Minimise Tax With A Bucket Company

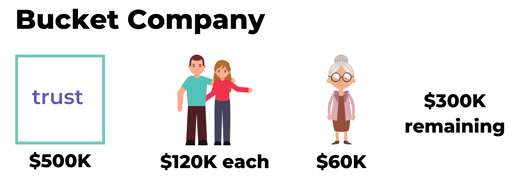

If you have a trust earning $500K in profit and you have given $120K each for the husband and wife and for whatever reason, you have only given $60K to your grandparent or the parent. If we add all those up, you have distributed $300K and you still have $200K remaining to distribute.

Where we get a bucket company is to soak up the remaining profit, which is $200K. If you distribute that to one of the husband and wife, you’re going to pay 39% or more in tax but if you were to distribute that to a bucket company, you would limit your tax on the remaining $200K at 26%. So you are saving 13% or more on every dollar that goes into that bucket company.

We use bucket companies for business owners or families that are earning sort of sub-$200K, $250K or more in tax to soak up the balance of that taxable income.

If you pay it to a bucket company, you pay less tax, but the cash has to go to the bucket company because if you don’t do that, it’s treated as a Division 7A loan.

If you are to distribute money to a company, the cash has to move into that bank account; otherwise; you loan it from the company and it’s a short-term strategy if we are not paying the cash over. What you would like to do is pay the family group enough to live on, with the excess going into that bucket company and it can invest it, buy shares and manage funds or lend it to other entities to buy property.

Register to our next event.

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.