The Rules For Giving To Churches Vs. Charities

Churches and charities are classed differently in terms of their ability to give pre-tax money. If you distribute tithes or give money to a church, and they are not a deductible gift recipient, then you need to make sure that they have an income tax exemption by looking their ABN on the Australian Business Register.

Click on their ABN, and down to the bottom you can see the charity tax concession status and income tax exemption.

Here’s an example of a church that you could distribute money to from a trust.

It is different to a charity, which is a whole lot easier and a lot less paperwork as well. But giving to a charity as a tax deduction, you will need to check if they are DGR or a deductible gift recipient.

You can’t make donations if it’s not entitled to receive tax deductible gifts but you can distribute trust distributions.

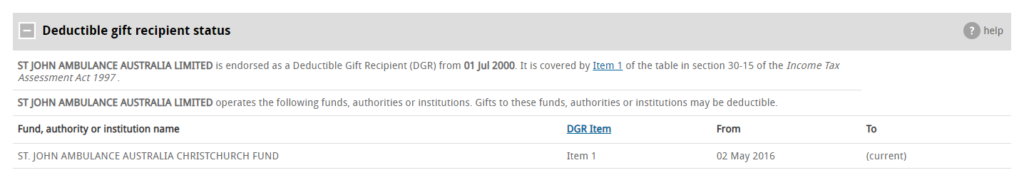

Another example is St John Ambulance Australia Limited

Deductible gift recipient status from 2nd of May, 2016 onwards – the reason why it’s more recent than this organisation would have existed is they changed the way they dealt with charities around about that time from memory. What you need to claim that on tax is a tax invoice from the charity, and it must be over $2 and you will be able to claim it.

Register to our next event .

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.