The Secret To Hitting Your Weekly Magic Number

At Inspire, we report our magic number every single day. We have a team daily huddle and a target for the week. Obviously, not everyone is involved in sales but we share our numbers at our morning meeting so that everyone is aware of how we’re tracking and it gives absolute clarity and focus for the people who are involved with sales. So we make sure we do everything we can to hit our numbers.

We work off our sales KPIs, or even our marketing KPIs are all around magic number. We estimate how many leads we need to hit that magic number, how many look under the hoods or structure and strategy sessions that we need to hold and how many proposals we need to send out.

So, if you have salespeople and sales agents that sell for you, you can work back how many phone calls to prospects that you need. If you start to know the magic number you need to bring it in. And if you know your conversion statistics, then you can start working backwards for literally how many times does that person need to pick up the phone during the day to make that outcome happen.

This is a great focus, but it doesn’t happen by looking at the number. It needs more of the business KPIs and everyone’s individual KPIs to make it happen.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant.

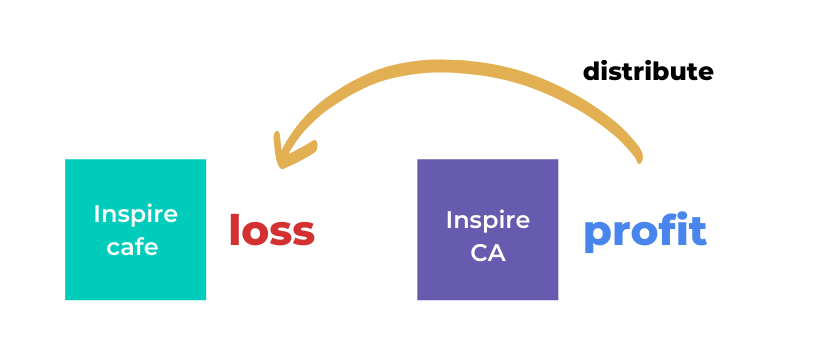

How to Distribute To A Loss-Making Entity

Ben initially created an accounting firm with a cafe in the foyer called Inspire cafe. It had a heap of losses over a number of years before it ended up closing. Over the accounting firm, it wasn’t making massive amounts of profits, because it was the first few years of the accounting firm and it was trying to support the cafe.

From both entities, they were separate legal entities, both had their own companies and trusts separate, but because Inspire CA was making a profit and the cafe was making a loss, he was able to distribute some of the profits and soak up the loss. He paid himself the remainder of the profit. This is how you can distribute from a profit-making entity to a loss-making entity.

You can distribute from a trust to a company or a profit-making trust to a loss-making trust. You can do either of those two combinations.

You cannot have a loss-making company distribute to anything because a company does not distribute its profits like a trust does.

Register to our next event.

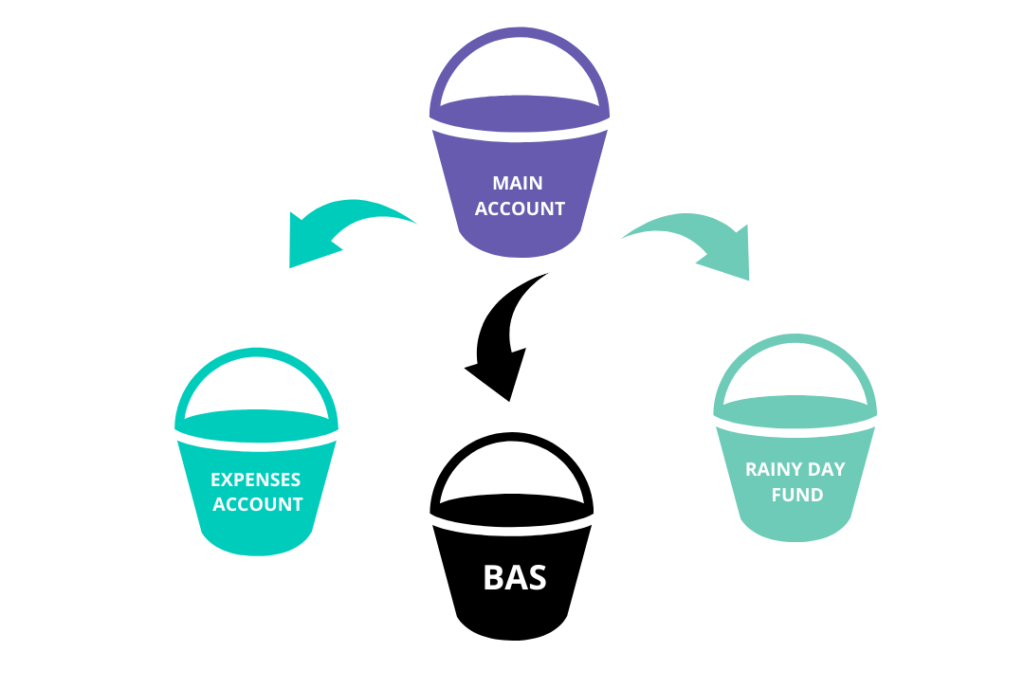

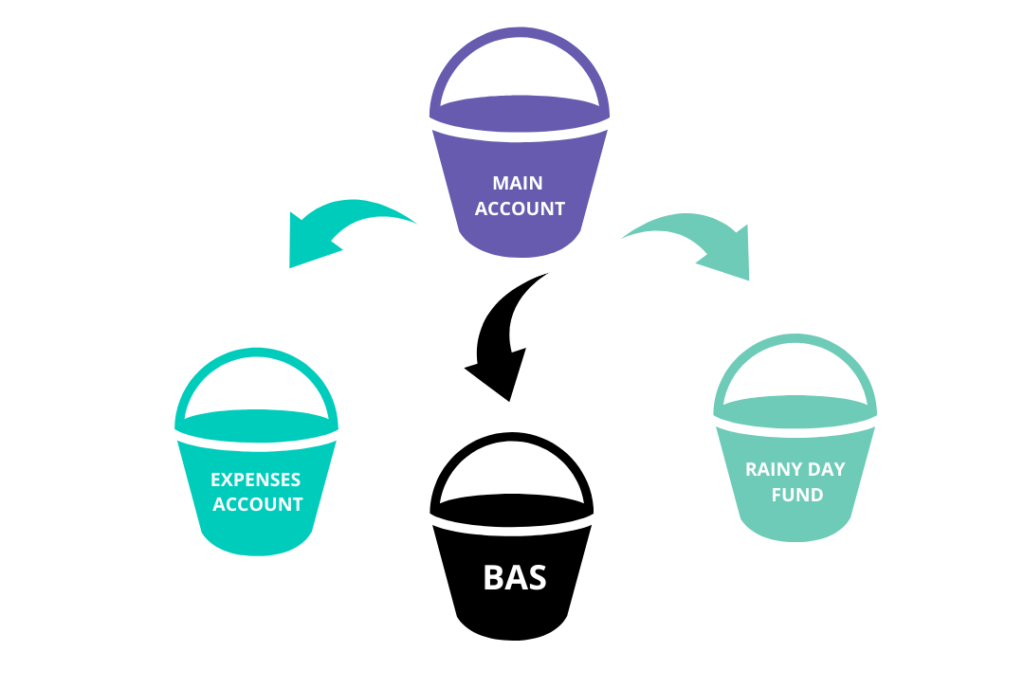

The 4 Bank Accounts Every Business Needs

The first one is the main account, it receives all income and it pays the headline expenses which are your pay, the wage bill, and any big suppliers. It disperses the rest into the other accounts.

You want all your income coming into this one, but a handful of transactions going out from the main account. It disperses the rest into these other bank accounts.

Expense accounts pay all the other expenses, the smaller, non-headline or non-critical expenses: things like your Zoom subscription and your email subscription. It can be a credit card that you put this on, but if it will encourage you to spend more money in your business by having it on a credit card and having that limit, don’t do it on a credit card. Just use a bank account and you can always use a credit card later if you are not tempted to spend more because credit cards can be a dangerous thing.

For most businesses, cash flow can be up and down throughout the month. If you’ve got your main account, then you may want to reduce the up and down effect as much as possible and if you’ve got a budget for your expenses, transfer it to your expenses account. If you start running out of money really quickly, you know that you might be spending more than your budget had in mind for that.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant at https://inspire.accountants/chat

Why You Need A Rainy Day Fund

The rainy day fund has an allocation of money to build a rainy day fund for your business. Start small with a small weekly contribution if you haven’t got anything and aim for three months worth of expenses.

We had a number of business owners who came to workshops years ago, they didn’t necessarily become clients but they reached out to specifically thank us, to say, “Hey, thanks so much for sharing that three years ago or four years ago, whenever it was, because I did it, and now that COVID’s hit and we’ve had a drop in sales, we can keep everyone employed”.

The power of a rainy day fund is it’s in place for those unexpected things that might throw your business off.

The build up can be used to clear a debt. If you’ve got excess money in your rainy day fund, then you can use a portion of that to clear any debt, but don’t empty your rainy day fund to clear a whole heap of debt, because you’ll have no rainy day fund left.

Keep in mind that this can be a personal offset account on your own home mortgage, but we encourage you to keep it separate from personal funds. Certain banks allow you to have multiple offset accounts on your home loan, and we would keep your rainy day fund for your business clearly separate from your personal offset account.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant.

Managing Multiple Bank Accounts In Xero

An attendee has asked:

“If you’re feeding all the cash deposits from the sales and it goes into your main bank account, and you split off all these different accounts, as far as bookkeeping and all that sort of thing, how does that work with Xero and having all the different accounts, for tax time and all the reconciliations? I might be feeding more money into the BAS account or my expense account, and then have to shift some back. Just keeping track of that whole flow of money, how does that impact, or how do you manage it?”

Here’s our answer-

We’d probably want to work out on how much you should allocate each week in the BAS account. If your quarterly bill is $20K and your quarterly super bill is another $10K, that is $30K over the quarter, divided by the weeks, will give you that answer. With your expense accounts, you can put $5K and when it diminishes, you can top it back up again.

Another method is to work out a rough budget and just transfer that every week. We can go to huge lengths to calculate exactly. It is never going to be perfect, but having a system like this is better than no system.

How do you keep track of it in Xero?

For example, you have four business bank accounts which are your main, your BAS, your expense account and your rainy day fund. The bookkeeper can go in and reconcile transfers between the two accounts. And it is simple as long as they are all feeding into your Xero account. The bookkeeper can all pick up the ins and the outs and as long as you use things like when you’re transferring.

Register to our next event.

How To Save Tax & Boost Your Super

A trust doesn’t technically distribute to a super fund like a discretionary trust but you as a member, can contribute the profit you receive from a trust into super.

The current tax deductible cap into a super fund per year is $27.5K.

Keep in mind that when money goes into super, there is a 15% contribution tax. If it goes into accumulation, you will get 15% tax on what it earns, and if it goes into a pension, you will get 0% tax on what that money earns. So, you will get your 27.5% cap.

If you haven’t used your caps in the previous financial years, you can bring those forward if you meet certain conditions. We’ve seen clients popping $100K as a tax deduction because they haven’t used those caps and they meet those conditions. It’s a fantastic tool to boost wealth through super which is a low tax environment, but also saves a whole heap of tax outside of super.

Register to our next event.

What Is Your Magic Number?

Magic Number is one of the strategies that we use to help business owners understand how much sales they need to make in their business so that everyone is paid including suppliers, team, and themselves. They make a healthy profit which a lot of business owners don’t budget for, and any debt repayments that they’ve got in their business.

Watch the webinar replay, ‘Numbers For Non-Accountants’ where we go into a bit more detail and it gives absolute clarity to the business owner that they need to encourage their team, to get around the whole concept of making sure they hit the magic number, and anything over that is a bonus. You need to make sure you hit the number, so that everyone is paid, business owners making a profit and everything is going well.

Watch ‘Numbers For Non-accountants’ free at https://learning.benwalker.com/courses/NFN

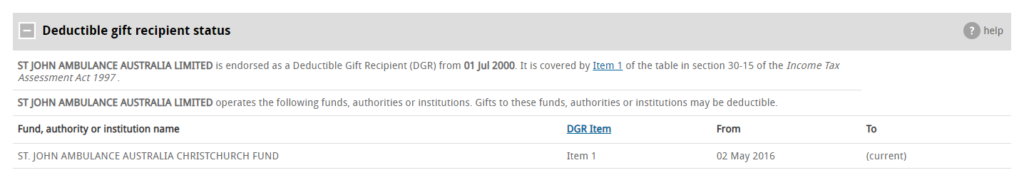

The Rules For Giving To Churches Vs. Charities

Churches and charities are classed differently in terms of their ability to give pre-tax money. If you distribute tithes or give money to a church, and they are not a deductible gift recipient, then you need to make sure that they have an income tax exemption by looking their ABN on the Australian Business Register.

Click on their ABN, and down to the bottom you can see the charity tax concession status and income tax exemption.

Here’s an example of a church that you could distribute money to from a trust.

It is different to a charity, which is a whole lot easier and a lot less paperwork as well. But giving to a charity as a tax deduction, you will need to check if they are DGR or a deductible gift recipient.

You can’t make donations if it’s not entitled to receive tax deductible gifts but you can distribute trust distributions.

Another example is St John Ambulance Australia Limited

Deductible gift recipient status from 2nd of May, 2016 onwards – the reason why it’s more recent than this organisation would have existed is they changed the way they dealt with charities around about that time from memory. What you need to claim that on tax is a tax invoice from the charity, and it must be over $2 and you will be able to claim it.

Register to our next event .

Minimise Tax With A Bucket Company

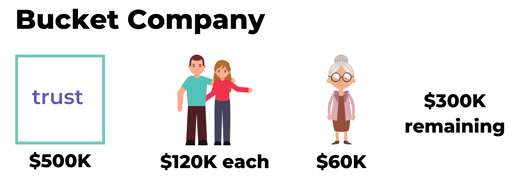

If you have a trust earning $500K in profit and you have given $120K each for the husband and wife and for whatever reason, you have only given $60K to your grandparent or the parent. If we add all those up, you have distributed $300K and you still have $200K remaining to distribute.

Where we get a bucket company is to soak up the remaining profit, which is $200K. If you distribute that to one of the husband and wife, you’re going to pay 39% or more in tax but if you were to distribute that to a bucket company, you would limit your tax on the remaining $200K at 26%. So you are saving 13% or more on every dollar that goes into that bucket company.

We use bucket companies for business owners or families that are earning sort of sub-$200K, $250K or more in tax to soak up the balance of that taxable income.

If you pay it to a bucket company, you pay less tax, but the cash has to go to the bucket company because if you don’t do that, it’s treated as a Division 7A loan.

If you are to distribute money to a company, the cash has to move into that bank account; otherwise; you loan it from the company and it’s a short-term strategy if we are not paying the cash over. What you would like to do is pay the family group enough to live on, with the excess going into that bucket company and it can invest it, buy shares and manage funds or lend it to other entities to buy property.

Register to our next event.

4 Categories Of Risks To A Business

Why would asset protection should be talked about when you haven’t run through what the actual risks are? People have had different experiences about getting sued so you may want to be prepared for it, rather than not prepared and have to react.

There are four categories of risks to a business and the first one is clients. If you stuff something up for a client, you cause them a loss and they might sue you to fix out whatever damage or loss that you ended up giving them.

The next one is suppliers, sometimes suppliers sneak into their contract and that is an example of a supplier doubling down on their risk mitigation. If you don’t pay a bill or you have an agreement with the supplier that’s not met, you might be suing them, or they might be suing you for some reason.

The third one is for employees. A HR consultant once said that Fair Works can charge up to $65,000 per offence if you do not meet their Fair Work Act. It’s an incredible amount of money for potentially forgetting a form and employees are one of the largest exposures to a business for asset protection.

The last one is competitors, and this is usually a sort of IP infringement. It could be things like copyright or you were naughty and used someone’s logo or name but this is actually a pretty low risk one.

Register to our next event.

Get Cashed Up