What Is A Franked Dividend?

On a recent webinar, one of our attendees has asked, “Please define the term ‘franked dividend”

Here’s our answer –

If the company is earning $100,000 in profit, you will pay 26% of tax, and you’ve got $74,000 left in the bank account.

You can pay a dividend, and you can attach the $26,000 tax as a credit because you’ve already paid tax on that $74,000. We call it a franking credit to the dividend so that your shareholder isn’t taxed on the full amount again.

In the shareholders’ hands, they are not paying tax on the $100,000 without any credit because the company has already paid the tax for $26,000. So, it’s basically preventing you from paying tax twice on the profit.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

Taking Money Out Of A Company Vs A Trust

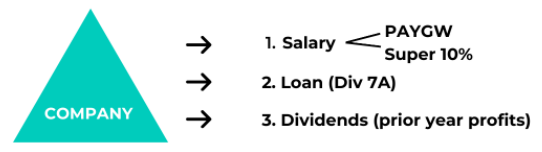

In terms of taking money out of a company versus a trust, the first way to take money out of a company is through a salary.

Take a salary out to pay yourself, or to your spouse if they work in the business. But you still have to take Pay As You Go withholding because it’s a requirement, and you have to pay super, which is currently 10% at the moment. It went up from 9.5% from 30 June to 1st of July and it just changed over a couple of months ago to 10%.

The second way to take money out of a company is to loan it out of the company.

Division 7A is the rules that surround loans from companies.

Take a salary out to pay yourself, or to your spouse if they work in the business. But you still have to take Pay As You Go withholding because it’s a requirement, and you have to pay super, which is currently 10% at the moment. It went up from 9.5% from 30 June to 1st of July and it just changed over a couple of months ago to 10%.

The second way to take money out of a company is to loan it out of the company. Division 7A is the rules that surround loans from companies.

The third option is to pay dividends.

Dividends are paid to the shareholders of the company. So when you set up a company, you need to be conscious of who owns the physical shares in that company, because they will be receiving the dividends from it and be taxed on that.

If you are setting up your structure, you will need a trust to own those shares. The whole idea of a trust owning the shares is, you can choose who gets the dividend at the end of the day.

Dividend is a payment of prior year profits. So, ordinarily you will earn a profit, and if you earn $100,000 in profit, you will pay 26% tax. So you are left with $74,000 in after tax profit in the company and you can pay out a franked dividend after you’ve paid that tax that is usually the next financial year.

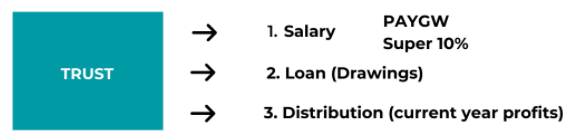

In terms of taking money out of a trust, the first way to do so is also to pay a salary. If you have a trust structure as your business structure, you may not be taking a salary, which is completely normal.

You can take a loan out from a trust and we call it ‘Drawings’ and there are no requirements for it. Division 7A in summary, says you have to repay the money from a company, and you can’t just endlessly rip it out. You have to repay it with interest, minimum repayments and a maximum term. But there’s no requirement to pay that money back to a trust because loans from trust don’t have those requirements.

A trust pays a distribution every single financial year. If a trust makes $100,000 in profit, you need to distribute that in that financial year and it hasn’t been taxed yet, so it will give its profit to family members including you, your spouse, kids, parents, and retired parents. There is a whole list of people we can consider, or it can give it to other entities in the family group.

Keep in mind that different client groups, different situations have different structures in place. On a global level, neither is better than the other, but it depends on your family situation, which one of these options is more appropriate for you.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

Short Term Solutions For Division 7A

One of the short term solutions for Division 7a is a lot of clients put their excess cash in their offset account to reduce the interest on their home loan. They repay the loan before 30 June, and that is a repayment of the Division 7A loan. But technically, if you rip it back out on the 1st of July, the ATO’s have the ability to look through it. We don’t want to be blatant about putting it in, ticking 30 June and then taking it out again. We do need a better medium to long term solution than the short term solutions. This is not our only trick, so to speak. But this is kind of no way to manage it long term.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

Medium Term Solutions For Division 7A

Option 1: Pay minimum repayments on unsecured loan

A common one we do is pay the minimum repayments on the unsecured loan. Unsecured Division 7A loan is a 7-year term. There are minimum repayments and we can pay these in cash (transfer back). The alternative is to issue dividends to the shareholders, or pay salaries to the people running the business on paper, instead of paying them cash because it reduces the loan outstanding. Basically, if there is a $10,000 minimum repayment needed. We can issue a $10,000 salary, instead of transferring cash from the company to the personal account. You can reduce that off the loan that the person owes back to the company.

Option 2: Cascading loans

If you are taking more cash out each year, you can start a new loan in that financial year that you take more cash out of the company because it resets your 7 year repayment term. Some balance sheets may have –

Loan – (your name) 2020

Loan – (your name) 2021

Each loan may have its own financial year attached if you are drawing down more each year.

Option 3: Build up the loan knowing you’ll pay the dividends to repay minimum repayment or the full loan

Sometimes this strategy is used when people are retiring and they are coming up to a business exit. So, we intentionally tax them less in their own names, build up a bit of a Division 7A loan in their company and once they are no longer earning income in the company, we pay down dividends back to the individuals to reduce the loan outstanding. Another way is to leave the money in the company and issue dividends each year to extract the money, once the business has sold or they’ve become retired.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

Long Term Solutions For Division 7A

It is possible to avoid Division 7A altogether, but there are potential drawbacks because we don’t get access to cash personally, but that may be okay depending on your circumstances. Here are the long term solutions for division 7A.

Option 1: Pay the cash back into the company

Pay the cash back into the company and repay the loan. But the downside or the drawback is, it may be a poor use of funds.

Option 2: Paying the “top up tax”

If you’ve already paid 26% tax in the company name and you want to get access to that cash permanently, then you can issue dividends or salary depending on your structure, to the individuals in the family group. You may be taxed up to 47%, and we call that the top up tax of 21%.

Option 3: Buying shares or managed funds in a bucket company

We’ve got the bucket company because we wouldn’t want to buy shares in a trading entity because if you are in business, it is attracting risk in your entity. So, from an asset protection perspective, we don’t want to create an asset to potentially lose if something were to go wrong in the business. But we can bolt on a bucket company to one of your structures so that we can take the dividends out of your trading entity, put it in a bucket company, and buy shares or managed funds. There is a way to do it, but we don’t want to buy shares or managed funds in a trading entity.

If you buy shares or managed funds in a company, you do not get access to the 50% capital gains tax discount if you own shares, managed funds, assets, or property, for more than 12 months. You get a 50% discount in your own name, or in a trust name whilst in a company, you do not.

Shares or managed funds often have an income component and your tax rate on that is 26% or if it’s a purely investment company, you’ll be paying 30% tax on your dividends and trust distributions from the managed funds or shares.

If you have the choice, the preference would be to invest in income focused shares and managed funds in the bucket company.

And if you have capital growth assets, there are certain index funds that the goal is to produce an income stream and there are index funds where the goal is to grow in capital but not pay anywhere near as much income along the way because your priority is a capital gain. But you may want to structure it in a trust instead, so that you will be able to access a 50% discount if you were to sell the index fund or managed fund.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

How Does An Offset Account Work?

On a recent webinar, one of our attendees asked, “Please define an offset account, and does an offset account only exist for a home loan?”

Here’s our answer:

Some of the banks offer it with a mortgage. If you put $10,000 in your offset account, that will offset a portion of the interest up to the interest of $10,000 on your mortgage. It offsets interest on your home loan, and calculated every day that your money is sitting in that offset account.

Watch the full webinar, ‘Solving Company Loads Division/7A Problems ’ at https://learning.benwalker.com/courses/solvingcompanyloansD7AP

5 Rules For Division 7A Loans

When Ben started in accounting, they had a couple of clients who had loans pre-1997, and they basically didn’t repay a cent because there were no requirements to abide by these sorts of rules.

But in general, the loans need to be documented. There’s a principal, and interest repayments required, a maximum term, and minimum repayments calculated per formula.

The interest rate each year is advised by the ATO and currently, it’s at 4.52%. It’s usually a few percent higher than you can get a home loan rate from and it has gone down over.

If the loan is unsecured, you have 7 years to pay. But if it is secured, you have 25 years to pay it back. And this is a little bit of a hint on one of our medium to long-term solutions for Division 7A loans.

It also applies to distributions from trusts. So, if you’ve made the hundred thousand dollars in a trust and you pay a portion to a bucket company and you distribute, you have to pay the cash to the bucket company. Otherwise, you create a Division 7A loan. It is not necessarily the worst thing in the world but we’ve just got to manage it.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant

What Are Your Lending Options Inside Super?

What are your lending options inside super? LRBA is an acronym for Limited Recourse Borrowing Arrangement.

Super funds on their own can’t lend money from a bank or anything. They are not supposed to lend in their own right. In the right conditions, you can borrow using funds with your super and receive the income into your super fund if you have the right trust set up, the right loan agreements, and if they meet the requirements of the Superannuation Act.

For super contributions, the ones you make as an employee or as a business owner, whether they’re from the business or personal contributions, they can count towards your servicing of your borrowing capacity in your super fund.

If you are dropping $55,000 a year between you and your spouse, plus the rental income of your prospective property, it will do wonders for your borrowing capacity. But if you’re only chipping in $5 a year in contributions, you will be relying on rent and the lenders in space need to see a little bit of consistency.

You can’t just dump $50,000. You will need a bit of history if you need contributions to service, unless it’s a really high-yielding property, then you will probably need your super contributions, or a low loan.

Need to speak to an accountant? Book a ZERO cost 20 minute strategy call with an Inspire Accountant.

The Process Of Buying Commercial Property

Here are the Process of Buying a Commercial Property:

Step 1. Preapproval

The first step is to get preapproval or some idea that you can buy what you are looking to buy. If it’s Inside Super, you don’t necessarily need your SMSF set up – you could be looking but not have an SMSF. Whilst Outside Super is more simple than a home loan to get pre-approval for a commercial property. If you’ve found a property, set up an SMSF and a bare trust, a trust, or whichever structure you are using.

Step 2. Set up SMSF (if SMSF) and bare trust or set up a trust

The bare trust is the lending vehicle, and the lead time is one to two months to be safe. Make sure when you look to buy something, you structure your set up to be able to sign the contract in the right name. If you don’t currently have an SMSF, the lead time on getting your existing super could take days or maybe one to two weeks.

Industry super funds are getting a lot better, but there’s still ones who make it difficult to take your super away because the sooner you do that, the less fees they get.

The setup of the SMSF and the paperwork itself wouldn’t take long for you to sign it, but what takes time is trying to get your money out of the industry super fund. And if you do make that decision, you want to pull that out, that industry super fund needs to be comfortable that the money doesn’t go to your secret bank account that you just go to Vegas with.

They want to make sure that it goes to a compliant super fund and it’s in the right name. There are checks and balances that they have to do before they release that. If you find a property in a hot property market, you’ve got to take this into account. You might lose out on property just because you haven’t got your ducks in a row. So, if it’s going to take some time and you are ready to do all this stuff, get in touch with your accountant first and make sure that it gets done as soon as possible.

Watch the full webinar, ‘How to buy your office, warehouse or clinic using your super fund’ at https://learning.benwalker.com/courses/howtobuyyouroffice

4 Business Structures Explained

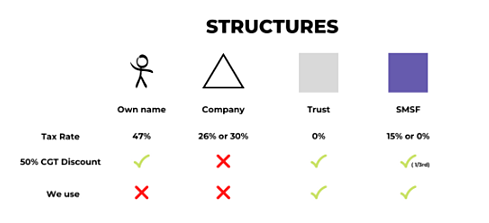

The first structure is in your own name, as a sole trader, or as an individual. Second is a company, third is trust, and fourth is a self-managed super fund.

There are three things that we look at, one is the tax rate. If you’re an individual, you can pay up to 47% in tax. Nearly half of your money goes to the ATO.

Then you’ve got the company where there are two different tax rates. You pay a flat tax at 26% or 30%, depending on how big your business is. More often than not, it’s at 26%. Or if you have passive investments, it’s in the 30% bracket and you have the trust where you pay 0% tax.

Trust is like a funnel and it doesn’t pay a tax on its own. It distributes to the beneficiaries, which could be a sole trader, an individual or a company, so you end up paying either 47% of tax, 26%, or 30%.

Self-managed super fund is 15% or 0%. Its sole purpose is for your retirement. Circling back to the age pension issue that we have in Australia, they’ve really given them some massive concessions when it comes to super. If you have investments in super, and you make money there before you retire, you pay 15% on all the income in that self-managed super fund and once you retire, it’s tax-free. The difference is once you are retired, they don’t want to clip you money because they want you to get tax-free income from your pension.

One of the major concessions that we have is a 50% CGT discount. So, if you sell a property, you make a $100K capital gain, and if you hold it for more than 12 months, you get a 50% capital gains discount. You get it as an individual, as a trust, and a self-managed super fund, but you don’t get it as a company.

Typically, we don’t like using individuals or companies where we kind of drive more of buying your commercial properties in trust and self-managed super fund.

With a trust and a self-managed super fund, you can effectively plan your asset protection strategies within your family. A self-managed super fund is fairly protected and that is one of the big benefits. If you ever go bankrupt, if people are trying to come after your assets, or for whatever reason, your super fund will be well protected.

You could own your commercial property outside of super but it is technically at a higher risk compared to your super. Your super is meant for your retirement and they want to protect that as much as possible.

If you compare all the structures overall, the self-managed super fund always has one of the best tax environments because it’s been 15% or 0% and you still get your capital gains discount. If you retire and you have all these properties and portfolios of shares or whatever that you invest in your self-managed super fund, you can start liquidating them and not worry about losing that capital to the tax man.

Watch the full webinar, ‘How to buy your office, warehouse or clinic using your super fund’ at https://learning.benwalker.com/courses/howtobuyyouroffice

Get Cashed Up