Why You Need A Rainy Day Fund

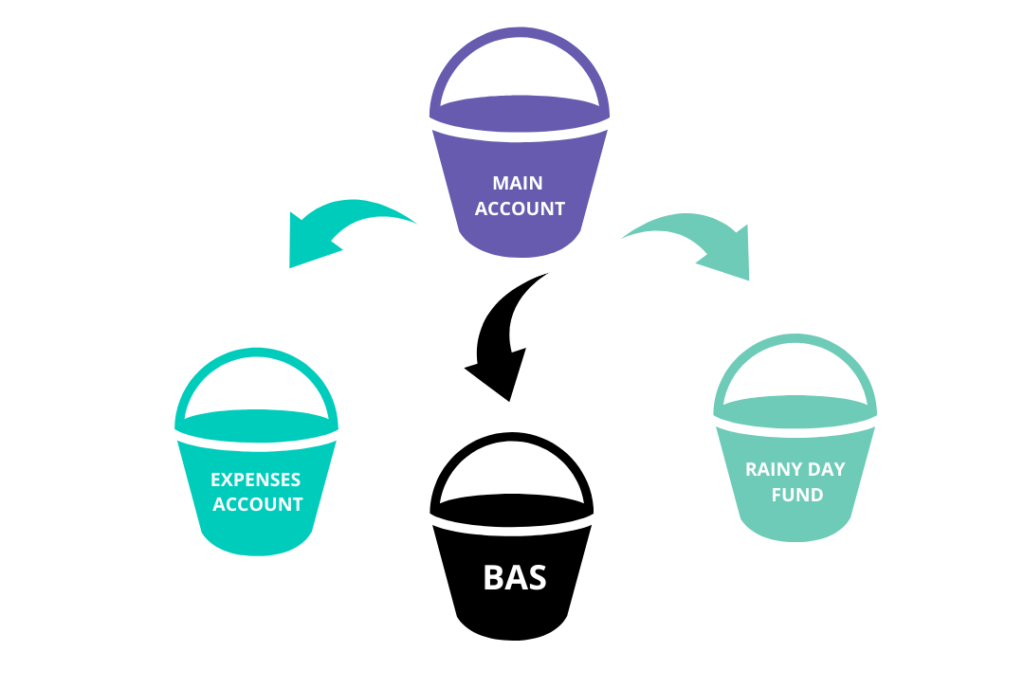

The rainy day fund has an allocation of money to build a rainy day fund for your business. Start small with a small weekly contribution if you haven’t got anything and aim for three months worth of expenses.

We had a number of business owners who came to workshops years ago, they didn’t necessarily become clients but they reached out to specifically thank us, to say, “Hey, thanks so much for sharing that three years ago or four years ago, whenever it was, because I did it, and now that COVID’s hit and we’ve had a drop in sales, we can keep everyone employed”.

The power of a rainy day fund is it’s in place for those unexpected things that might throw your business off.

The build up can be used to clear a debt. If you’ve got excess money in your rainy day fund, then you can use a portion of that to clear any debt, but don’t empty your rainy day fund to clear a whole heap of debt, because you’ll have no rainy day fund left.

Keep in mind that this can be a personal offset account on your own home mortgage, but we encourage you to keep it separate from personal funds. Certain banks allow you to have multiple offset accounts on your home loan, and we would keep your rainy day fund for your business clearly separate from your personal offset account.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant.

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.