4 Business Structures Explained

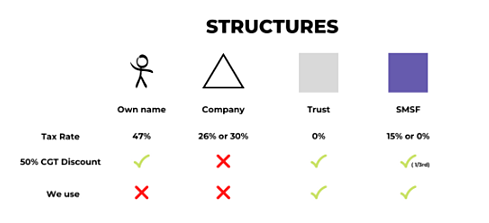

The first structure is in your own name, as a sole trader, or as an individual. Second is a company, third is trust, and fourth is a self-managed super fund.

There are three things that we look at, one is the tax rate. If you’re an individual, you can pay up to 47% in tax. Nearly half of your money goes to the ATO.

Then you’ve got the company where there are two different tax rates. You pay a flat tax at 26% or 30%, depending on how big your business is. More often than not, it’s at 26%. Or if you have passive investments, it’s in the 30% bracket and you have the trust where you pay 0% tax.

Trust is like a funnel and it doesn’t pay a tax on its own. It distributes to the beneficiaries, which could be a sole trader, an individual or a company, so you end up paying either 47% of tax, 26%, or 30%.

Self-managed super fund is 15% or 0%. Its sole purpose is for your retirement. Circling back to the age pension issue that we have in Australia, they’ve really given them some massive concessions when it comes to super. If you have investments in super, and you make money there before you retire, you pay 15% on all the income in that self-managed super fund and once you retire, it’s tax-free. The difference is once you are retired, they don’t want to clip you money because they want you to get tax-free income from your pension.

One of the major concessions that we have is a 50% CGT discount. So, if you sell a property, you make a $100K capital gain, and if you hold it for more than 12 months, you get a 50% capital gains discount. You get it as an individual, as a trust, and a self-managed super fund, but you don’t get it as a company.

Typically, we don’t like using individuals or companies where we kind of drive more of buying your commercial properties in trust and self-managed super fund.

With a trust and a self-managed super fund, you can effectively plan your asset protection strategies within your family. A self-managed super fund is fairly protected and that is one of the big benefits. If you ever go bankrupt, if people are trying to come after your assets, or for whatever reason, your super fund will be well protected.

You could own your commercial property outside of super but it is technically at a higher risk compared to your super. Your super is meant for your retirement and they want to protect that as much as possible.

If you compare all the structures overall, the self-managed super fund always has one of the best tax environments because it’s been 15% or 0% and you still get your capital gains discount. If you retire and you have all these properties and portfolios of shares or whatever that you invest in your self-managed super fund, you can start liquidating them and not worry about losing that capital to the tax man.

Watch the full webinar, ‘How to buy your office, warehouse or clinic using your super fund’ at https://learning.benwalker.com/courses/howtobuyyouroffice

Get Cashed Up

Liability limited by a Scheme approved under Professional Standards Legislation.