.

There are other reasons too, but this should be enough to persuade you to get online, scroll through some holiday packages and make some plans.

Bon voyage!

Harvee – Adam Houlahan is a friend of Inspire and a social media guru! He runs Web Traffic That Works, a social media agency that helps entrepreneurs gain influence and credibility online. He has a particular skill for LinkedIn, and this post is filled with some great insights on how to use it properly.

Plus… There’s a special bonus for Inspire Community at the end!

Enter Adam..

Have you ever considered LinkedIn for growing your career or your business?

LinkedIn is the social media channel for professionals to interact and engage in a professional way. Unlike other social media platforms, LinkedIn is all about it users’ professional lives and profiles. It is also a premium channel to enlist for using social media for business and marketing purposes.

There are numerous ways to create a LinkedIn marketing strategy, and in this article we’ll look at some simple tips and explain how to use LinkedIn for business and create a marketing plan for measureable results.

To achieve sustainable success in the long term with professional social media marketing, you will need to develop a consistent, comprehensive LinkedIn marketing strategy. Whether you are a small business consisting of a sole trader, or a larger corporation, LinkedIn can be a powerful lead generator.

How do you achieve this? Follow these steps:

- Remember LinkedIn is NOT your online resume!

Too many LinkedIn users view the platform as an online resume. When it comes down to it, do the professional connections you make now care where you went to school? Or where your first job was? At the end of the day, the audience doesn’t care about you as much as they care about what you can do for them. So use your profile to tell your audience what you do now; what makes you stand out from the crowd; how you can benefit others; and include testimonials from others that support your claims.

- Create a company page on the platform

Whilst your personal profile will always be the main presence and way you interact on LinkedIn, consider your LinkedIn business page as an extension of your business website. Include job opportunities, new products and services, and compelling content. Invite your existing customers, clients, partners, vendors and employees to connect with and follow your LinkedIn page. Key partners, clients, or customers may be willing to endorse you via the LinkedIn tool – this can be a very powerful asset to your business.

Use your page to provide compelling content in the form of industry updates, showcasing your business, interesting and informative blog articles, etc. Remember to segment your followers appropriately so that you can target updates in a relevant way.

- Add visual content

Visual content is much more engaging than raw test and with great visual content on your profile, text is more likely to be read. Use the LinkedIn Professional Portfolio feature to enhance your profile with images, screenshots, videos, infographics, SlideShare presentations and linked articles. Update your profile regularly so that its content is dynamic; include recent press articles, work samples, case studies, screenshots of tweets based on your work, special programs and events, and speaker videos.

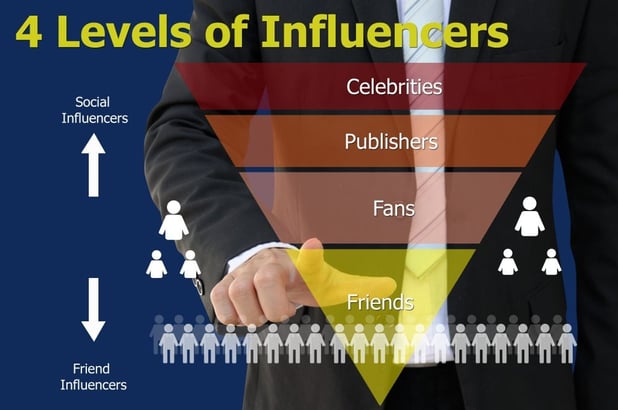

- Make influence networking work for you

You want to develop real relationships on this platform, as opposed to simply collecting connections. One way to do this is to provide targeted value within your niche. Contrary to the common practice of broadcasting at your wider audience, instead aim to connect with your network to ultimately create an active relationship that is mutually beneficial and ultimately grows your business’ bottom line. This will humanise you, your business and your brand, and your engagements and interactions will become more meaningful.

As a result, you will stand out from your competition, position yourself as of value to your connections, trigger reciprocity, and engage your network.

Ways to make influence networking work for you include:

- Identify the most valuable people (MVP) in your network.

- View the MVP’s profiles to learn what is important to them.

- Use this information to find ways to interact: Help, promote, congratulate, acknowledge and connect with them in a mutually beneficial way.

- Use @mentions.

- Promote and share the ideas of your MVP.

- Launch an industry-specific LinkedIn group

LinkedIn groups bring together members of the platform who share common interests and goals. By creating and launching such a group specific to your niche, you can position yourself as an authority and a thought leader within your industry.

LinkedIn groups also allow you to message your members directly each week, delivering campaigns and promotions and directing them to your compelling content like newly published blog articles.

Assign a moderator role to a person who asks open questions, pre-approves discussion topics, and manages group membership. Organically inform clients, customers, partners, vendors, relevant connections and employees as well as key influencers in your industry. Key influencers can become ambassadors for the group to enlist new members and help lead discussions to keep the group activity dynamic.

- Provide thought leadership

Prove yourself to be an expert in your field and you will achieve greater results with your marketing campaign. As a marketer that provides value to others through compelling content that is of high quality, you will be remembered by consumers when the time comes to make a purchase to fulfil a need. Great social content helps to foster and generate leads.

It’s also a great idea to designate suitable company employees to assist in the implementation and maintenance of your overall LinkedIn marketing strategy. Having employees on board fosters an extended network and a greater presence for your business.

- Utilise sponsored updates and paid ads

LinkedIn sponsored updates allow you to target your content towards the key influencers and decision makers on the platform. This in turn will result in your credibility as an authority in your niche expanding, and your exposure across the platform will be enhanced.

- Monitor your LinkedIn marketing campaign

Thanks to LinkedIn’s detailed analytics tools, you can track the effectiveness of your LinkedIn marketing campaign via the following metrics:

-

- Clicks

- Impressions

- Interactions

- Audience demographics

- Followers acquired

- Social actions and engagement

- Total spend

- Click-through rate (CTR)

- Cost per click (CPC)

- Sponsored versus non-sponsored updates

Blogging on LinkedIn

When you consider how to use LinkedIn for business, one thing to adopt is blogging on LinkedIn. LinkedIn’s Influencer Program was launched in 2012, and it allowed thought leaders to publish highlighted blog posts on topics ranging from innovation and leadership to case studies. The capability was extended to all platform users in 2014, and anyone in your network can see and benefit from your blog posts.

Blogging on LinkedIn enhances your profile and professional standing. Some basic tips for successfully blogging on this platform and to enhance your social media marketing campaign include:

- Write what you know. Demonstrate your expertise in your field and incorporate the function of your job and what makes you and your role unique.

- Reflect your profile in your articles. Keep aligned with your brand identity.

- Don’t write too much or too little. Tell a story that is valuable, but make it readable. Ideally (according to LinkedIn data analytics), an ideal blog post will be in the vicinity of 700 words.

- Include images, links to your website, videos and other visual content to engage readers.

- Engage with readers in the comments section; social media is about dialogue.

- Track analytics to learn what works and what does not.

- Share your content with links to your posts outside LinkedIn, posting to Twitter or Facebook, for example.

LinkedIn is a powerful professional social tool for growing your business. With some attention to the above suggestions, you are certain to enhance your overall social media marketing campaign. LinkedIn can’t be ignored.

Special invite for the Inspire Community..

If you’ve got some ideas for LinkedIn from Adam in this article, we strongly recommend his free four week LinkedIn eCourse – it will fast track your path to raising your profile, generating leads and boosting your business through LinkedIn.

The answer is always Xero. Take this quick quiz to see if you could improve the way you work

Inspire is built on the premise that we can help small business owners with young families, draw more happiness in the form of time and resources from the work they do. One of the things standing in the way of owners achieving this goal is too much time spent on invoicing, bookkeeping and administration. Now this doesn’t necessarily apply to everyone but ask yourself these important questions. At the end, we’ll tell you what it all means:

- Do you fire up the laptop to “just finish up a few admin/invoice things” when the rest of your loved ones are hitting the hay?

- Are you tired and jaded in the morning because the invoicing had to be done last night?

- Do you stare intently into the middle distance when you’re asked about your business numbers?

- Did you just doze off for a minute there – because worry and stress has robbed you of decent sleeps?

- Weekends. Did you know they consist of two and sometime three or four days?

- Have you ever messed up the trading terms on an invoice you wrote at 2.30am?

- Is nailing 7-9hours of sleep three nights in a row just a dream to you?

- Did you know people do that?

- Do you ever mess up your cash flow because you didn’t get your invoice out promptly?

- Do you keep a shoebox to store all your receipts and still lose the important ones?

- Do you understand that these answers are affecting your business, your family and you?

- Do you wish you could answer “no” to the vast majority of these questions but can’t, in all honesty?

- Are you still wondering how on earth to find a few more hours per week with the family?

We’ll leave the questions there because you probably need to get back to your invoicing and/or admin. But what does it all mean? Let’s take a look.

If you answered “yes” to any questions aside from questions 5 and 8, we need to talk because you have problems that we can help you solve. And Xero will feature in many of the solutions.

Bonus question: How can I use automation and easy access to my numbers to drastically reduce stress and time away from my family?

Answer: Xero

Talk to your accountant or us about switching to Xero and get your head out of the books and back into the clouds, where it belongs on your days off… you know… days off?

Pay it again, Sam. The joys of recurring revenue

A reliable, recurring and regular income stream for your business from a single source is a wonderful thing. Some businesses refer to them as retainers, others simply call it repeat business. There are other names too but whatever you call it, from the outside looking in, it’s called a healthy and valuable business.

You see, marketing is an expense that can get really expensive if it’s not leading you to more sales. Cold calling contact lists can take its toll and prospecting for new clients is necessary but not necessarily easy. But providing goods and services regularly to regular customers is – or at least relatively so.

When a small business can show turnover, unencumbered by heavy costs of doing business such as business development time (and associated fees and or salaries), it’s a clear sign that margins are healthier. It also suggests that profits will be healthier and more sustainable. Potential investors or those in the market to buy all or a piece of a small business, will be attracted by the sweet, sweet scent of recurring dollars. Even if you are not interested in selling your business or taking on an investor, take their interest as affirmation that you are on the right track and the value that you add for your clients has made your business even more valuable.

Recurring revenue or retainers also suggest to interested parties that you have and maintain good relationships with those clients. It says that you and your commercial enterprise are easy to do business with, which means running the business will be easier. All of these aspects of your business represent valuable ticks in all the right boxes and are important features of a “Cashed Up Business”.

If 50% or more of your revenue is derived from monthly subscriptions or similar, you will automatically have more time to work on your business (the offer, the customer experience, innovation and future-proofing…) instead of in it. You will have progressed from maybe “owning a job” where you find yourself well and truly in the operational space to owning a Cashed Up Business. Now you can rely on your established processes and systems to help keep the business and the revenue ticking over.

Tip: ensure that all of these valuable processes, protocols and systems are clearly documented. Think of this compendium as an owner’s manual or instruction booklet. Any well-oiled machine is far more valuable when it comes with a detailed handbook and a clear path to sustainable success i.e. recurring revenue.

For more tips on how to turn your life’s work into a Cashed Up Business, book your place at one of our workshops (June 2 and 15), it will make all the difference to you.

Is your Accountant making or taking your money? Cashed Up Business Q&A pt 2

As we inch closer and closer to the end of the financial year and the conclusion of the tax season, there’ll be conversations around how your business did and how well you did on the tax front. As accountants ourselves, we know that part of the glory and all of the blame rests with us when the final (tax) reveal takes place. If you’ve saved a lot of tax because of the advice you received and the actions you took as a result – happy times. If not, one of two things generally happen. One nothing. Or two, disappointment (perhaps some unkind words but rarely) and then… nothing.

This is not a good outcome for you, the small business owner. It should, all things being equal, start the search for a more invested, proactive accountant to guide you through the fiscal jungle or at least lead to some fairly direct conversations about expectations.

So, to the questions.

Why does my accountant look so calm before hitting “enter” for the last time?

You know that moment when you’ve been sitting with your accountant for quite some time and they are just about to tell you what you owe or what you’ll be getting back from the ATO? You’re excited, perhaps you’re nervous, perhaps you’re feeling physically sick. This could be bad, it could be really, really bad. And yet, there they sit, as cool as a cucumber.

Why?

There are two possibilities. One because they know they have done some great work for you and they know you’ll be delighted with the result. If anything, they’re mildly curious about how you’ll spend all that extra money that you thought would be heading the ATO’s way.

Or two, they simply don’t care. Unfortunately, there are those in our industry, and every industry for that matter, who are permanently in “fill and file” mode. This is not great but it gets worse when you realise that someone like that is “taking care” of your small business’s money. The same money with which you promised yourself, you’d make a great life for your family.

How much will a good accountant cost my business?

Nothing. Costs, particular when it comes to tax, can mount up pretty quickly if you don’t have a good accountant. But if you do, you will find that their fees will be dwarfed by the amount you save as result of engaging their services. We’ve said it before but it bears repeating – If your accountant isn’t putting $10,000+ a year back in your pocket in tax savings it might be time for a change.

What else should my accountant be doing for me?

Aside from taking care of lodgements there are a number of things your accountant can and should be doing for your business:

- Educating you on your numbers and what they mean

- Ensuring you only pay your fair share of tax and not a cent more

- Insulating you against pressure from the ATO through great advice and even organising payment plans if things become very difficult

These quick examples don’t include the basic goal of helping you build a better, stronger business with which to help you enjoy life with your family.

That’s the key – no question.

If you do have more questions, particularly around assessing the type of service you’ve been getting versus the quality you deserve, please do contact us.

Are you up or are you down? It’s time to check the scoreboard… if you have one

With only 8 weeks to go until the end of 2016/17 financial year aren’t you a little curious as to how your business will look, results-wise, come June 30? The correct answer here is “no”. Bonus points if you added an exclamation point. Apart from curiosity killing a cat, what’s wrong with wondering if you finished in the red or the black, up or down, flat or flush? The reason “yes” to these questions is a red flag, is because you should already know. Maybe not down to the last 10cents, but at this stage of the game there should be no surprises and no need for guesswork or crossed fingers.

Knowing your numbers provides the answers to all of these questions. It even answers the question, “how can I tell what’s going to happen in June when we’re only in the beginning of May?” That’s the beauty of having a full picture of all the numbers that matter to your business. They will not only tell you what just happened but they will offer clear insights into what will happen next.

The scoreboard should tell you more than just the score

When we at Inspire recommend that small business owners establish and regularly check their scoreboard or dashboard, we’re not simply looking for the amount of money in the account. While cash on hand is important (vital actually) it doesn’t tell the full story. Buried (but not too deep) in monthly and weekly numbers are profit drivers and lag indicators. They are hiding in plain sight just waiting for someone to take a look at and formulate some next steps based on what the numbers are saying.

Too often, small business owners see a lower than expected (hoped for?) number and start feverishly cannibalising their own margins to prop up the turnover figures. Dangerous. Very dangerous. We’ve talked about how times of difficulty call for an increase in value not heavy discounting. With a clear view of the numbers, problems are solved while they are still just lag indicators, leaving you plenty of time to prepare your countermeasures. Similarly, when forecasts indicate an upswing in sales based on real data, a knowledge of your numbers will signal the right time to take advantage with added investment in staff, capital or simply a larger safe.

Using a dashboard regularly (weekly) and for its intended purpose, represents an investment of time and money that will pay for itself many times over, regardless of the story it tells. “Forewarned is forearmed” and “first in, best dressed” are the key messages that highlight the value of knowing your numbers. Not just the ones that tell you what happened in your business, but the ones that show what can happen for you.