Bucket Companies: The least known and most underutilised strategy to save thousands in tax

“Use Bucket companies – tax tip of the week!”

I’d love to shed some light on what we call ‘Bucket Companies’, also called:

- Corporate Beneficiary

- Dump Company

- Family Vault

- Second Super

- And a few other creative ones!

Why this strategy is so critical, is because it can help cap your tax rate at 30%.

And as a quick refresher, as a sole trader you can pay up to 51% in tax (including the temporary budget repair levy).

Who is a Bucket Company strategy for?

Ideally:

- Business owners (or investors)

- Running their business or receiving income through a discretionary trust structure

- Not caught under the Personal Services Income (PSI) rules (if you don’t know what this is, hopefully the rules don’t apply, but you can read more on PSI here)

The idea of a bucket company is that they take ‘excess’ profits, after distributing a reasonable amount to the people within a family group.

Bucket Companies are incredibly useful

- For business owners who earn more than their cost of living, and want to build a nest egg for their family;

- When business owners are having big fluctuations in incomes between financial years as they can be used to make the tax bills more consistent; and

- For business owners coming up to retirement or selling their business, and no longer earning as much business income moving forward.

What are the tax benefits of using a Bucket Company?

If done right, Bucket Companies can generally save thousands of dollars in tax for a client, year on year.

Let’s use an example of a trust earning $300k in profit. But we’ll review the tax rates first.

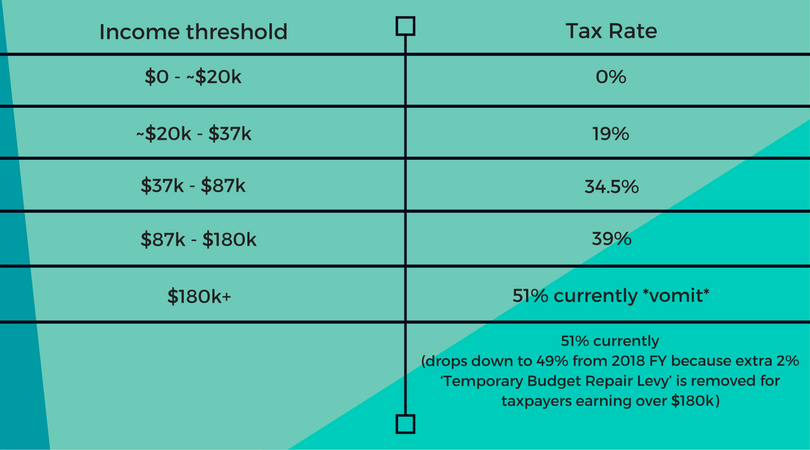

For 2017 FY, the individual tax rates (including medicare levy) are:

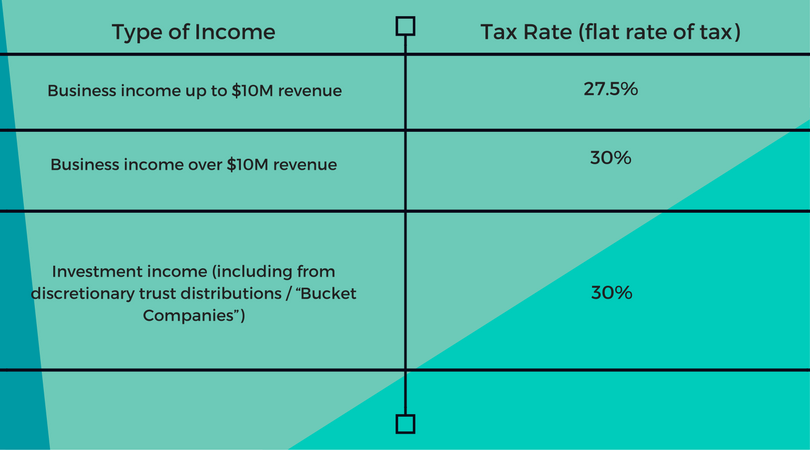

Company tax rates for 2017 FY are:

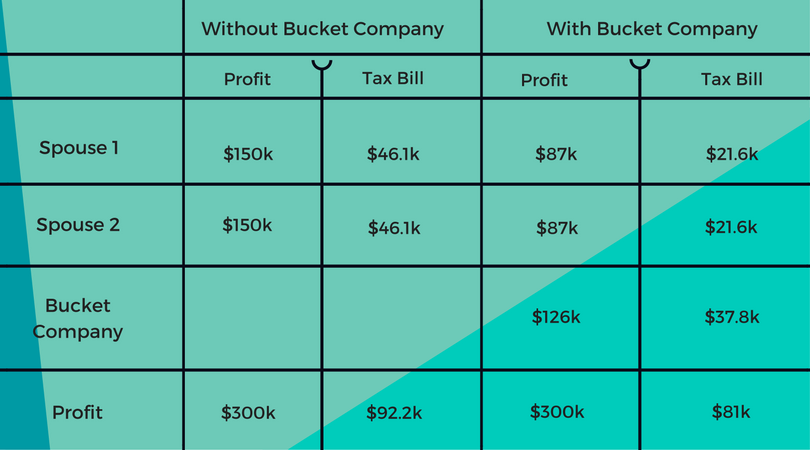

So if we’ve got a trust that’s earned $300k in profit, we need to allocate that to people or entities within a family group.

Now it makes sense to take eligible people up to $37k in income. That means we’ve taken them up to 19% tax on their income, and every dollar over $37k (but under $87k) they pay 34.5% tax. (See the table above)

Compare that to a company, where it would only pay 30% on the first dollar it receives, but every dollar after that.

But our ‘magic number’ from a distribution perspective to individuals (or people) is $87k, which might defy some people’s logic. This means they will be paying 34.5% tax on the income between $37-87k.

Do read on.

Do I need to actually pay the cash to the Bucket Company?

The reason why the magic number is $87k, is that when we distribute to a company, the cash needs to follow as well (the company needs to get paid). Otherwise we raise Division 7A issues and the ATO doesn’t like ‘on paper’ distributions without the intention of ever paying them.

We find that the $87k mark usually covers people’s cost of living, and they can commonly pay all or a good portion of the cash to their bucket company.

If you distribute to a company, then the company itself will have a tax bill. So you’ll have to pay at least 30% of whatever you distribute to it as a tax payment eventually!

What are the Tax Benefits of a Bucket Company?

Let’s look at the benefits of the bucket company using $300k profit as a case study:

Tax saving by using Bucket Company $11,200. Not bad ‘ey?

Getting the cash out of Bucket Companies

We discovered above that the cash actually has to follow the distributed amount from the trust. And then the tax bill needs to be paid.

But now we’re left with some money in the company, so how do we get the money out?

Well there’s two ways to do it:

- Loan it from the company

- Pay dividends to the shareholders from the company

They both have their pro’s and con’s – let’s hit it:

1. Loan it from the company

These loans are called ‘Division 7A loans’ and are a minefield if not treated correctly, but can be used effectively.

Your Bucket Company effectively becomes a bank.

You loan money from it, and have to pay principal and interest repayments.

If your loan is unsecured, you have 7 years to pay back the cash.

If your loan is secured (on a property let’s say), then you have 30 years to pay back the cash.

The interest rate is set each financial year by the ATO, but usually not rediciulous. (5-7%)

So it’s kind of treating your company at arms length, like a bank, without dealing with the muppets.

This strategy can be very effective for loaning your 20% deposit for a house or property, then the 80% difference from an actual bank. That way (if secured) you get 30 years to pay back the loan to your own company. (More on this in a moment.)

2. Pay dividends to the shareholders from the company

The second way to get money out of a Bucket Company is through paying a dividend to the shareholders of the company.

The shareholders are who ‘own’ the shares in the company.

Now when we pay a dividend, the shareholders get taxed on that dividend, but they receive a ‘franking credit’ for the tax that the company has already paid.

Sidenote on franking credits: The company has paid 30% tax on their income, or 30 cents for each dollar it earned. When the company pays dividends, the shareholder is taxed on the full amount of the dividend (or profit the company has already paid tax on). But the franking credit offsets the tax bill for the shareholder. For instance, if the shareholder will pay on average 34.5% in tax on the dividend they receive, they get a 30% franking credit, only having to pay ‘top up tax’ of 4.5% on the dividend they received.

So you should always consider the tax impact of paying that dividend.

And MORE importantly, you must consider who the shareholders are of the Bucket Company.

If they are individuals, then you can only distribute to those individuals (in the % of shares that each of them own).

All too often we see husband & wife owning 50/50% of the bucket companies. But the problem with this is we may have little control on what the husband and wife earn separately to the dividend.

The best thing to own the shares in a Bucket Company is actually another, separate discretionary trust. We call these ‘Asset Trusts’.

That means when we pay the dividends from the company, they fall to the asset trust, then the trustees of the asset trust can allocate the didends to the family members who pay the least amount of tax. You retain ultimate flexibility.

In summary, getting the money out isn’t straightforward, and working with an advisor who knows their stuff is non-negotiable.

How will giving money to a Bucket Company affect my ability to get finance from a bank?

Stupid disclaimer and warning: always consult a savvy mortgage broker for questions about finance, aka a “Loans Guy or Girl”. Ben Walker isn’t a licenced credit representative, and this section is a compilation with Jake Pretorius from our office (our “Loans Guy”) and a licenced Credit Representative (No. 402028) of BLSSA Pty Ltd ACN 117 651 760 (Australian Credit Licence No. 391237). It’s based on our understanding of banks at the time, but they change their policies more then they change their underpants. Let’s keep in mind this is general advice and does not take into account your personal needs and financial situation.

Our understanding and experience with banks is that Bucket Companies don’t stop you getting finance from the banks.

Because you’re a business owner, the banks don’t just take your personal income to service your loan.

They’ll look at all related companies and trusts, and assuming there’s consistency, they’ll take your total group income into account.

So if you distribute $100k to a Bucket Company, banks should see this as your business income.

Can I use equity in my current property, plus cash from the Bucket Company for a deposit to buy an investment property?

While this is a complex question and scenario, but we believe it’s possible. But always check with your switched on mortgage broker to find the lenders who will do this.

Can the company buy property?

The company can technically own property and use the built up cash to buy it, but I wouldn’t recommend that strategy.

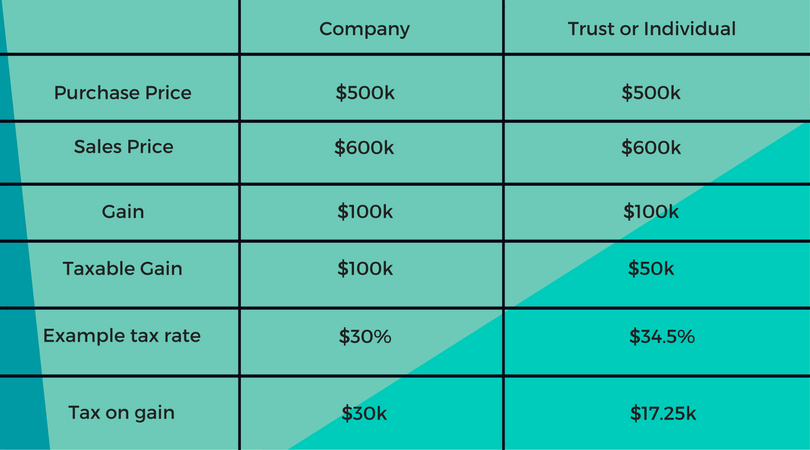

The simple reason why is that a company is NOT eligible for the ‘50% capital gains tax discount’, but a trust or an individual is.

Now in english, the ‘50% capital gains tax discount’ means that if you own an asset (like a property) for more than 12 months, then you get a 50% discount on the amount you get taxed on when you sell that asset and make a gain.

Some quick numbers on the benefits:

Tax saving by owning property in trust or individual is $12,750.

So to maintain ultimate control of your tax bill when you sell the property, own the property or asset through an Asset Trust.

Ok, so how do I use the cash in the company to buy property?

You can loan the money from the Bucket Company to your Asset Trust (secured). Then the rest can come from the bank.

This gives you 30 years to pay back the loan to the company, and assuming it’s an investment property, pay tax deductible interest from the Asset Trust back to your own Bucket Company.

See the “Loan it from the company” section above for more details.

And always, always, always see a switched on mortgage broker for help with this sort of loan structuring.

In conclusion…

That’s a super detailed overview of what we call ‘Bucket Companies’ and how you can use it to cap your tax rate at 30%.

If you want to ask any questions about this strategy or you’d like a second opinion on your tax, flick me an email to ben@inspireca.com.