How To Create An SMSF Investment Strategy

Some of the things that you should consider in creating an SMSF strategy are:

Risks of your investments

If you’re investing in cryptocurrency, note that it might be extremely risky compared to leaving it in cash, which also has its risks with inflation. You need to basically have a common sense and documentation of the risks and why you’ve chosen that for each of the members.

Diversification of investments and benchmarks for classes of assets

You need to set in your investment strategy and you may target 60-70% of your fund that you want in real property whether it’s residential or commercial. You may want 40% in cash because you want a bit of liquidity, so you have to document what you’re aiming for and keep it up to date. Make sure the range that you are aiming for is what reality looks like.

If your SMSF holds property, and your home or property has increased in price and in value, then you may have a larger portion of your funding property and it may be on the upwards range of your investment strategy.

It is important to make sure that your investment strategy is kept up to date with the market values of your fund.

Document your intended return on investment

Document your intended return on investment and document your overall fund targeting the cash rate plus 5% or an overall return of 20% net of tax or whatever it is.

Borrowings

If you want to explore Borrowings in your fund, it is usually with property.

Insurances

It doesn’t mean you need to have insurance in your SMSF, but you do need to document what you’ve done with insurances.

Liquidity

Liquidity needs to be documented as well. It’s just common sense. There’s a bit of planning with liquidity and cash flow requirements. If you are in pension mode, you need to make an account for cash to pay out pensions. It’s not set and forget so we need to review that each year.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant at https://inspire.accountants/chat

300K Gain Tax-Free Case Study

Tax-Free Case study:

A few years ago, we had a client who had a commercial property outside of Super worth about a million dollar value. He is shifting into retirement and he wanted to move more money and assets into Super. So, he transferred that million-dollar property to Super. He wasn’t an owner-occupier, but he received rent for a few years at 0% tax because he was in pension mode.

Within 2 to 3 years, he received an offer to buy that property for $1.3 million. And because he was retired, he paid no tax on the gains. So, he got a $300K gain at the 0% tax because he bought it for about 1 million, and sold it for 1.3 million – a great outcome for him.

Watch the full webinar, ‘Become an SMSF millionaire’ at https://learning.benwalker.com/courses/SMSFmillionaireweb

The 3 Key Aspects of Incapacity Planning

in a webinar, “Become an SMSF Millionaire” we talked about the 3 key aspects of Incapacity planning.

If you do lose the capacity to make financial decisions for yourself, or another member of your SMSF is in that situation, always have an enduring power of attorney in place for every member of your SMSF.

The Super Fund requires all members to be Trustees or Directors. If you’re a member in a fund, you need to be a Trustee of the fund, and if it’s Individual Trustees, then we don’t recommend that anymore. If it’s a Company Trustee, you need to be a Director. But the Director or the Trustee can be the enduring power of attorney for the person who’s lost capacity, and it can’t just be a general power of attorney.

Also, you need to make sure the Trust Deed or the SMSF Deed and Constitution of the Trustee is set up to allow this in the event of incapacity. A lot of the good Deeds at the moment should be fine around this stuff but the bit that you need to make sure is everyone having an enduring power of attorney in place.

You won’t want to be in these situations, and you can’t access money, you can’t invest, you can’t sell an asset because you haven’t got some of this stuff sorted, and it creates a massive problem that you have to work through legally.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant at https://inspire.business/chat

The Cost of Setting Up A Company Structure

We give advice and education before setting up a company structure. The session costs $750 plus GST, depending on what you need, because some situations are sometimes completely different. But most structures are around about $2,500 for us to implement for you.

We do that in the context of making sure it’s right for your family. We make sure we build in the asset protection in there, and also we make sure you really understand how to use it. So, just over $3K to get a structure set up from having nothing.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant at https://inspire.business/chat

Risk-Takers & Asset Holders Explained

Here at Inspire, when there’s a couple in the family group, we designate one of them to be the risk-taker and one of them is the asset holder. And when we’re running the business, we are setting up structures for that family. When they are buying and investing in property or shares, we make sure it’s done very specifically.

Risk-taker roles are the director of the trading entities, the director of trustee companies if a trust is running the business. And ideally holds no assets in their own name. For instance, if the family home isn’t in their name.

In terms of the asset holder, they’ve got control of the assets and holding entities such as asset trust and bucket companies. 100% ownership of family assets like home, cars, and their typical roles in structures are the shareholders, trustee of asset trusts and the appointor of trusts.

What if the asset holder just buggers off and leaves the risk-taker without anything, nothing in their own names?

We’ve been told by multiple family lawyers that even though the assets are spread between the spouses with 100% in one and zero in the other, all of that is seen as marital assets. In the case of relationship breakdown or divorce, it’s not just one person who gets everything and the other gets zero. The idea of that is because the family court is the court that can look through all this asset protection and structuring.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant at https://inspire.business/chat

Why Division 7A Was Brought In

Why Division 7A was brought in? If you were a sole trader and you made $1M, here are some options:

Option 1:

Taxed in your own name at 47% top tax rate. 47% is the highest marginal tax rate of an individual and it’s higher if they have a hex debt of another 8-10%. So, you are above half of your profit going to the taxman and more again if you don’t have private health insurance. For argument’s sake, let’s say 47% tax is option 1 which means on a $1M, you’re left with $530,000 in after tax profit.

Option 2.

If you earn a $1M profit in a company, and you meet the requirements for the reduced company tax rate of 26%, which is a flat rate of tax and it is not marginal, you’re left with net after tax profit of $740,000.

Whether a million bucks was earned in a single year, or over a couple of years, the point is, In a company, you end up with a lot more after tax money. The whole idea of Division 7A is for most people to get that out and spend it.

Here’s an example:

Clive Palmer wants to buy a bigger boat. He can buy a bigger one if he funnels the million dollars in profit through a company versus his own name. He’s got more net cash if he structures as a company versus taking it out in his own name.

What he would do in this case is, he buys a boat in a company name. It is still a Division 7A issue if the asset that he buys is a personal asset like a boat, for instance. If it’s nothing to do with his business, then he has Division 7A consequences on his boat even if it’s in the company name.

The second option is where he takes the cash out of the company into his own name and buys a house.

He buys another Gold Coast mansion, so instead of paying tax on the profit in his own name, the company pays less tax, and it loans him the net profit. He still puts it through the company, but instead of paying it out as a salary or a dividend, he loans it out, so he doesn’t pay that extra tax. Basically, it’s a way of taxing that money that’s loaned out, or personal assets that are bought in the company’s name.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

When Is A Bucket Company Worth It?

When is a bucket company worth it? A webinar attendee has said, “In the future, the personal income tax rate will reduce for most people to around 30%.”

Yes, we have been signalled by previous budget releases, but we still have a high marginal tax rate which is still above the $180K of income or more. You still pay probably 47% or similar, but the 30% tax rate will be a lot larger. The band will be from memory from about $45k to maybe $180k, or $120K. It is a larger band which should be similar to a company tax rate.

“Considering the admin fee (accounting fees of running a company) how much profit is worth to set up a company structure as a bucket company? So, when is it worth having a bucket company?

This really comes down to the family situation. $120K right now is where the tax rate goes from 34.5% to 39% tax. So at that stage, if it’s just you, it’s already better off to go to a company. But if you can spread income between you, your spouse, and if you have adult children that we can give some money to, then the cost benefit of a bucket company might only come into play at $300K, $400K, or $500K in profits.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

What Is A Franked Dividend?

On a recent webinar, one of our attendees has asked, “Please define the term ‘franked dividend”

Here’s our answer –

If the company is earning $100,000 in profit, you will pay 26% of tax, and you’ve got $74,000 left in the bank account.

You can pay a dividend, and you can attach the $26,000 tax as a credit because you’ve already paid tax on that $74,000. We call it a franking credit to the dividend so that your shareholder isn’t taxed on the full amount again.

In the shareholders’ hands, they are not paying tax on the $100,000 without any credit because the company has already paid the tax for $26,000. So, it’s basically preventing you from paying tax twice on the profit.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

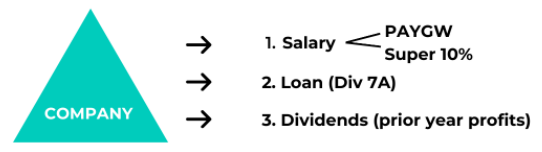

Taking Money Out Of A Company Vs A Trust

In terms of taking money out of a company versus a trust, the first way to take money out of a company is through a salary.

Take a salary out to pay yourself, or to your spouse if they work in the business. But you still have to take Pay As You Go withholding because it’s a requirement, and you have to pay super, which is currently 10% at the moment. It went up from 9.5% from 30 June to 1st of July and it just changed over a couple of months ago to 10%.

The second way to take money out of a company is to loan it out of the company.

Division 7A is the rules that surround loans from companies.

Take a salary out to pay yourself, or to your spouse if they work in the business. But you still have to take Pay As You Go withholding because it’s a requirement, and you have to pay super, which is currently 10% at the moment. It went up from 9.5% from 30 June to 1st of July and it just changed over a couple of months ago to 10%.

The second way to take money out of a company is to loan it out of the company. Division 7A is the rules that surround loans from companies.

The third option is to pay dividends.

Dividends are paid to the shareholders of the company. So when you set up a company, you need to be conscious of who owns the physical shares in that company, because they will be receiving the dividends from it and be taxed on that.

If you are setting up your structure, you will need a trust to own those shares. The whole idea of a trust owning the shares is, you can choose who gets the dividend at the end of the day.

Dividend is a payment of prior year profits. So, ordinarily you will earn a profit, and if you earn $100,000 in profit, you will pay 26% tax. So you are left with $74,000 in after tax profit in the company and you can pay out a franked dividend after you’ve paid that tax that is usually the next financial year.

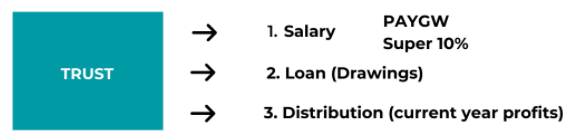

In terms of taking money out of a trust, the first way to do so is also to pay a salary. If you have a trust structure as your business structure, you may not be taking a salary, which is completely normal.

You can take a loan out from a trust and we call it ‘Drawings’ and there are no requirements for it. Division 7A in summary, says you have to repay the money from a company, and you can’t just endlessly rip it out. You have to repay it with interest, minimum repayments and a maximum term. But there’s no requirement to pay that money back to a trust because loans from trust don’t have those requirements.

A trust pays a distribution every single financial year. If a trust makes $100,000 in profit, you need to distribute that in that financial year and it hasn’t been taxed yet, so it will give its profit to family members including you, your spouse, kids, parents, and retired parents. There is a whole list of people we can consider, or it can give it to other entities in the family group.

Keep in mind that different client groups, different situations have different structures in place. On a global level, neither is better than the other, but it depends on your family situation, which one of these options is more appropriate for you.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

Short Term Solutions For Division 7A

One of the short term solutions for Division 7a is a lot of clients put their excess cash in their offset account to reduce the interest on their home loan. They repay the loan before 30 June, and that is a repayment of the Division 7A loan. But technically, if you rip it back out on the 1st of July, the ATO’s have the ability to look through it. We don’t want to be blatant about putting it in, ticking 30 June and then taking it out again. We do need a better medium to long term solution than the short term solutions. This is not our only trick, so to speak. But this is kind of no way to manage it long term.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

Get Cashed Up