What Is A BAS Bank Account?

BAS is an actual acronym for Bas And Super. BASes and superannuation are paid quarterly for GST purposes for most businesses.

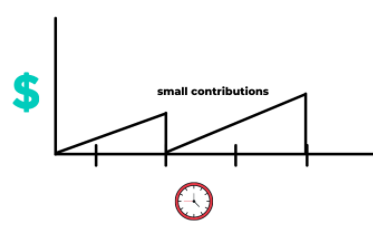

We want to make small contributions throughout the quarter and then you will take a big hit when you need to pay BAS and super.

This is the account you do that in, not your main account. Because if you’re not having a separate account for this stuff, and you start seeing $50K, $100K, $200K build up in the main account, you will get excited and you might be spending money that is intended for GST and the Pay As You Go withholding from employees or even spending super.

Make sure that you are setting a small amount aside each week. Reduce the ups and downs in the main account because that is the whole purpose of doing that weekly contribution, and paying bills in full and on time every quarter.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant at https://inspire.accountants/chat

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.