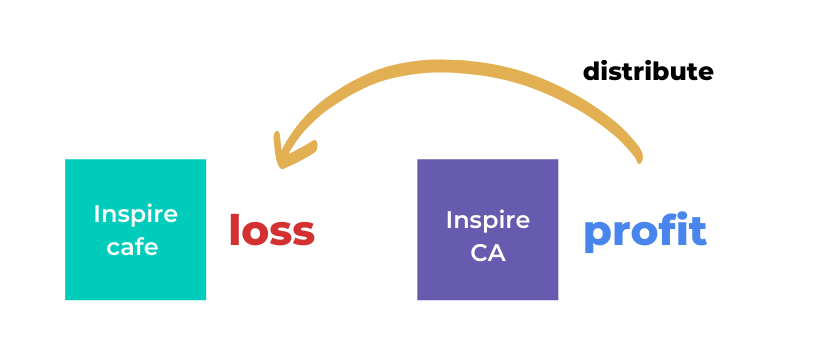

How to Distribute To A Loss-Making Entity

Ben initially created an accounting firm with a cafe in the foyer called Inspire cafe. It had a heap of losses over a number of years before it ended up closing. Over the accounting firm, it wasn’t making massive amounts of profits, because it was the first few years of the accounting firm and it was trying to support the cafe.

From both entities, they were separate legal entities, both had their own companies and trusts separate, but because Inspire CA was making a profit and the cafe was making a loss, he was able to distribute some of the profits and soak up the loss. He paid himself the remainder of the profit. This is how you can distribute from a profit-making entity to a loss-making entity.

You can distribute from a trust to a company or a profit-making trust to a loss-making trust. You can do either of those two combinations.

You cannot have a loss-making company distribute to anything because a company does not distribute its profits like a trust does.

Register to our next event.

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.