Paying little, less or no tax when you sell a business or large investment

So, broadly speaking you’re looking to make capital gains or a sale of business assets or investment assets and just like any Australian, your intention is not to pay any more taxes than is needed on the gain on those when you do sell them.

Great question.

There’s three main ways, or tax concessions, I see to pay little, less or no tax:

- The General 50% CGT Discount;

- paying 0% tax in your superannuation fund; and

- the Small Business CGT concessions.

What is CGT?

‘CGT’ is ‘capital gains tax’.

Basically, that’s the tax that you pay when you sell an asset like a house, or business, or a portfolio of shares and you make a gain.

You buy a house for $500k, you sell it for $600k – that means you’ve made a ‘capital gain’ of $100k.

Tax might be up to $47,000.

The tax you pay on that capital gain depends on who owned the asset, and any concessions or exemptions you may be eligible for.

You pay CGT on gains you make on things like investment properties, business sales, sale of shares, managed funds (there’s more, but that’s an example).

The “General 50% CGT discount”

There is a ‘general discount’ for Capital Gains Tax.

This is available is assets are owned by individuals (people) or trusts (like family trusts, discretionary trusts or even Self Managed Super Funds are classed as a type of trusts – although Super Funds only get 33% discount, not 50%).

The general discount allows an individual or a trust a 50% discount on the tax they pay on their capital gain, so long as they’ve held an asset for more than 12 months.

You buy the same house above in January – then you sell in February the following year (13 months later), still making the same $100k capital gain.

The 50% discount means that you’ll only pay tax on 50% of the gain, or only tax on $50k.

Tax has now halved, and you may pay up to $23,500.

Good stuff!

Paying 0% on Capital Gains made in Super

So in your superannuation fund, when you’re drawing a pension, the ATO gives you a tax break.

If you’re over the age of 60 and drawing a pension from your super balance (Note: not the transition to a retirement pension), then that tax rate is currently 0% on any income including capital gains. You need to be 60 years old, and your pension balance is taxed at 0%. (There are also other requirements and maximum balances too.)

So, say for instance that today you were to buy a commercial property that your business was renting. You do that through your self managed super fund, or SMSF.

Now, if you held onto that investment until you were 60 years old, and you were drawing down a pension at the time, then any gain on sale of that asset would be taxed at 0%. (This would be assuming your SMSF was 100% pension in your name – or other members also over 60 drawing a pension.)

Let’s put some numbers behind that.

Say you buy a commercial property worth 1 million dollars today, then 30 years later you sell that for 3 million dollars. So you’ve made a 2 million dollar capital gain.

Now, outside of super, if you purchased it in your own name you’d be up for quite a bit of tax, rough numbers $470k in tax.

But if you held the property inside your self managed super fund, you’d pay 0% and $0 in tax. (Again assuming you were 60 years or more, drawing a pension.)

That transaction would save you hundreds of thousands of dollars in tax by careful structuring.

Now, that applies to other investments like a residential investment property sale. Same with shares that you own in listed companies or other people’s businesses. So it’s pretty significant.

It’s like you’re having your own legal tax haven in Australia.

So, that’s the superannuation pathway of paying no tax on sale of assets.

Small Business CGT Concessions

Now, I mentioned at the start the small business capital gains tax exemptions were the other option.

This one applies to capital gains made from selling all or part of a business.

There’s also 4 concessions that are available for small businesses – so they’re pretty powerful tax saving strategies!

The four concessions are:

- 15 year exemption

- 50% active asset reduction

- Retirement exemption

- Rollover

The great thing about the concessions is that you can apply multiple concessions on the same transaction or ‘sale’.

Eligibility for Small Business CGT Concessions

Now, first we need to make sure that you’re eligible for those exemptions, and there’s three main tests that are looked at.

The first test is ‘does your business and any connected businesses turn over in total less than 2 million dollars in sales’. That would look at any connected entities. So, if you’re into two businesses, you need to make sure that turnover of total annual sales does not exceed 2 million dollars. If it does exceed that, all is not lost.

The second test is that you hold an asset as an investment (like a property), and it’s used in a ‘small business’ of a connected entity. Note: this one is not available to property held by Self Managed Super Funds.

The third test, and I would say the most heavily relied on, is the ‘$6M net assets’ test. This says the business owner selling the business has to have less than $6M in business and investment assets, less any debt (and not including some assets such as the family home or your superannuation).

So let’s say the business owner has $10M of assets – including debt of $3M, superannuation of $1M and a family home of $1M. Rough figures, the business owner would have $5M in net assets under this test, and be eligible for the concessions.

Running the numbers on the concessions

Let’s assume for all four concessions that we have a business sale of $1M. And you started it from scratch 16 years ago, so there was no original cost for you buying the business.

That means you have a capital gain of $1M, and without the concessions, assuming you held it through a trust or individually, you’d pay upwards of $235,000 in tax on that sale. ($1M x 47% tax rate x 50% general CGT discount.)

I might just mention as well those small business CGT concessions are only for business assets, they’re not for passive investment assets like listed shares or residential rental properties – but it can include commercial property that was used in the running of your business, unless held by an SMSF.

Let’s look at the concessions now.

15 year exemption

The first of the four concessions is the ‘BIG KAHUNA’!

This exemption says if you have been running the business for more that 15 years, you can disregard the capital gain COMPLETELY!

$1M gain.

$0 tax.

No tricks!

50% active asset reduction

Under this exemption, you get an additional 50% discount on top of your first 50% general CGT discount.

So you’d pay upwards of $117,500 in tax. ($1M x 50% x 50% = $250,000 x 47% tax)

Still a fair bit, but less than $235k!

Retirement exemption

This allows you to disregard a capital gain of up to $500k in value over your lifetime.

Now if you’re under 55 years old at the time, the money you disregard has to be put into super.

If you’re over 55, there is no requirement to put it into super.

The good thing about this is that you can apply the other reductions or concessions first.

$1,000,000 gain x 50% general discount x 50% Active Asset reduction = $250,000 gain.

If you’re under 55 years old and put the remaining $250,000 into your super fund, then you pay $0 in tax personally!

Rollover

Now, the next one is the rollover relief. I’ve actually used this myself personally.

What it says is if you sell a business asset, then you can elect to rollover the money that you received from that to buy another asset, and you’ve got up to two years to do that.

So, if you receive $1,000,000 from a sale of a business, you can apply the 50% general discount, then the 50% active asset reduction. So you’ve got $250,000 in capital gain left.

You can then buy a $250,000 replacement asset (must be a business or an asset used in business) within two years and pay no tax!

Wrap up

Now, I think that wraps up the three main things that come to mind when you’re looking to pay as least tax as possible on business and investment gains.

Keep in mind I’ve skimmed over reams of pages of legislation here and wrote it based on today’s rules.

So this is very general help and we always say get personalised advice before planning or going through any big transactions like this. If you mess these up, it may cost you $100’s of thousands in tax that you didn’t expect to pay. So don’t say I didn’t warn you to get the advice!

The best tax outcome for Putting Money away for the Children

A question we get from time to time is about parents wanting to set up a bank account or a share investment portfolio for their children.

We love this idea as it’s a great way for the kids to get ahead. Whether the money goes to education in time, or helping them with their first house – it’s a great head start!

The two things we need to consider about putting money away for the kids’ is:

-

Who pays the tax on any earnings, and also

-

How we structure the holding of those assets

We know that what structure that those investments are held in will determine, firstly, who owns the asset when considering asset protection, but also who pays the tax on the earnings from the investments.

In Australia, children under 18 aren’t actually seen as legal entities, and so they cannot hold bank accounts or share portfolios directly in their names.

What the banks or the share portfolio providers will want to do is set up the parents or parent as trustee for the child, so it’s very similar to a discretionary trust we talk about, where you’ve got this trust account with a trustee or the guardian of the trust making decisions for it.

In the case of children, if you go to a bank and set up a bank account, if it was my child, it would be Ben Walker As Trustee for Monkey. (That’s the name of one of our dogs, no human children yet!)

What will happen is say I put $10,000 into the account, and over the course of year it earns $500 in interest. The unfortunate thing about it is that interest will actually be taxable in my personal name.

Sometimes we don’t want that, especially if the parent is a high income earner, and they’re already paying a high amount of tax, and also the other spouse may also be on a high tax bracket. Any interest earned in the name of the child’s trust account is actually taxable to the parents, and usually is not desirable.

The alternative to that is to actually set up a discretionary trust or a family trust for your children.

We’d have a clean trust for holding assets beneficially for you and your children. You would still need ‘you’ as an individual or a company you own to be a trustee of their trust. But the difference is set up correctly, it wouldn’t all be taxed in your name.

Let’s use the same scenario that $10,000 in cash was put into the discretionary trust account and it earned $500 of interest. The first $416 per child of income that that trust earns can actually be distributed to them tax free.

Why $416? That’s the number that the ATO has set that minors (under 18 year olds) can earn from investments without paying the top rate of tax.

In previous years, that distributable amount has been thousands of dollars per child, so that dropped down the limit that a child can receive tax free significantly.

If you had more than $416 in income per child, then that would have to go to another family member. It could be paid to you, but it all depends on your family situation – retired parents or lower income family (who are over 18 years old) are best. It could also be paid to what we call a “bucket company”. There’s actually another article where I’ve written all about bucket companies and how useful they can be.

The best ‘tax time’ for this type of investment is when your child turns 18. They then get taxed like an adult – so the first $20,000 or so they earn is tax free!! This can be very helpful so they pay little or no tax on the investments you’ve put away for them, while they might be studying or travelling after school.

That’s a bit of an overview on setting up a savings account or a share portfolio for your children.

Again, if you’re looking to build up quite a significant balance over the years, then getting the structure right from the start will mean you don’t need to change it down the track, which could cost you a fair bit of money in capital gains tax.

Also in the meantime, if it just stays in your name as trustee for your child, then you might be paying 34.5 cents in the dollar, or 39 cents in the dollar, or even worse, 47 cents in the dollar in tax, which is usually not great.

Learn how to turn a BAS Deadline into a BIZ Lifeline.

Of course, there’s more to “getting BAS right” than merely satisfying the minimum requirements set out by the ATO.

The BAS process offers the in-the-know business owner valuable insights into:

Growth building profit drivers – their effect and where they are coming from

Vital course corrections – what’s going right and what’s costing too much and what to do next

The state of play – are you winning, are you behind and why?

In this 90 min interactive webinar, you will learn –

5 common BAS mistakes and how to avoid them

How business structures affect the BAS / Tax you pay

Save Tax, Boost Profit and Accelerate Cashflow using using your own:

– Profit and Loss or P&L

– Balance Sheets

– GST report

– Cash flow summary

– Business budget

Getting the most value from your business advisory board

– Your Bookkeeper

– Your Accountant

– Your CFO (chief financial officer)

If you hate BAS Time it’s probably because –

* You feel you are paying too much tax, and it is chewing in to your cashflow.

* You don’t have enough set aside to pay the BAS, and your accountant is of little help.

* You don’t really know how the business is performing, or how to turn things around.

Learn how to turn things around this BAS season with Inspire.

“The big difference between winning occasionally and winning almost always is not only knowing the score but understanding the factors that can and will influence it.”

– Ben Walker

A Cashed Up Business

Everyday business owners ask us “how do I get Cashed Up?” We work with many businesses who are already well on their way to getting Cashed Up, but most are either drowning or just keeping their head above water.

My reasoning as to why so many businesses are so cash poor is because they don’t know their numbers – they are driving blind. Most business are started by very skilled technicians (an accountant, a PT, a psychologist, a Videographer, a Financial Planner, a Physio etc) with very little mastery in the key areas of business – sales, marketing, leadership and most importantly NUMBERS. With no insight into numbers that matter, no advice from numbers people (accountants) and no knowledge of the how to create the numbers you want, it is no surprise to us that 3 in 4 businesses fail.

As a result of not knowing your numbers, most business owners –

- Give half their profits to the tax man, unnecessarily.

- Have revenue but wonder where the profit went.

- Come up short when bills are due.

So whether you are financially “drowning” or only just keeping your “head above water”, your primary job as a business owner is to get Cashed Up. That means pulling more money, time and happiness from your business.

Everyone reading this has an opportunity to start again with a new sheet of paper and a new plan. You just need the desire to change and the courage to action.

So, if your business was Cashed Up here’s what would be doing:

Capture Your Profit

In a world where we spend what we earn, protecting your profit is essential. If you don’t have a profit improvement plan, regardless of how much money you earn, you will always struggle.

- You’d get rid of any team members who you’d answer NO to the following question – “Would you enthusiastically re-employ each of your current employees?”. One or two team underperforming team members could be chewing up $150k annual profits.

- You would be earning at least $250,000 or more revenue each year for each director in the business. Any less and you’ll struggle to take a decent profit.

- You would have a separate account (other than your main operating account) where you put no less than 15% of revenue aside for Tax & GST.

- You would have another separate account (other than your main operating account) where you put at least 15% of revenue aside Profit.

- You would be profitable by the end of this year. If not, shut up shop and get a job.

- You would only pay your fair share in tax. Not a cent more!

- You would donate at least 10% of your profits to a charity, a church or causes dear to your heart.

- You would consider yourself to be highly rewarded financially for your industry.

Control Your Cash

Simply growing your business is no longer enough, if you want to escape the cash crisis permanently. You need to get paid faster and be in control. In a time when “Cash is King”, are you ruling it or is cash ruling you?

- You would receive part or all of your revenue before you deliver your product or service.

- You could tell 3 months in advance if there will be a shortfall or excess of cash.

- Your revenue would come mainly from recurring sources (retainer, subscription, repeat order)?

- You would easily pay a BAS or Tax bill in full and on time, using money in your 15% tax reserve.

- You would pay everyone on time.

- Everyone would pay you on time.

- You’d have 3 x months of Operational Expenses in an emergency rainy day fund.

- No one client or customer would represent more than 20% of your total revenue.

Check Your Numbers

Business owners who know their numbers have a tremendous advantage over those who do not. Your financials tell a story – and understanding the story behind your numbers can be one of the most important ingredients for long-term success.

- You wouldn’t have to push your accountant for responses or ideas.

- You would have a real time business performance dashboard on your phone.

- You wouldn’t be afraid to call your accountant for quick phone calls, emails or meetings, out of fear of getting slapped with a bill.

- You would know your numbers.

- You would use Xero.

- Your bookkeeper would keep your accounts perfectly up to date by the 3rd of each month.

- You would sit down with your accountant in april each year to plan a significant tax saving. We’re talking tens of thousands in tax savings each year.

- You would be 100% up to date with all of your ATO payments and lodgements.

Cover Your Assets

Operating your business through trusts and companies is the easiest way to stop giving half your profit to the tax man and start protecting your house, car and livelihood. Businesses with the right structure and strategy keep more of their hard earned cash.

- You would operate your business in a trust and / or company.

- You would review your structure with your Accountant each year for tax efficiency and asset protection.

- You would fully understand your structure, be able to draw it and understand the best way to take money out of it.

- On paper are you would be worthless. Everything in your spouse name.

- You would know the differences between Companies, Trusts & Sole Traders.

- You would know the difference between a salary, a dividend, a distribution and a loan.

Concentrate Your Value

Most business owners actually own a job not a business. Once you have an idea for what your business is really worth and you understand how to increase that valuation, making more profit becomes easy.

- You would have a current business plan that you and your team review each quarter.

- You would absolutely love working with every one of your clients / customers

- You would fire every client / customer you don’t love working with

- You would have thousands of dollars a month appear in your bank account, seemingly magically, from recurring sources e.g. monthly subscription.

- You would have a recent independent valuation for what your business is worth.

- You would have have systems & procedures in place for how things are done in your business.

- No more than 20% of your revenue come from just a few key clients / customers.

- You would have already said NO to an offer to buy your business.

Compound Your Wealth

Turning your business profits and cash into wealth is the fastest way to avoid the time for money trap and spend more time doing the things you love. The process is simple, rewarding and liberating.

- You would accumulate and protect your wealth in a SMSF (Self Managed Super Fund)

- You would max out yours and your family’s annual super contribution limits.

- You would implement a debt recycling strategy using a split loan to pay down non tax deductible debt first.

- You would use credit cards to earn you a family holiday each year but pay off the balance in full every month.

- Your net wealth would be at least $500,000 and growing….

- You would own more than one property, other than your own home

- You would own your business premises in your SMSF and effectively pay your business lease to yourself.

Create Your Lifestyle

Never get so busy making a living that you forget to make a life. Work a few days a week, take regular family holidays and give to worthy causes, all while knowing your cash machine is building a beautiful future.

- Outside of work and family, you would have hobbies that you regularly participate in?

- You would hardly ever work weekends or nights.

- You would be living in your dream home.

- You would regularly eat out at nice restaurants and often go on date nights.

- You would be fully present when you are at home with the family.

- You would take 8 – 12 weeks holiday each year.

- You would get 8 hours per night sleep.

As a result of not knowing your numbers, most business owners –

- Give half their profits to the tax man, unnecessarily.

- Have revenue but wonder where the profit went.

- Come up short when bills are due.

So whether you are financially “drowning” or only just keeping your “head above water”, your primary job as a business owner is to get Cashed Up. That means pulling more money, time and happiness from your business.

Everyone reading this has an opportunity to start again with a new sheet of paper and a new plan. You just need the desire to change and the courage to action.

So, if your business was Cashed Up here’s what would be doing:

That’s what you would be doing if you had a Cashed Up business. If you really want to Save Tax, Boost Profits & Accelerate Cashflow it might be time to change accountants.

P.S. If you are thinking of changing accountants, first have a listen to the DENT Podcast that tells the story about how disrupting the accounting industry saw Ben Walker (founder of Inspire CA) become an award winning entrepreneur.

The top 9 Tax Planning strategies for High Income Employees

We recently had a question from a client, not about structuring for his business, but what his wife could do from a tax planning perspective.

The scenario is the husband runs a business, and earns a good $130k profit. And through proactive tax planning, we ended up saving him over $35,000 in tax, keeping his average tax rate on the business income less than 20%.

Great! He loved that, so what about his wife?

His wife earns $250,000 as an employee. This means she’s paying 47% tax on a good portion of that income, but an average tax rate of about 37% on each dollar she earns.

Not cool.

Unfortunately there’s not as many things you can do to plan for tax as an employee then you can as a business.

And I would NEVER recommend spending $1 on something tax deductible to save 47 cents in tax just for the tax savings. (Although it sounds tempting – you lose 53% of what you’re spending money on)

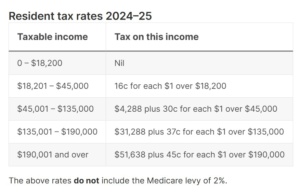

As a refresher, for 2025 FY, the individual tax rates (including medicare levy) are:

So, what are the top tax planning strategies for high income employees?

1. Contribute to your Superannuation Fund

The first way you can reduce your taxable income (and therefore your tax on that income) is through additional superannuation contributions.

Be careful to not exceed your ‘Contribution Cap’ for deductible superannuation contributions.

These deductible super contributions include both your employer minimum (mandatory 11.5% they have to pay on your salary) plus any salary sacrifice or additional contributions that you do.

From 1 July 2024, the general concessional contributions cap is $30,000 for all individuals regardless of age.

Going over the caps mean you pay an effective tax rate of 47% in tax. Ouch!

Crunching the numbers, let’s imagine that your employer already chipped in $25k so far in the tax year as the minimum they need to on your salary, you have $5k that you could contribute, taking you up to the cap.

You’d have to contribute $5000 of money into super, but it would save you $2,350 in tax by doing so (if you were paying 47% tax on your salary).

Always talk to a good Financial Adviser to make sure this is appropriate for your situation.

2. Negatively Gear an Investment Property

Another very common scenario is that high income earners have a negatively geared investment property.

What this means is that the tax deductions they get from renting out the property outweigh the rent they receive from the property.

This could be $25k in rent received, less $20k in expenses paid for during the year (like interests on loans, council rates, agent’s fees), and then a further deduction of $20k for depreciation on the property.

Under this scenario, while the property ‘made’ $5k net in positive cash flow, the property made a taxable loss of $15k.

If you’re paying tax at 47%, this ‘negative gearing’ would reduce your tax bill by $7,050.

3. Get Private Health Insurance

Having Private Health Insurance (hospital cover) means that you do not have to pay the ‘Medicare Levy Surcharge’.

There’s often confusion when clients have hospital cover, but they still pay Medicare Levy. That’s because there’s two types of Medicare payments on your tax:

- Medicare Levy (all individuals pay this, and it is calculated at 2% of your taxable income if you’re earning more than ~$27k)

- Medicare Levy Surcharge (additional 1% to 1.5% depending on your income)

You need to pay the Surcharge component if you’re single and earn over $90k, or have a spouse and together your income combined is more than $180k – and you don’t have private health insurance (hospital cover).

Of course if you, or you and your spouse do hold the hospital cover, you do not have to pay the surcharge component.

If you earn $300k, you’d be up for $4,500 in Medicare Levy Surcharge alone.

And Hospital Cover may only cost you $2,000 to take out!

On that maths, you’d be up $2,500.

So if you’re over the income threshold ($97k if you’re single, or $194k if you have a spouse, incomes combined), or are creeping toward it, it may be worth taking out cover.

And just as an FYI – Private Health Insurance (extras cover) does not remove the surcharge.

4. Salary sacrifice your vehicle

Some people salary sacrifice a vehicle that they use both for business and private use.

This usually looks like your employer organising a novated lease, operating lease, hire purchase or paying for your car.

There are many ways to structure it depending on what your employer is comfortable with – and we recommend getting advice on what option is best for you and your employer at the time.

This can usually shave a few hundred, or a few thousand off your tax bill.

5. Donate to Charity

If giving is something you do, or want to do, then consider making a tax deductible donation.

As an employee, you can claim a donation of anything over $2, to an Australian Deductible Gift Recipient (“DGR”), and as long as you get a tax invoice from them.

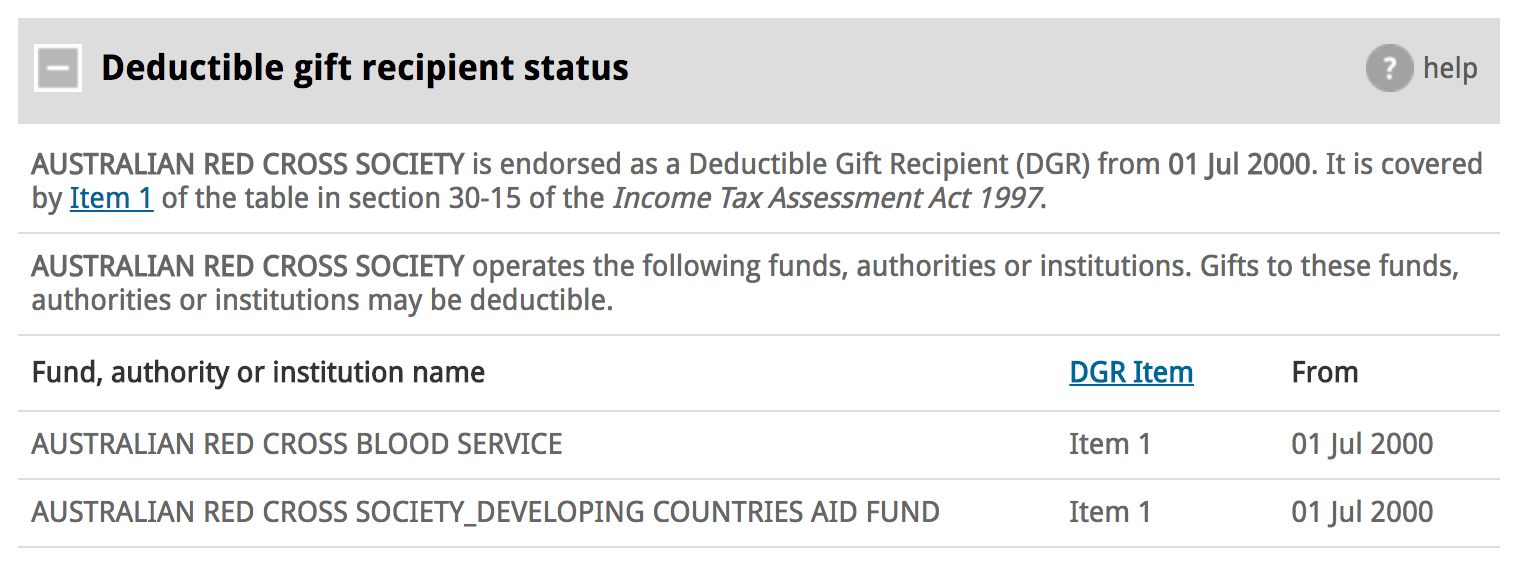

To work out if a charity is a DGR, you can check the Australian Business Register here: http://abr.business.gov.au/

Once you search for your charity and find it, you can look down the bottom of the search and the ‘Deductible Gift Recipient Status’ will show up:

Donating or ‘tithing’ to Churches cannot be claimed as a tax deduction on an individual tax return.

6. Income protection insurance

If you’re ballin’ on six figures or more of salary, it’s probably a good idea to protect your income.

Especially if you’re the sole earner in the family, or have loan repayment obligations each month that if you all of a sudden found yourself out of work, you’d have trouble paying.

You can do this through taking out income protection insurance.

While we do not offer advice on how much to take out and what cover you need, we know that if the policy is paid personally, we can claim the premiums as a tax deduction.

If you need help with this, reach out and we can put you in touch with some great people who can help.

7. Self-Education, Training or Executive Coaching

If extra study or developing your skills are of interest to you, then you can pay for self-education, professional development or training and claim this on your tax.

You could also hire an executive coach to help you perform better in your role.

Keep in mind that there has to be direct connection with the training and what you do as an employee.

For instance, if you have HR responsibilities at work, and want to do a training course on how to manage people better, then this would be deductible.

But if you’re in a sales roll, and want to learn how to fly a plane (which has nothing to do with your employment), then sorry, that’s not deductible.

8. Structure Investment Income Appropriately

We often see highly paid people build wealth over years.

It’s critical that the ownership of any investments (such as interest earning bank accounts, shares, investment properties) is carefully considered.

Whoever owns these assets and receives the income pays the tax on that.

So if the wife owned the assets, she’d pay 47% in tax on the investment earnings.

Compared with say the husband at a rate of 32% – a big difference.

Be careful with restructuring investments that you own at the moment, as shifting between family members or entities usually triggers capital gains tax, or stamp duty (or both!)… Best to chat with an accountant who understands this stuff!

9. Change the way you get paid

The biggest and best way we’ve seen highly paid, high functioning people reduce their tax is through changing the way they get paid.

Most common is to start a business consulting to other similar businesses who need their skill, knowledge or service.

To make this worthwhile and beneficial from a tax perspective, you would need two or more clients.

And one single client could not pay you more than 80% of your total income. For instance, if you earned a total of $300k gross from consulting, your biggest client could not pay you more than $240k (or 80%) of that total in a year.

It’s also worth noting that the two clients cannot be related parties. Even with two different ABN’s, if the businesses are related or associated, this cannot happen.

But if changing the way you get paid (such as starting a business) is a possibility, do let us know.

If you’d like a better understanding of how these strategies can work for you, feel free to book in a Test Drive – a rapid fire Q & A with a Chartered Accountant.

Lease Incentives: Should I take it as a fit out or rental reduction?

Question:

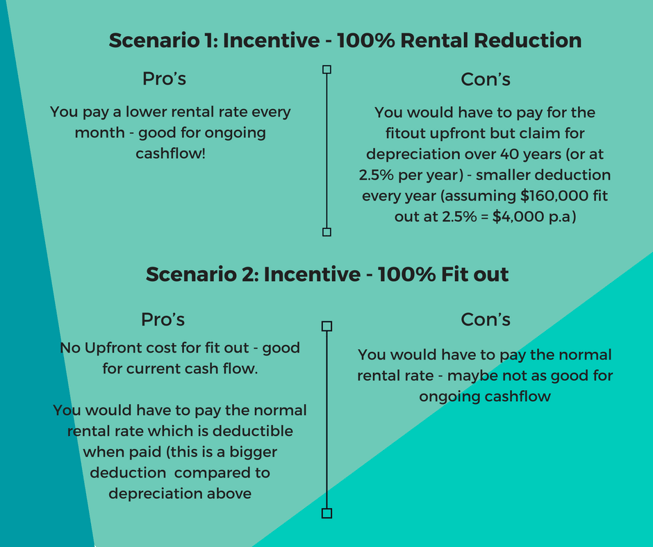

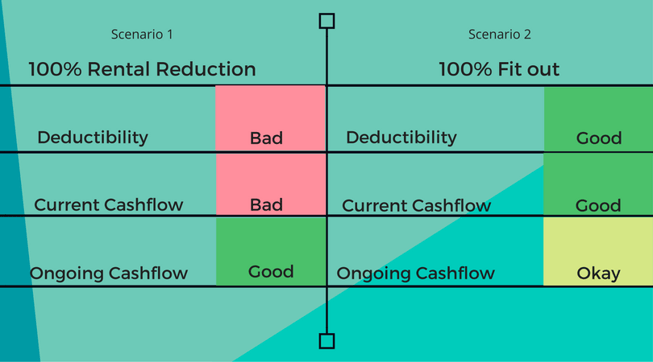

We’re negotiating our new office and discussing fit out etc. The landlord is giving an incentive amount of $115,000 over 5 years. So we can either take this in rental reductions or a combination of rental reductions and fitout.

I’m wondering whether we should take a combo of rental reductions and fit out or pay for the fitout ourselves (i.e. $30,000 to $80,00) and get the incentive in 100% rental reductions. I figured if we pay for the fitout then we could claim perhaps depreciation etc.

Riz, we’re at the pointy end of negotiations. A quick response would be very helpful in securing this deal. I look forward to hearing from you.

Answer:

Great question – from a tax perspective it all boils down to this …

Which strategy gives you most tax savings soonest?

Here’s my take based on the info provided:

So boiling it down the pro’s and con’s can be measured again 3 key measures. Tax deductibility, Current Cashflow and Ongoing Cashflow.

Ultimately we want business owners to avoid a lease altogether and be able to Use their SMSF to Purchase Your Business Premises.

But in the meantime, let us help you run the numbers on your scenario before you sign on the bottom line.

IS YOUR CURRENT ACCOUNTANT A DINOSAUR?

Your current account may be a dinosaur if he / she –

- Offers advice late or not at all

- Does only what you ask

- Basically just does tax

- Only sees you once or twice a year

- Charges you for a quick call or email

- Charges by the hour (or the minute)

- Charges like a bull (aka expensive)

- Doesn’t try save you tax pre-EOFY

- Doesn’t visit / call

- Doesn’t follow up

- Doesn’t embrace cloud & tech

- Doesn’t run a great business him / herself

- Is quite frankly, boring…

- Doesn’t explain things simply

- Doesn’t help with business advice

- Isn’t approachable

- Takes hours, days and even weeks to respond

- Is buried in paper

- Is about to retire

- Doesn’t give to charitable causes

- Passes you on to the junior accountant

- Communicates poorly

- Over-promises & under-delivers

- Let’s you know your BAS is due, on the day it’s due

Accountants that do the opposite of the above are priceless member of your advisory team.

Keep them close and never let them go.

Could You Do With Some More Business?

An important component of managing cashflow is to increase the amount of cash that’s flowing in. Which of course means getting new business through the door.

How is that going for you? Getting enough enquiries and orders, week after week?

If you’re in the same boat as most business owners, you probably need more.

So have you any clues as to why more potential customers aren’t getting in contact?

In my 30+ years of providing marketing strategy and campaigns to small businesses, I’ve found that it usually boils down to two reasons.

Reason No 1 Why More Prospects Aren’t Contacting You

The first reason is that your potential customers don’t know about you yet. They haven’t found you online or through any other form of marketing. You’re virtually invisible.

The only way to fix this is to do some marketing.

However the kind of marketing you need to do to reach more prospects, is a big wide topic. It will depend on

- who your target market is

- where they hang out

- what their needs are

- what they really really want

- what the decision making process for your kind of product or service usually is

- how you’re different to your competitors

- what your budget is

What I want to focus on now in this post is Reason 2 – because that is something you can fix fairly quickly at no or low cost.

Reason No 2 Why More Prospects Aren’t Contacting You

Your potential customers fear you could be risky.

They may have found your listing or website or social media page, but are wary of giving you a go. They aren’t 100% confident you can help them, or do so for a fair price, or provide stellar customer service. They really don’t know you so they are not happy about risking their money with you.

What to Do About It

There are several ways to easily overcome the doubts listed in Reason 2 and inspire people to contact you and give you a go. It’s all to do with building trust and removing risk.

In fact we have a proven process which has had a big impact on our client’s results. Our process has several components, and they all work together to increase new business enquiries and conversions.

One of our clients, a young couple who run a painting company in Brisbane, decided to give our process a try to see if it would improve their enquiry rate and reduce their expensive Google Adwords costs.

Here’s just some of their results.

- Since implementing four years ago, they’ve gone from 30% of new business coming from referrals – to a whopping 72%.

- They are booked out for 2-3 months in advance

- They’ve cut their Google Adwords advertising budget by two thirds

Special Invite – Free Masterclass on Getting More Business

I will be sharing details of our exact process on how to get more people to contact you, choose you over your competitors, and regularly refer you to their friends, in my How to Get More Enquiries, Business and Referrals Live Masterclass next week.

These are just some of the questions I’ll be answering:

- Where does 65% of new business come from?

- What do 85% of people do before making an enquiry or booking?

- What makes people choose one business over another?

- How do you get customers to refer you, over and over again, without having to constantly ask them?

This is knowledge that all business owners need to have if they want to take control of increasing the incoming cashflow. Once you’ve got a bit of inside knowledge on buyer behavior, then the next step is to exploit it. On the webinar, I’ll show you exactly what our clients are doing, and share further details of their results.

Places are limited so save your seat now here: How to Get More Enquiries, Business and Referrals Masterclass

Author’s bio

I’m a loyal client of InspireCA, and also have a passion to help small business owners build a business that gives them the freedom to live life to the max and not just scrape by. I love to inspire and help business owners to create the type of marketing and customer service that makes their business irresistible. I’m privileged to have a talented team at Commonsense Marketing who create and execute beautiful websites and engaging social media and email campaigns that deliver results. We love to work with the owners and teams of small to medium sized business who are motivated to become the best in their niche and achieve more than they ever thought possible.

Your online guide to making BAS work for you

Learn from mistakes without having to make them at our 17 Feb online workshop

The big difference between winning occasionally and winning almost always is not only knowing the score but understanding the factors that can and will influence it.

Ben Walker

For some, taking care of your BAS (business activity statement) is like a government-imposed quarterly check up at the dentist. There may be some minor concerns but mostly everything looks okay on the surface, you pay some money, hopefully get a rebate of some sort and see you again in about 3months. There. Relatively painless and all is well… until a tooth drops out, rots, cracks or starts keeping you up at night.

That won’t happen with a really good dentist though. They tend to look beneath the veneer, tell you to brush more often and give you a few tips on dental hygiene that’ll save you thousands of dollars over the coming year or so.

Smile, we’ve made it easier than ever to get BAS right and reap the benefits

Of course, there’s more to “getting BAS right” than merely satisfying the minimum requirements set out by the ATO. The BAS process offers the in-the-know business owner valuable insights into:

- Growth building profit drivers – their effect and where they are coming from

- Vital course corrections – what’s going right and what’s costing too much and what to do next

- The state of play – are you winning, are you behind and why

This is all very important stuff, especially if you are driven by the achievable goal of using your business as the engine that powers a better life for you and your family. That’s why we want to invite you to our “How to Turn Your BAS Deadline into a Business Lifeline” online work shop at xx.xx am/pm on Friday 17 February.

A BAS workshop that works

We believe that this workshop will be particularly valuable to you because it doesn’t simply focus on BAS (your scoreboard, if you like) but the factors that will affect your inputs. There are three parts to the workshop that will have an impact on you and your business:

- 5 common BAS mistakes and how to avoid them

- Accelerating profit growth using your own:

- Profit and Loss or P&L sheets

- Balance sheets

- GST report

- Cash flow summary

- Business budget

- Getting the most value from your business advisory board

- Bookkeeper

- Accountant

- CFO (chief financial officer)

We’ve made it really easy to get on board and become involved in your own business development. You can register at www.inspireca.com/BAS-March and or contact the team at hello@inspireca.com OR 07 3106 3320

Your investment in your business will go a long, long way

Your $77 plus GST investment entitles you to:

- Attend the 77 min LIVE Online Workshop + Q & A on Fri Feb 17.

- Access the 77 min ON DEMAND Workshop within 24 hours.

- Receive a $77 discount off the Become a Cash Rich Business [One Day Cashflow Acceleration Workshop] on March 24.

- $77 Guarantee – If you attend the workshop and hate it, we’ll give your money back no questions asked.

- Feel even better about your decision – some of your investment will provide 77 days of access to life-giving water for a family in Cambodia (check out our business for good proposition).

Remember, the “How to Turn Your BAS Deadline into a Business Lifeline” is just 3 days (17 Feb) after Valentine’s Day so after you’ve done the right thing by your special someone, why not pay some special attention to your business.

We’d love to see you make the most of this opportunity

Cheers

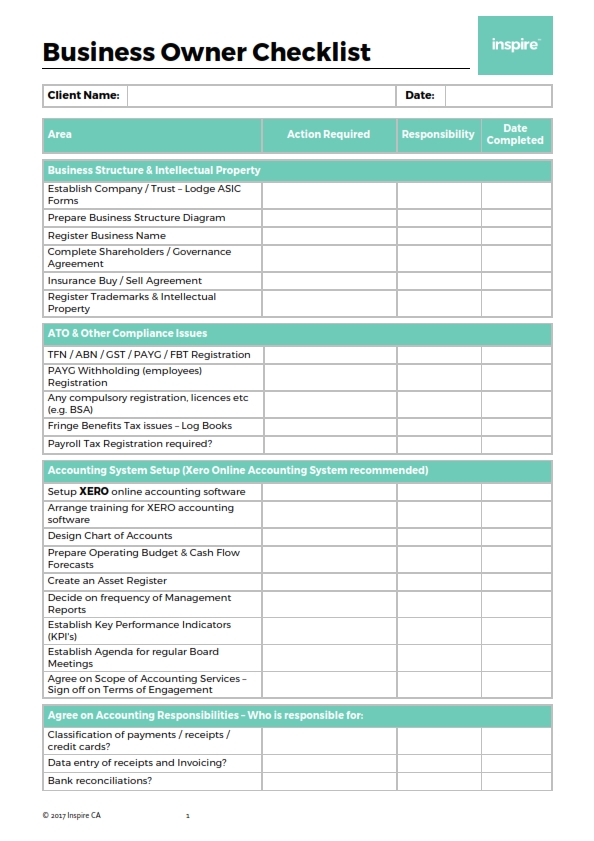

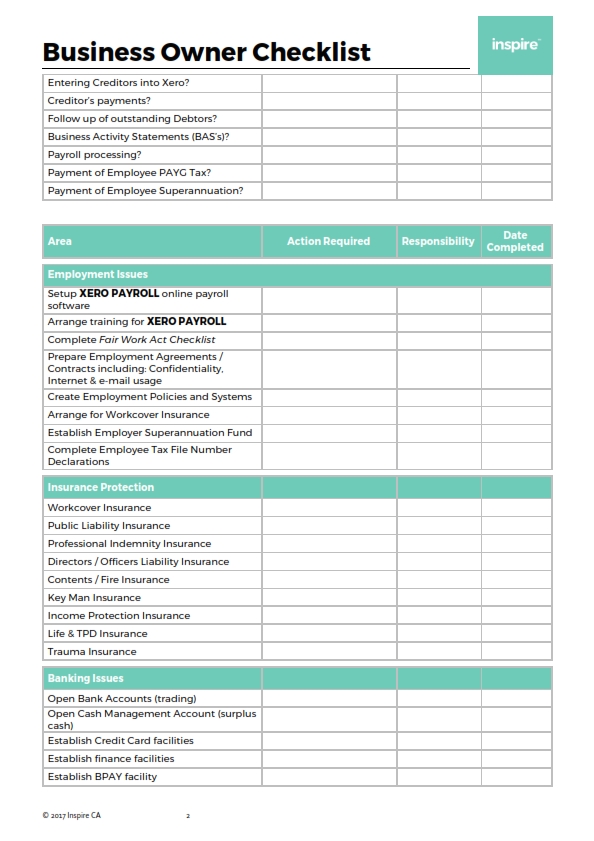

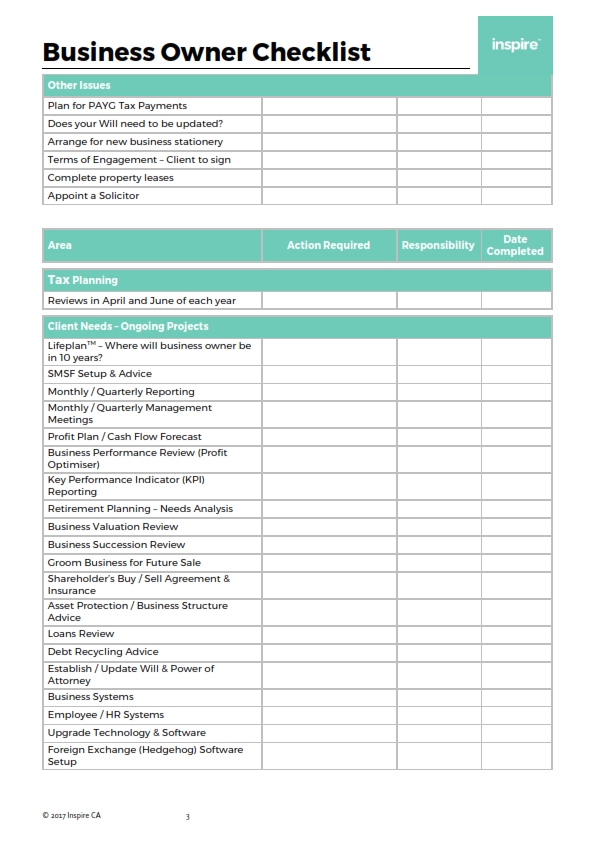

Business Owner Checklist

Download the business owners checklist here

When you’re starting out in business it can be overwhelming with all the things you need to get in order. The easy ones are business name, accounting software and logos. But few realise how extensive the list of start up to-do’s really is. So we’ve put together the ultimate checklist guide for NEW business owners to make sure they have everything in order from the beginning.