What is your business?

MyCladders does transportable buildings; colour bond roofing metal roofs, wall cladding

we put on roofs and gutters and help builders build roves.

What was your reasoning to start up your company?

I am accountable to myself. I have the ability to give someone a full time job.

What makes you a good husband?

It’s about the level of commitment between husband and wife. Find a balance between business and family. To be a good husband means to be well balanced.

What makes you a good father?

To be a good father it requires discipline with your child and selves as a married couple. We are the biggest role model in our son’s life. When you say you will do something you have to then follow through. If I’m not a good husband then I wont be a good father. It’s about discipline and balance of time.

What is your one piece of advice to manage both worlds Business & Family?

I personally try to switch off at 5pm from the business. now it’s family time, away from work time. The office is currently at home, it wont be for long, what’s hard with the office being at home is it is easy to get swept back into and it and it can continue. I need to switch off, having a designated time to switch off so i can contribute to the running of the house hold.

I look for the little wins with both family and business to bring balance, you really need this! It’s important to know how to switch off and to be fully present. Its a family soul business, that means

I bring a lot of the business into the family in relation to the people in the business are friends outside of the business. I make it really clear that Business is business and personal is personal. This helps them see that their boss is a human being and helps with the balance!

It’s ongoing. You cant be stand with your feet in concrete cause thats when it will all fall apart!

I started my own business in 2012 (3 years ago)

I left a much larger corporation owning 50% of the company to take the plunge.

Wife: Emma.

4 kids, (2 under 2years old). Isabella,Tate, Quinn, Enya

What is your business and what do you focus on?

Building and creative design- innovation for entertainment through Law.

The two things that differentiates us from other lawyers is speciality and focus – We focus on industry within the entertainment spectrum; musicians, film, builders of wealth, business- what drives them. We understand the way these people think, talk, breath, what makes them click. We focus specifically on, immigration of media, leaders within this field in the country.

What has been the biggest change going from corporate to small business?

Which is more stressful?

I am everything in my business.. You don’t have access to that administration, marketing director, 2 salary partner, grounds clerk when you run your own small business. In big companies there is plenty of leverage that can be done. The stress’s and pressures are different between each. It’s by no means easier in a small firm just different (every call’s mine, my balls are on the line, my kids eating is on the line.)

One of the things I notices is stamps are 60c. I am now licking my own stamps for the first time in years!.

When I was working in corporate Law I employed my wife to be part of the team and saw a huge turn around in the business. – It was hard having my wife work for me but it was the best decision as it helped me be able to transition out of that company cause it wasn’t the right fit for me. My wife then wanted to come over to help me with my new business and thats how it happened.

How are you a good husband?

To be a good husband honesty is the key.

We have worked out a routine that has been very helpful. Dad is the point of call when he is home from work.

My wife needs extra time support especially when it comes to feeding and when you have extra kids the kitchen isn’t always the cleanest every day. Its not as simple as hiring nanny’s especially when you are a start up, so to speak, or in a young business.

It’s about balancing the family, Being around to be with kids.

I take Bella to school 3 days a week and I am always home to put the kids to bed.

We are not a 9-5 office. Getting home is important so 1-2 days a week I work though the night to have flexibility with the other days.

It’s not about working for working sake but it all about making room to be able to be flexible!

What where some of the things you did to keep the business ticking while you had 2 kids under the age of 2 when you started your business?

The right staff – actively small.

Everyone says ‘we are growing’ but we measure our growth strategy by how many staples are in the office. It’s about having the right staff and being clear with the work that you are going to take on, so we don’t just take walk ins off the street. we focus on a particular industry.

We don’t just put people on as staff for the sake of it. I prefer to have a 3rd of the output in the business in keeping 100% of the quality over that period of time rather than having twice the output half the quality cause thats a short term look. it has an effect on the bottom line but its a choice that we make. We focus on quality through well thought out staff members. quality rather than quantity, getting things done well!

Bucket Companies: The least known and most underutilised strategy to save thousands in tax

“Use Bucket companies – tax tip of the week!”

I’d love to shed some light on what we call ‘Bucket Companies’, also called:

- Corporate Beneficiary

- Dump Company

- Family Vault

- Second Super

- And a few other creative ones!

Why this strategy is so critical, is because it can help cap your tax rate at 30%.

And as a quick refresher, as a sole trader you can pay up to 51% in tax (including the temporary budget repair levy).

Who is a Bucket Company strategy for?

Ideally:

- Business owners (or investors)

- Running their business or receiving income through a discretionary trust structure

- Not caught under the Personal Services Income (PSI) rules (if you don’t know what this is, hopefully the rules don’t apply, but you can read more on PSI here)

The idea of a bucket company is that they take ‘excess’ profits, after distributing a reasonable amount to the people within a family group.

Bucket Companies are incredibly useful

- For business owners who earn more than their cost of living, and want to build a nest egg for their family;

- When business owners are having big fluctuations in incomes between financial years as they can be used to make the tax bills more consistent; and

- For business owners coming up to retirement or selling their business, and no longer earning as much business income moving forward.

What are the tax benefits of using a Bucket Company?

If done right, Bucket Companies can generally save thousands of dollars in tax for a client, year on year.

Let’s use an example of a trust earning $300k in profit. But we’ll review the tax rates first.

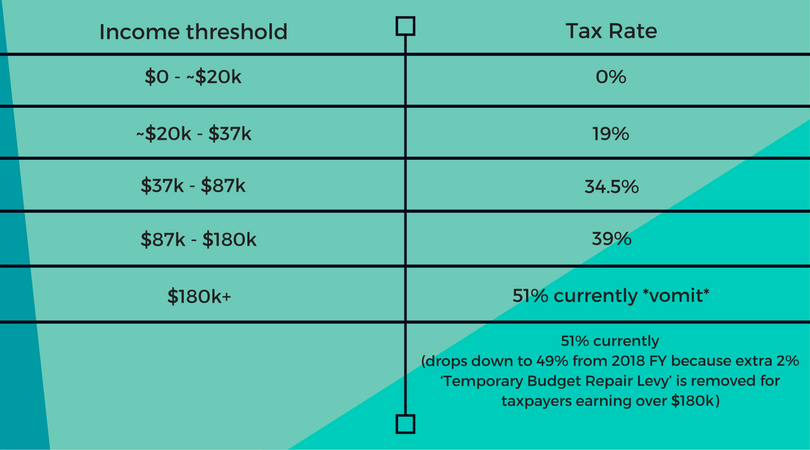

For 2017 FY, the individual tax rates (including medicare levy) are:

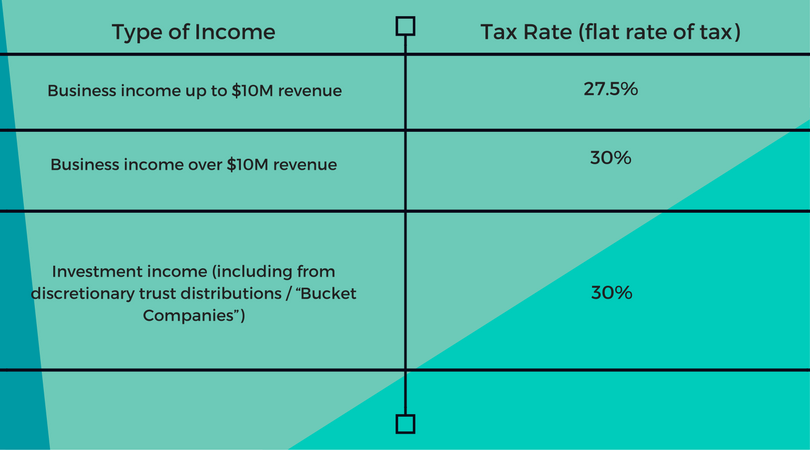

Company tax rates for 2017 FY are:

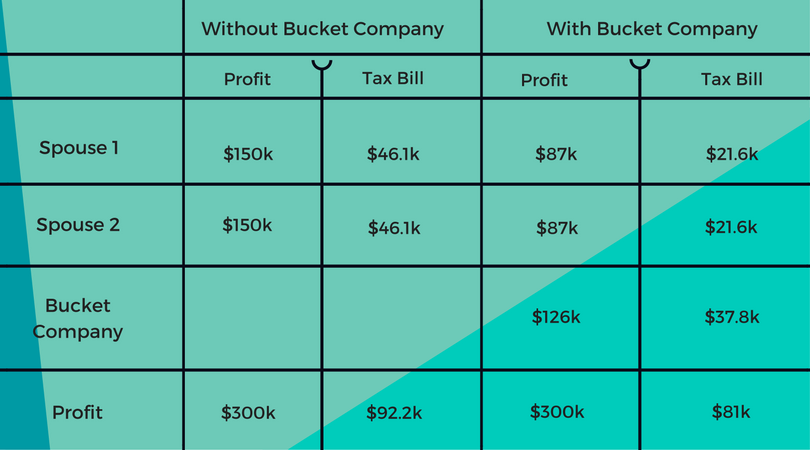

So if we’ve got a trust that’s earned $300k in profit, we need to allocate that to people or entities within a family group.

Now it makes sense to take eligible people up to $37k in income. That means we’ve taken them up to 19% tax on their income, and every dollar over $37k (but under $87k) they pay 34.5% tax. (See the table above)

Compare that to a company, where it would only pay 30% on the first dollar it receives, but every dollar after that.

But our ‘magic number’ from a distribution perspective to individuals (or people) is $87k, which might defy some people’s logic. This means they will be paying 34.5% tax on the income between $37-87k.

Do read on.

Do I need to actually pay the cash to the Bucket Company?

The reason why the magic number is $87k, is that when we distribute to a company, the cash needs to follow as well (the company needs to get paid). Otherwise we raise Division 7A issues and the ATO doesn’t like ‘on paper’ distributions without the intention of ever paying them.

We find that the $87k mark usually covers people’s cost of living, and they can commonly pay all or a good portion of the cash to their bucket company.

If you distribute to a company, then the company itself will have a tax bill. So you’ll have to pay at least 30% of whatever you distribute to it as a tax payment eventually!

What are the Tax Benefits of a Bucket Company?

Let’s look at the benefits of the bucket company using $300k profit as a case study:

Tax saving by using Bucket Company $11,200. Not bad ‘ey?

Getting the cash out of Bucket Companies

We discovered above that the cash actually has to follow the distributed amount from the trust. And then the tax bill needs to be paid.

But now we’re left with some money in the company, so how do we get the money out?

Well there’s two ways to do it:

- Loan it from the company

- Pay dividends to the shareholders from the company

They both have their pro’s and con’s – let’s hit it:

1. Loan it from the company

These loans are called ‘Division 7A loans’ and are a minefield if not treated correctly, but can be used effectively.

Your Bucket Company effectively becomes a bank.

You loan money from it, and have to pay principal and interest repayments.

If your loan is unsecured, you have 7 years to pay back the cash.

If your loan is secured (on a property let’s say), then you have 30 years to pay back the cash.

The interest rate is set each financial year by the ATO, but usually not rediciulous. (5-7%)

So it’s kind of treating your company at arms length, like a bank, without dealing with the muppets.

This strategy can be very effective for loaning your 20% deposit for a house or property, then the 80% difference from an actual bank. That way (if secured) you get 30 years to pay back the loan to your own company. (More on this in a moment.)

2. Pay dividends to the shareholders from the company

The second way to get money out of a Bucket Company is through paying a dividend to the shareholders of the company.

The shareholders are who ‘own’ the shares in the company.

Now when we pay a dividend, the shareholders get taxed on that dividend, but they receive a ‘franking credit’ for the tax that the company has already paid.

Sidenote on franking credits: The company has paid 30% tax on their income, or 30 cents for each dollar it earned. When the company pays dividends, the shareholder is taxed on the full amount of the dividend (or profit the company has already paid tax on). But the franking credit offsets the tax bill for the shareholder. For instance, if the shareholder will pay on average 34.5% in tax on the dividend they receive, they get a 30% franking credit, only having to pay ‘top up tax’ of 4.5% on the dividend they received.

So you should always consider the tax impact of paying that dividend.

And MORE importantly, you must consider who the shareholders are of the Bucket Company.

If they are individuals, then you can only distribute to those individuals (in the % of shares that each of them own).

All too often we see husband & wife owning 50/50% of the bucket companies. But the problem with this is we may have little control on what the husband and wife earn separately to the dividend.

The best thing to own the shares in a Bucket Company is actually another, separate discretionary trust. We call these ‘Asset Trusts’.

That means when we pay the dividends from the company, they fall to the asset trust, then the trustees of the asset trust can allocate the didends to the family members who pay the least amount of tax. You retain ultimate flexibility.

In summary, getting the money out isn’t straightforward, and working with an advisor who knows their stuff is non-negotiable.

How will giving money to a Bucket Company affect my ability to get finance from a bank?

Stupid disclaimer and warning: always consult a savvy mortgage broker for questions about finance, aka a “Loans Guy or Girl”. Ben Walker isn’t a licenced credit representative, and this section is a compilation with Jake Pretorius from our office (our “Loans Guy”) and a licenced Credit Representative (No. 402028) of BLSSA Pty Ltd ACN 117 651 760 (Australian Credit Licence No. 391237). It’s based on our understanding of banks at the time, but they change their policies more then they change their underpants. Let’s keep in mind this is general advice and does not take into account your personal needs and financial situation.

Our understanding and experience with banks is that Bucket Companies don’t stop you getting finance from the banks.

Because you’re a business owner, the banks don’t just take your personal income to service your loan.

They’ll look at all related companies and trusts, and assuming there’s consistency, they’ll take your total group income into account.

So if you distribute $100k to a Bucket Company, banks should see this as your business income.

Can I use equity in my current property, plus cash from the Bucket Company for a deposit to buy an investment property?

While this is a complex question and scenario, but we believe it’s possible. But always check with your switched on mortgage broker to find the lenders who will do this.

Can the company buy property?

The company can technically own property and use the built up cash to buy it, but I wouldn’t recommend that strategy.

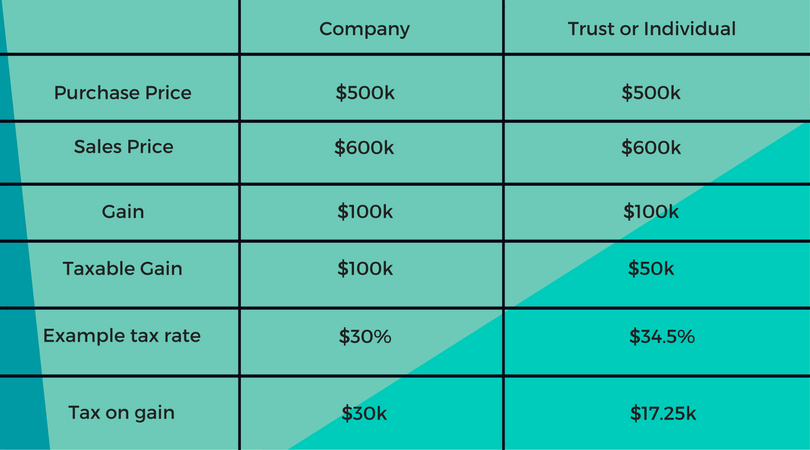

The simple reason why is that a company is NOT eligible for the ‘50% capital gains tax discount’, but a trust or an individual is.

Now in english, the ‘50% capital gains tax discount’ means that if you own an asset (like a property) for more than 12 months, then you get a 50% discount on the amount you get taxed on when you sell that asset and make a gain.

Some quick numbers on the benefits:

Tax saving by owning property in trust or individual is $12,750.

So to maintain ultimate control of your tax bill when you sell the property, own the property or asset through an Asset Trust.

Ok, so how do I use the cash in the company to buy property?

You can loan the money from the Bucket Company to your Asset Trust (secured). Then the rest can come from the bank.

This gives you 30 years to pay back the loan to the company, and assuming it’s an investment property, pay tax deductible interest from the Asset Trust back to your own Bucket Company.

See the “Loan it from the company” section above for more details.

And always, always, always see a switched on mortgage broker for help with this sort of loan structuring.

In conclusion…

That’s a super detailed overview of what we call ‘Bucket Companies’ and how you can use it to cap your tax rate at 30%.

If you want to ask any questions about this strategy or you’d like a second opinion on your tax, flick me an email to ben@inspireca.com.

Bucket Companies: The least known and most underutilised strategy to save thousands in tax

“Use Bucket companies – tax tip of the week!”

I’d love to shed some light on what we call ‘Bucket Companies’, also called:

- Corporate Beneficiary

- Dump Company

- Family Vault

- Second Super

- And a few other creative ones!

Why this strategy is so critical, is because it can help cap your tax rate at 30%.

And as a quick refresher, as a sole trader you can pay up to 51% in tax (including the temporary budget repair levy).

Who is a Bucket Company strategy for?

Ideally:

- Business owners (or investors)

- Running their business or receiving income through a discretionary trust structure

- Not caught under the Personal Services Income (PSI) rules (if you don’t know what this is, hopefully the rules don’t apply, but you can read more on PSI here)

The idea of a bucket company is that they take ‘excess’ profits, after distributing a reasonable amount to the people within a family group.

Bucket Companies are incredibly useful

- For business owners who earn more than their cost of living, and want to build a nest egg for their family;

- When business owners are having big fluctuations in incomes between financial years as they can be used to make the tax bills more consistent; and

- For business owners coming up to retirement or selling their business, and no longer earning as much business income moving forward.

What are the tax benefits of using a Bucket Company?

If done right, Bucket Companies can generally save thousands of dollars in tax for a client, year on year.

Let’s use an example of a trust earning $300k in profit. But we’ll review the tax rates first.

For 2017 FY, the individual tax rates (including medicare levy) are:

Company tax rates for 2017 FY are:

So if we’ve got a trust that’s earned $300k in profit, we need to allocate that to people or entities within a family group.

Now it makes sense to take eligible people up to $37k in income. That means we’ve taken them up to 19% tax on their income, and every dollar over $37k (but under $87k) they pay 34.5% tax. (See the table above)

Compare that to a company, where it would only pay 30% on the first dollar it receives, but every dollar after that.

But our ‘magic number’ from a distribution perspective to individuals (or people) is $87k, which might defy some people’s logic. This means they will be paying 34.5% tax on the income between $37-87k.

Do read on.

Do I need to actually pay the cash to the Bucket Company?

The reason why the magic number is $87k, is that when we distribute to a company, the cash needs to follow as well (the company needs to get paid). Otherwise we raise Division 7A issues and the ATO doesn’t like ‘on paper’ distributions without the intention of ever paying them.

We find that the $87k mark usually covers people’s cost of living, and they can commonly pay all or a good portion of the cash to their bucket company.

If you distribute to a company, then the company itself will have a tax bill. So you’ll have to pay at least 30% of whatever you distribute to it as a tax payment eventually!

What are the Tax Benefits of a Bucket Company?

Let’s look at the benefits of the bucket company using $300k profit as a case study:

Tax saving by using Bucket Company $11,200. Not bad ‘ey?

Getting the cash out of Bucket Companies

We discovered above that the cash actually has to follow the distributed amount from the trust. And then the tax bill needs to be paid.

But now we’re left with some money in the company, so how do we get the money out?

Well there’s two ways to do it:

- Loan it from the company

- Pay dividends to the shareholders from the company

They both have their pro’s and con’s – let’s hit it:

1. Loan it from the company

These loans are called ‘Division 7A loans’ and are a minefield if not treated correctly, but can be used effectively.

Your Bucket Company effectively becomes a bank.

You loan money from it, and have to pay principal and interest repayments.

If your loan is unsecured, you have 7 years to pay back the cash.

If your loan is secured (on a property let’s say), then you have 30 years to pay back the cash.

The interest rate is set each financial year by the ATO, but usually not rediciulous. (5-7%)

So it’s kind of treating your company at arms length, like a bank, without dealing with the muppets.

This strategy can be very effective for loaning your 20% deposit for a house or property, then the 80% difference from an actual bank. That way (if secured) you get 30 years to pay back the loan to your own company. (More on this in a moment.)

2. Pay dividends to the shareholders from the company

The second way to get money out of a Bucket Company is through paying a dividend to the shareholders of the company.

The shareholders are who ‘own’ the shares in the company.

Now when we pay a dividend, the shareholders get taxed on that dividend, but they receive a ‘franking credit’ for the tax that the company has already paid.

Sidenote on franking credits: The company has paid 30% tax on their income, or 30 cents for each dollar it earned. When the company pays dividends, the shareholder is taxed on the full amount of the dividend (or profit the company has already paid tax on). But the franking credit offsets the tax bill for the shareholder. For instance, if the shareholder will pay on average 34.5% in tax on the dividend they receive, they get a 30% franking credit, only having to pay ‘top up tax’ of 4.5% on the dividend they received.

So you should always consider the tax impact of paying that dividend.

And MORE importantly, you must consider who the shareholders are of the Bucket Company.

If they are individuals, then you can only distribute to those individuals (in the % of shares that each of them own).

All too often we see husband & wife owning 50/50% of the bucket companies. But the problem with this is we may have little control on what the husband and wife earn separately to the dividend.

The best thing to own the shares in a Bucket Company is actually another, separate discretionary trust. We call these ‘Asset Trusts’.

That means when we pay the dividends from the company, they fall to the asset trust, then the trustees of the asset trust can allocate the didends to the family members who pay the least amount of tax. You retain ultimate flexibility.

In summary, getting the money out isn’t straightforward, and working with an advisor who knows their stuff is non-negotiable.

How will giving money to a Bucket Company affect my ability to get finance from a bank?

Stupid disclaimer and warning: always consult a savvy mortgage broker for questions about finance, aka a “Loans Guy or Girl”. Ben Walker isn’t a licenced credit representative, and this section is a compilation with Jake Pretorius from our office (our “Loans Guy”) and a licenced Credit Representative (No. 402028) of BLSSA Pty Ltd ACN 117 651 760 (Australian Credit Licence No. 391237). It’s based on our understanding of banks at the time, but they change their policies more then they change their underpants. Let’s keep in mind this is general advice and does not take into account your personal needs and financial situation.

Our understanding and experience with banks is that Bucket Companies don’t stop you getting finance from the banks.

Because you’re a business owner, the banks don’t just take your personal income to service your loan.

They’ll look at all related companies and trusts, and assuming there’s consistency, they’ll take your total group income into account.

So if you distribute $100k to a Bucket Company, banks should see this as your business income.

Can I use equity in my current property, plus cash from the Bucket Company for a deposit to buy an investment property?

While this is a complex question and scenario, but we believe it’s possible. But always check with your switched on mortgage broker to find the lenders who will do this.

Can the company buy property?

The company can technically own property and use the built up cash to buy it, but I wouldn’t recommend that strategy.

The simple reason why is that a company is NOT eligible for the ‘50% capital gains tax discount’, but a trust or an individual is.

Now in english, the ‘50% capital gains tax discount’ means that if you own an asset (like a property) for more than 12 months, then you get a 50% discount on the amount you get taxed on when you sell that asset and make a gain.

Some quick numbers on the benefits:

Tax saving by owning property in trust or individual is $12,750.

So to maintain ultimate control of your tax bill when you sell the property, own the property or asset through an Asset Trust.

Ok, so how do I use the cash in the company to buy property?

You can loan the money from the Bucket Company to your Asset Trust (secured). Then the rest can come from the bank.

This gives you 30 years to pay back the loan to the company, and assuming it’s an investment property, pay tax deductible interest from the Asset Trust back to your own Bucket Company.

See the “Loan it from the company” section above for more details.

And always, always, always see a switched on mortgage broker for help with this sort of loan structuring.

In conclusion…

That’s a super detailed overview of what we call ‘Bucket Companies’ and how you can use it to cap your tax rate at 30%.

If you want to ask any questions about this strategy or you’d like a second opinion on your tax, flick me an email to ben@inspireca.com.

JobKeeper: Do I Need to Pay Super?

“Do I have to pay superannuation on the JobKeeper payments?”

There are three relatively common examples your team members might be in.

- Team members that have been stood down – not giving any hours to the business. You still need to pay the minimum $1,500 per fortnight to receive the JobKeeper payment for them. Any top-up amount or the full $1,500 is paid to an employee that has been stood down, there’s actually no super on that at all, which is great.

- Team member working part time or not on high wages (one or two days a week) receiving about $500 a fortnight. Keep in mind, you have to top up their pay to $1,500 a fortnight for you to be eligible for the JobKeeper payment. Let’s say, they’re working still and they’re earning $500. With the $500, that’s what you would normally pay super on. But any top-up amounts to take them up to the JobKeeper level, there’s no superannuation requirement on that portion, which is great.

- Team members paid more than $1,500 a fortnight – they’re still working for the business, they’re not stood down and they haven’t been terminated. Now, they’re already getting paid more than the minimum $1,500 per fortnight and if they’re working, then yes, you still have to pay superannuation on their salary or their wages.

So if they’re stood down, then no, you don’t have to pay super on the minimum JobKeeper payment.

If they’re earning something but not the full $1,500 and you have to top up their wage, you pay super just on what they’ve earned, not on that top up.

And if someone’s earning more than the JobKeeper and still working, then of course, no rules have changed there. There’s still superannuation on their salary.

If you need help with JobKeeper book a strategy call with one of our accountants: https://calendly.com/inspireca/strategycall

JobKeeper Programme: Extensions Announced

Last week, the government announced two extensions for the JobKeeper programme.

- The enrollment to the JobKeeper programme has been extended to the 31st of May. So there’s no rush to enrol now.

- If you want to claim JobKeeper from the start ( the fortnight beginning on the 30th of March) you need to make sure, any back pay for those first two fortnights, are paid by the 8th of May.

We’re really pleased with the announcement as it gives us a bit of time to not rush things through and to help more people.

If you need help with JobKeeper book a strategy call with one of our accountants: https://calendly.com/inspireca/strategycall

Happiness is a number between 1 and 10. What’s yours?

If happiness was as simple as forcibly contracting a set of facial muscles, we’d all be happy – whenever we wanted and the world might be a better a place. However, that’s not the case. So this question might sound a bit forced but it’s a starting point to finding more happiness in your business life, drawing it out and enjoying it with family and friends. On a scale of 1-10 (10 being “all-the-time” awesome and one being “I’m so exhausted, my brain has decided to switch everything off but my heart and lungs), how happy are you?

Wait, don’t answer that yet. How happy are you at the end of your weekend when Monday, whenever that occurs for you, is only a few hours away? Dreading it? Take a point off. Does the weekend just mean that you can get on with more work and admin without having to necessarily answer the phone or emails? Take another point off. Has it become a pattern that another weekend flew by without you having a chance to have some meaningful time with your family – or even your “non-work self”? Take a thousand points off! Yes, a thousand! Now answer.

We get it, you’re operating on auto-pilot, staggering from one week to the next, maybe you don’t know what to do about it and that’s all very frustrating. But as usual there is an answer.

Men are from Mars, Women are from Venus and Frustration comes from not knowing

Frustration makes you feel helpless, a little bit angry and comes with an overwhelming feeling that change is a long, long way away. Of all the numbers we like to talk about such as your magic number, what your business is worth, the payment terms you offer etc, all roads surely lead to this number: Your happiness score out of 10. Your happiness score’s natural enemy is frustration and frustration comes from not knowing your other numbers. Let’s look at a couple of test scenarios in dot point form:

- You don’t know how much money you’re going to have to pay out this month – frustration

- You don’t know how much money is coming in this month – frustration

- You don’t know if you’ll have enough to cover BAS (how’s that for timing?) – frustration

- You don’t know if you could have paid less tax – frustration, anger, resentment, bitterness

You know what? There’s no way you could enjoy a true happiness score over maybe a 4 with all that frustration.

Lift your awareness, lift the burden, lift your game, raise your happiness score

Rather than us simply saying to you, “if you’re not as happy as you think you should be, just force a smile and you’ll feel better”, we want to offer you the type of sound advice that allows you the freedom to be genuinely happy. Happy with yourself, your business and of course your family. If you’re not feeling it, they’ll know and no amount of cheek muscle raises and flexes will fix that.

We’re all about, helping you get to a point where work doesn’t feel like toil and it actually brings a certain joy to you and your family – and if not joy at least an average score of around 8/10. If you like the sound of that then please feel free to call our number and let’s get to work on it.