The Tax Benefits Of An SMSF

In a recent webinar, “Become an SMSF millionaire” we run through the SMSF tax benefits.

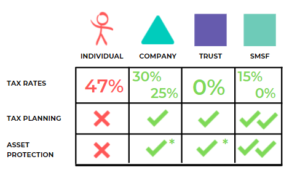

SMSFs have a very low tax environment.

Under trust, it says 0% because trusts like discretionary trusts, give their profit to other entities or people in their family group and they pay the tax. 0% is not quite correct for trust but it actually gives it away.

With an SMSF, an SMSF pays 15% tax or 0% tax on the money it makes. So, they are much lower than the other tax rates and that is kind of a high-level overview of the differences between the tax rates.

Why are there two rates for an SMSF?

The first one is 15% when you’re accumulating your balance over the majority of your lifetime. Then you switch into 0% tax when you’re drawing a pension and when you are over a certain age. You can only get that 0% concessional rate on up to $1.7 million per member in pension. So, if you have $3 million in your own fund balance and in your member balance, then you can’t get that 0% concession on the whole lot.

On the difference. So, on the remaining $1.3 million, if you’ve got the total of $3 million in super, you will still pay the 15%. It’s still low and it’s just not zero. Even if you had $50 million in your own pension account, whatever it earns is taxed at 0%.

Benefits of drawing a pension or being in 0% tax mode plays out if you earn dividends from owning shares in super, then you will pay 0% tax. But some other instances are if you own a business through super, or part of a business, then the profits that go back to the SMSF in that pension account are at 0% tax and similarly if you sell an asset.

So what we see is if you buy a commercial property in your forties or fifties, hold it for 20 years and sell it when you are retired and in pension mode, you can make a massive gain and you can do that without paying any CGT.

Get Cashed Up