Cryptocurrency Tax Accountant

It’s rare to see a client where crypto is their ‘day job’ – but more and more of our clients have portfolios, are trading, or are engaged in some form of investment or business with cryptocurrency here in Australia.

Quick Links

In this blog, we’ll cover

- Crypto tax myth busters

- Broad tax concepts for context

- Specific tax outcomes with:

- HODLing (long term holding)

- Mining

- Trading

- NFT’s

- Staking

What we won’t cover

- Specific tax recommendations (all tax is general, not specific, as the specific circumstances can sometimes change the answer)

- Recommend what coins to buy, what exchange to use, and that you should invest in crypto

- Any financial advice

- Launching an ICO

- Basics or 101 of crypto investing

Crypto Myth #1

“I’ll only pay tax when I convert it to AUD”

- Cryptocurrency is like a currency

- The timing of the tax event is when you dispose of any asset or currency

- So, if you sell Bitcoin to buy Ethereum, you’ve still sold / disposed of your Bitcoin

- If your business is paid in Japanese Yen, you still need to pay business tax even though you haven’t converted it to AUD

Crypto Myth #2

“If I make a gain, but put the money into another coin, I delay the tax bill”

- The timing of the tax event is when you dispose of any asset or currency

- Regardless of what you purchase next, you’ve still made a gain at the time of selling

Crypto Myth #3

“I don’t have to pay tax because the ATO will never know about my portfolio”

- “We are alarmed that some taxpayers think that the anonymity of cryptocurrencies provides a licence to ignore their tax obligations.” Mr Loh (ATO) said.

- “While it appears that cryptocurrency operates in an anonymous digital world, we closely track where it interacts with the real world through data from banks, financial institutions, and cryptocurrency online exchanges to follow the money back to the taxpayer.”

- Don’t forget: Your “sleep at night tax” is a tax!!

Crypto Myth #4

“My crypto is a hobby so I don’t have to pay tax”

- The ATO’s view is that crypto is personal use if it is kept or used mainly to make purchases of items for personal use or consumption (i.e. used to buy clothes, music, games etc). Not to buy / sell / trade in.

- It is NOT a personal use asset where:

- It’s intended use is to purchase income producing investments;

- you intend to keep it for a number of years with the intention of selling it at an opportune time based on favourable value

Crypto Myth #5

“My SMSF cannot invest in crypto”

- No laws prevent it

- Read the trust deed (or the trustees can amend it to include it!)

- Investment must meet the ‘sole purpose test’

- Cannot acquire from a related party

- Need to consider it in the investment strategy

- Needs to be ‘owned’ in the SMSF – ensure correct names on exchange accounts, wallets, etc.

- Keep a very good record. Your SMSF is audited!

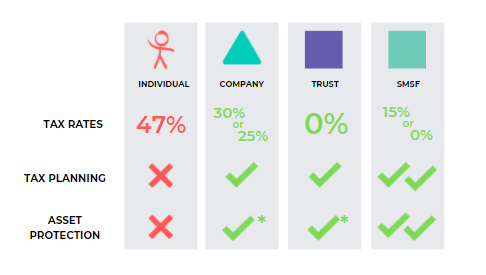

Tax Concept – The Right Structure

What Tax Rates Each Pays

Individual

One of the big reasons why we might go for trust or company is because of the alarming tax rates where individuals pay up to 47% tax, depending on their income.

Company

Companies have two different rates depending on what the company does. If it’s purely an investment company (so it doesn’t run a business, a business of trading cryptocurrencies, or a business of mining crypto currencies) the 30% tax rate is applicable. The 25% tax rate is for small businesses (so the business of trading, or mining for instance). You need to have most of the company’s income as business income to access this lower 25% tax rate.

Trust

Trust doesn’t necessarily not pay tax, but a trust gives its profits to other individuals, companies, or other entities in the family group, and then they pay the tax on the trust’s behalf.

SMSF

15% tax is what we call the Accumulation phase – where you’re growing your balance in super throughout your lifetime. The 0% is for the pension phase. When you’re drawing on your super, you’re a certain age or older, and you’ve met the conditions of release for super, you will have an option for your super to be taxed at 0%.

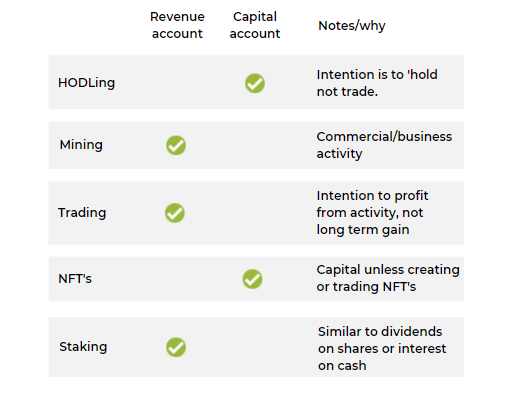

Tax Concept – Revenue or Capital

Money you receive is treated as either revenue account (ordinary income) or capital account.

Revenue Account

- e.g. normal ‘business’ income

- Trading income (includes bots)

- Mining income

- Income from staking

- Tax is paid on income, less expenses to derive that income

Capital Account

- HODLing (buy and hold, longer term)

- Intention is to profit over time on eventual sale

- Allowed a discount on gain, if held over 12 months

- Tax is paid on sale value, less cost base, adjusted for any discounts

Bob trades and makes a $1M profit.

Bob also works and earns a $120K salary.

Tax just on the crypto profits – depending on structure:

Sole Trader – $465K in tax

Company – $250K in tax

Tax saving if company (revenue account) = $215K

Tax Concept – Capital Example

Bob HODLs for 10 years and makes a $1M capital gain.

Bob also works and earns a $120K salary.

Tax just on the crypto profits – depending on structure:

Sole Trader – $230K in tax

Company – $300K in tax (if investment company, and companies don’t have CGT discount)

Extra tax if a company = $70K

So what is the “Normal” Tax Treatment?

How to reduce your Crypto Tax

- Know the rules

- Get on the front door (don’t bury your head)

- Get your structure right (ideally from the start)

- Do tax planning with a good accountant

- Report accurately to avoid fines/penalties

If you’re trying to make it look like something it isn’t, that’s when you need to be worried (i.e. capital instead of revenue for your benefit)

How to track your transactions for Tax

- If your affairs are simple, use exchanges who give good reporting

- Use crypto tax specific apps

- Koinly.io

- CryptoTaxCalculator.io

- CoinTracker.io

- (Pay the fee, it’s cheaper than an accountant working it out!)

Want to learn and watch more about cryptocurrency tax?

- Watch the full webinar recording ‘Cryptocurrency Tax Masterclass’ on our facebook page

- 6 Tips To Reduce Your Crypto Tax

- Tracking Crypto Transactions For Tax

- Tax Warning For Crypto Hobbyists

- Can You Delay Crypto Tax Bills?

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.