Modernisation of PAYG instalments

If you have a company running a business and you’re prepaying some tax for the current financial year, this is something that has been anticipated. The pay as you go (PAYG) instalments is the way that you prepay tax for the current year and usually, it’s based on last year’s returns that were lodged. The last year of business and the current year can be vastly different for a business in terms of performance and the business is still paying tax as if it’s trading as it was last year.

PAYG does not necessarily mean you are saving tax but it is a cash flow help so you don’t have to prepay as much. Businesses and companies can opt into a real-time PAYG instalments system and calculations which is based off of the accounting software you use. It will be looked into by looking at the current year and then they will calculate the tax instalment that you are supposed to be paying based on the performance of your business currently and not for the previous year.

The great thing about this is, it helps you budget your cash flow and plan your cash a lot easier. For example, some clients are paying $15,000 in instalments, but they don’t have that money and start falling behind on their payments. While there is the ability to levy it down to a reasonable amount, this is more of a proactive approach. So in reality, it is being realigned to be closer to what your business is actually doing at the moment and in turn, managing cash flow is more important than ever.

NOTE: The PAYG Instalment default calculation of last year + 10% will be changed to 2% for 2023 FY

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

The Impact Of Money Printing On Investors

We invited Nick Webb of RSM Financial Services Australia to share his thoughts on the impact of money printing on Investors

Here’s what he said:

An important focus, for a physio clinic business, is to make sure you are getting a great utilisation from your team. This means the number of hours you are paying them to work, versus the number of hours they are in consultations with their clients. The focus is maximising the dollars that they are brining in the business, for the hours they are working and the salary that you are paying them.

How does QE, or money printing, and QT affects decision making about what assets to purchase?

There is so much money out there in the system. The official figure out of the US was in 2021, they printed essentially 40% of their total currency in circulation, so it becomes a big problem. That’s why we see so many of these inflationary spikes at the moment because people are spending like drunken sailors as there’s so much money that’s being printed.

Ultimately, it very much goes and devalues currency. It’s about looking at different opportunities across the globe as well. So looking in some countries where they haven’t printed to the same extent as places such as the US.

In periods like we’re in at the moment, domestically, and in Australia, even though it is a shallow market, we’ve got a huge benefit from very high dividend or income-paying stocks. We’ve got the benefit of franking credits as well, which makes it nicer on the top line from a return perspective.

When we’re looking at QE and tightening on the other side of the coin as well, it’s very much just taking a broader macro view as to what does that flow through to how is that really going to impact upon listed investment markets and other investments that clients will have in their portfolios, such as direct property or any unlisted investments that they have as well.

But typically, jumping into that commodity space, for a lot of people, they like that because there’s a finite supply of things like gold and silver; whereas, when you turn the money printing press on, there’s an in infinite supply of currency. It’’s just weighing up the current state of affairs and where to from there.

Disclaimer:

The information contained in the video above is intended to be general in nature and is not personal financial product advice

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Every Business Owner Should Have This

Rainy Day Fund

When we went through the first few months of COVID and lockdowns, there was a valuable thing called a Rainy Day Fund. It is a backup account in case of an unforeseen event, you can get this easy-to-access pot of cash that can save the business. As a business, we shared this concept from 2015 or 2016 onwards wherein we were doing it at workshops. One of the awesome things is we were getting phone calls or emails unexpectedly from people who had come to those workshops back in the day, they started during the middle of lockdowns.

We’ve been putting away this money for years and it indeed saved our business. It will save our employees throughout turbulent times. I have never seen a better example of this coming in handy as an accountant, but it’s a fulfilling part where people do this and it saves them and exists for that purpose.

Start with excess cash and contribute regularly

The idea of a Rainy Day Fund is that you start with excess cash, a regular contribution that you almost don’t notice. The contribution goes from your main trading accounts over to a separate bank. So, it’s out of your normal, login and internet banking, you can’t see it build up.

Aim for 3 months expenses

The target to aim for is about three months’ worth of expenses. The thought process there is that if your sales are turned off for three months, will you be okay? Will your business be okay to fund those expenses and keep everything going throughout that time? So, that’s the whole reason for three months’ expenses. In that 90-day window or 3 months, you’re able to do something to turn that around or work that out.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

Save Tax With A Motor Vehicle Logbook

There are two ways to claim expenses for a motor vehicle

Cents per kilometre method

Your car depreciation, fuel, parking, tolls, repairs, insurance, etc. is grouped into one. You can claim $80 cents per kilometre, for every kilometre you have driven your car for business or work purposes. And it will not give you a big deduction.

Maintaining a logbook

If you’re someone who drives 10,000 – 15,000 kilometres in a year for business or work, we recommend maintaining a log book for 12 weeks. A logbook is basically for every time you enter your car, you need to write down the odometer of your destination and the purpose of the trip whether it is work or personal. At the end of 12 weeks, we look at the number of kilometres you have driven. Then, we evaluate and look at how many kilometres you drove for work or business purposes and the number of kilometres you drove for personal use.

For example, you drove 70% for business purposes. The logbook will allow you to claim 70% of all motor vehicle expenses. If you have spent $1,000 on fuel in a year, 70% is a deductible expense, insurance is 70% and even on a car depreciation as well. Another example is if you buy a car worth $50,000 Then you can claim the 70% as a write-off. We don’t have a write-off limit, so we can claim the full 70% in one financial year, and the car limit is $60,000.

Maintaining a log book would be helpful. You need to be consistent for 12 weeks and you can use the same log book for up to 5 years as long as you’re still driving the same car. If the usage of the vehicle hasn’t changed and you’re still using the same percentage for business purposes, and if you haven’t maintained a log book, we would highly recommend you to do so.

If you’re keen to explore changing accountants, we have a non-obligation process to do that. The first step is booking a strategy call with one of our accounting team. It’s a free 20-minute zoom or phone call where you get to meet us to manage your questions.

From that point, you can consider doing a “Look Under The Hood” with us. There is no obligation to change accountants, but we give you a second opinion if you’re paying too much tax.

Throughout that process, we can identify any problems we see with your current setup. Anything that your current accountant hasn’t claimed, or tax you may have overpaid, and strategies of how we might fix that going forward. We can run through with you once you book with us.

How To Make Your Employees Work Efficiently

For a lot of businesses, employment costs are the biggest expenses in their business. We noticed that if you do not have processes around making your employees more effective and efficient, there’s a lot of value that is being missed out on. Empowering your employees to either upsell, utilise their time fully and not shying away from sales conversations can massively impact your bottom line which is something to watch out for.

The best thing to do is training your employees on doing things more efficiently. We recently had a client who has a pool business and he has a lot of technicians servicing the pools in residential areas. He had a business process where the invoicing did not happen on the spot; rather the technician used to go back to the shop and tell the admin person to do the invoicing. This caused delays and sometimes missed payments. So, by changing that for their business, they could get back so many admin hours and they could upsell more services on the go just by giving their employees the ability to raise an invoice on the spot.

Consider how you can be more efficient with your employees and how you can maximise the use of their time. Good employees are hard to find and they’re expensive at the same time. Make sure that you’re doing everything in your power to make your employees efficient. Because at the end of the day, you cannot be at every site and your employees represent the business. So, think about how you can leverage them to increase your revenues.

Got a burning question you want to get off your chest? Book a complimentary 20-minute strategy chat with an Inspire Accountants at https://inspire.accountants/chat/

How to convert website traffic into leads?

Have a compelling offer

This is your chance to stand out from the crowd. Offer something your competitors are not. If you sell products, offer a free demonstration OR show them a video of how your existing clients use the product. Bear in mind that, you do not have to offer a discount to have a compelling offer.

Make contacting you easy & flexible

Some prospects prefer calling than submitting a request form and waiting a few business days. Others, prefer the online approach and for those, we recommend using the Facebook messenger or another chat option so you can quickly get back to them. As always, make these options easy to spot on your website.

Ensure your prospects can easily find what services or products you offer

Ask a non-biased friend, family member or a stranger to give honest feedback in regards to your website. Their task should be to go on your website and within the first 20-30 seconds, be able to tell you exactly what you offer.

To price or not price (your service or product)

This will depend on whether your price is competitive in the market or not. Some businesses might lose customers purely because of the price without really hearing a pitch or knowing the value of your product/service. If you are focusing on volume and competitive pricing, then opt to list your price. However, if your goal is to attract quality customers who will pay premium prices for a great service, then opt for either a price range OR simply do not list any pricing.

Cryptocurrency Tax Accountant

It’s rare to see a client where crypto is their ‘day job’ – but more and more of our clients have portfolios, are trading, or are engaged in some form of investment or business with cryptocurrency here in Australia.

Quick Links

In this blog, we’ll cover

- Crypto tax myth busters

- Broad tax concepts for context

- Specific tax outcomes with:

- HODLing (long term holding)

- Mining

- Trading

- NFT’s

- Staking

What we won’t cover

- Specific tax recommendations (all tax is general, not specific, as the specific circumstances can sometimes change the answer)

- Recommend what coins to buy, what exchange to use, and that you should invest in crypto

- Any financial advice

- Launching an ICO

- Basics or 101 of crypto investing

Crypto Myth #1

“I’ll only pay tax when I convert it to AUD”

- Cryptocurrency is like a currency

- The timing of the tax event is when you dispose of any asset or currency

- So, if you sell Bitcoin to buy Ethereum, you’ve still sold / disposed of your Bitcoin

- If your business is paid in Japanese Yen, you still need to pay business tax even though you haven’t converted it to AUD

Crypto Myth #2

“If I make a gain, but put the money into another coin, I delay the tax bill”

- The timing of the tax event is when you dispose of any asset or currency

- Regardless of what you purchase next, you’ve still made a gain at the time of selling

Crypto Myth #3

“I don’t have to pay tax because the ATO will never know about my portfolio”

- “We are alarmed that some taxpayers think that the anonymity of cryptocurrencies provides a licence to ignore their tax obligations.” Mr Loh (ATO) said.

- “While it appears that cryptocurrency operates in an anonymous digital world, we closely track where it interacts with the real world through data from banks, financial institutions, and cryptocurrency online exchanges to follow the money back to the taxpayer.”

- Don’t forget: Your “sleep at night tax” is a tax!!

Crypto Myth #4

“My crypto is a hobby so I don’t have to pay tax”

- The ATO’s view is that crypto is personal use if it is kept or used mainly to make purchases of items for personal use or consumption (i.e. used to buy clothes, music, games etc). Not to buy / sell / trade in.

- It is NOT a personal use asset where:

- It’s intended use is to purchase income producing investments;

- you intend to keep it for a number of years with the intention of selling it at an opportune time based on favourable value

Crypto Myth #5

“My SMSF cannot invest in crypto”

- No laws prevent it

- Read the trust deed (or the trustees can amend it to include it!)

- Investment must meet the ‘sole purpose test’

- Cannot acquire from a related party

- Need to consider it in the investment strategy

- Needs to be ‘owned’ in the SMSF – ensure correct names on exchange accounts, wallets, etc.

- Keep a very good record. Your SMSF is audited!

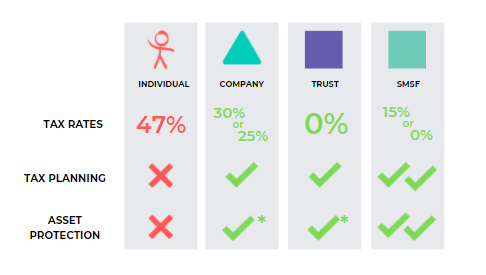

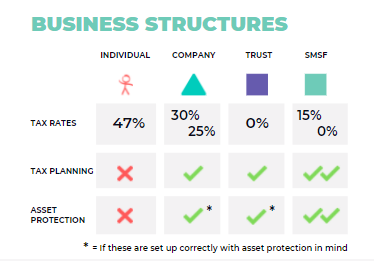

Tax Concept – The Right Structure

What Tax Rates Each Pays

Individual

One of the big reasons why we might go for trust or company is because of the alarming tax rates where individuals pay up to 47% tax, depending on their income.

Company

Companies have two different rates depending on what the company does. If it’s purely an investment company (so it doesn’t run a business, a business of trading cryptocurrencies, or a business of mining crypto currencies) the 30% tax rate is applicable. The 25% tax rate is for small businesses (so the business of trading, or mining for instance). You need to have most of the company’s income as business income to access this lower 25% tax rate.

Trust

Trust doesn’t necessarily not pay tax, but a trust gives its profits to other individuals, companies, or other entities in the family group, and then they pay the tax on the trust’s behalf.

SMSF

15% tax is what we call the Accumulation phase – where you’re growing your balance in super throughout your lifetime. The 0% is for the pension phase. When you’re drawing on your super, you’re a certain age or older, and you’ve met the conditions of release for super, you will have an option for your super to be taxed at 0%.

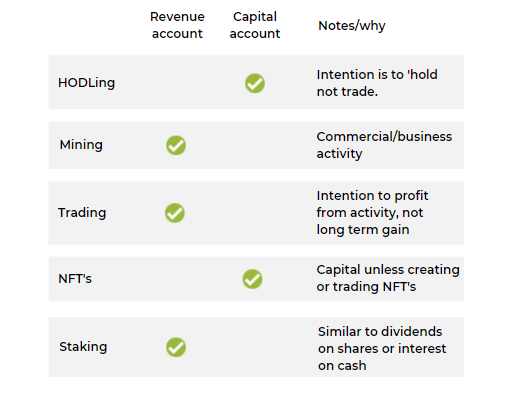

Tax Concept – Revenue or Capital

Money you receive is treated as either revenue account (ordinary income) or capital account.

Revenue Account

- e.g. normal ‘business’ income

- Trading income (includes bots)

- Mining income

- Income from staking

- Tax is paid on income, less expenses to derive that income

Capital Account

- HODLing (buy and hold, longer term)

- Intention is to profit over time on eventual sale

- Allowed a discount on gain, if held over 12 months

- Tax is paid on sale value, less cost base, adjusted for any discounts

Bob trades and makes a $1M profit.

Bob also works and earns a $120K salary.

Tax just on the crypto profits – depending on structure:

Sole Trader – $465K in tax

Company – $250K in tax

Tax saving if company (revenue account) = $215K

Tax Concept – Capital Example

Bob HODLs for 10 years and makes a $1M capital gain.

Bob also works and earns a $120K salary.

Tax just on the crypto profits – depending on structure:

Sole Trader – $230K in tax

Company – $300K in tax (if investment company, and companies don’t have CGT discount)

Extra tax if a company = $70K

So what is the “Normal” Tax Treatment?

How to reduce your Crypto Tax

- Know the rules

- Get on the front door (don’t bury your head)

- Get your structure right (ideally from the start)

- Do tax planning with a good accountant

- Report accurately to avoid fines/penalties

If you’re trying to make it look like something it isn’t, that’s when you need to be worried (i.e. capital instead of revenue for your benefit)

How to track your transactions for Tax

- If your affairs are simple, use exchanges who give good reporting

- Use crypto tax specific apps

- Koinly.io

- CryptoTaxCalculator.io

- CoinTracker.io

- (Pay the fee, it’s cheaper than an accountant working it out!)

Want to learn and watch more about cryptocurrency tax?

- Watch the full webinar recording ‘Cryptocurrency Tax Masterclass’ on our facebook page

- 6 Tips To Reduce Your Crypto Tax

- Tracking Crypto Transactions For Tax

- Tax Warning For Crypto Hobbyists

- Can You Delay Crypto Tax Bills?

Buying Commercial Property SMSF |

Inside and Outside Super

WHY WE’RE SHARING

- Ben Walker has personally been an SMSF member since 2011

- He began working with SMSFs in 2007 (before starting Inspire) and his role was heavily geared towards SMSF’s to grow people’s wealth. Since then he worked with hundreds of SMSF’s throughout his career.

- Roughly 28% of our clients have an SMSF, and of those 28%, 60% of Inspires’ SMSF clients hold some sort of property.

- He act as an advisor to many of our clients’ purchases and restructures – so when we get a client looking to buy something, we meet and discuss the best way regarding how to do this.

WHY WE’RE SHARING NOW

- COVID has knocked us all around in some way or another.

- Some businesses still rely on physical premises and still need to meet with clients face to face, for example, medical practitioners and allied health specialists

- There are other businesses that don’t rely on premises, which has dropped the supply of tenants. What we saw early on when COVID arrived is that a lot of people weren’t going to their premises – they didn’t need it when working from home and you’ve got landlords here earning a portion of the rent they used to receive, or nothing at all.

- This is an opportunity for those who need or want their own commercial property to purchase in a buyers market

- Or others who want to buy now before prices get back to “normal”.

The first thing you have to nail is your business structure. Here’s a quick overview:

Sole Trader – If you’re an individual, you may have to pay up to 47% in tax – meaning almost half of your earnings could go to the ATO.

Company – There are two different tax rates for a Company – you pay a flat tax rate of 25% or 30% (depending on how big your business is). More often than not, it’s 25%, unless you have a passive investment, then it falls in the 30% bracket.

Trust – You don’t technically pay tax in a trust. A trust is like a funnel: it doesn’t pay tax on its own. What it does is it distributes funds to the beneficiaries, which could be a sole trader or company, so you end up paying either 47% of tax, or 25% to 30%.

Self Managed Super Fund – The tax rate for SMSF is 15% or zero. The sole purpose an SMSF is established for is for retirement, so if you have investments in super and you make money there, before you retire you pay 15% on all the income in that SMSF, and once you retire it’s tax free.

Tax Concessions

One of the major concessions that we have is a 50% CGT discount: Say you sell a property and you make $100,000 capital gain – If you held that for more than 12 months you get a 50% capital gains discount. You are eligible for this if you’re trading as an individual, trust, or SMSF (although a 33% CGT discount in super), however, you don’t get this discount as a company.

What We Use

Typically we don’t recommend using individuals or companies as a structure. We prefer trusts and SMSF’s as thats where we drive more of the buying of your commercial properties – the reason why is because of the flexibility that we have in terms of tax planning in the long term, for an unknown amount of gain at purchase.

With a trust and SMSF, you can also effectively plan your asset protection strategies as well as within your family. An SMSF is fairly protected – that’s one of the big benefits to keep in mind if you ever go bankrupt. Yes, you can own your commercial property outside of super, but it is at a higher risk compared with an SMSF.

If you compare all structures, the SMSF structure has one of the best tax environments and you still get your capital gains discount. If you retire and have all these properties or shares that you’ve invested in your SMSF, then you can start selling them, you don’t need to worry about losing a huge chunk to the tax man.

LENDING OPTIONS

OUTSIDE SUPER VS. INSIDE SUPER

Lending Options Outside Super

- Slightly Less Complex Lending

Lending options outside super (so in your own name, company, trust) are slightly less complex lending. - Higher Tax Outcomes

There are also higher tax rates outside of super which is a con doing it outside of super. - Business/Personal Income To Service

There is also business or personal income to service and you can adjust for existing rent if you will owner occupy. - Can Use Other Security For Deposits

You can also use other security for deposit which is unique about lending options outside super.

Lending Options Inside Super

LRBA

For Lending options Inside Super, there is “LRBA” which is an acronym for Limited Recourse Borrowing Arrangement.

Superfunds on their own can’t really lend money from a bank as they’re not supposed to lend in their own right. There are rules where in the right conditions with the right trust set up and loan agreements and if you meet the requirements of the superannuation act, then you can actually borrow using funds with your super and receive the income in your superfund.

Super Contributions And Rental Income To Service

Estimated rental income of the property you’re purchasing along with your super contributions can be used to service the purchase of a property in your super fund. Of course tax is a better outcome on this too – either 15% or 0% depending if you’re in accumulation or pension.

Very Few Lenders (Still Good)

There are very few lenders; 2 main ones but others will consider. The form to apply for a limited recourse borrowing arrangement is less than the one to buy a home. It is however covered by different legislation, so you don’t get the consumer protection.

Typically A Higher Rate

It’s typically a higher rate for lending. Also depends how much of a loan you get as a percentage of the value of your property. If you’ve got a higher deposit on the property, you’re going to pay less on the interest rate.

Needs A Cash Deposit

You cant borrow equity from another property even if it’s another property owned in your super fund. You cannot cross collateralise or access the equity.

Cannot Borrow For Construction Costs Unless Off The Plan

For SMSF lending you can only have 1 loan for 1 asset. i.e. You can’t borrow money for the land and then separately for construction. You can borrow for the land and pay cash for the construction. Or you can buy it off the plan; so 1 contract from a developer where you pay for the land and construction in 1 contract.

Lending Options For Both (Inspire & Outside Super)

Both lending outside and inside can owner occupy for commercial property only. You cannot owner occupy residential. You can see LVR’s go to 80% both inside and outside super. (Sometimes more than 80% outside super given your industry)

Deposit Required

Deposit required depends on the lender, the postcode you are buying in, the asset type (is it an office, a warehouse, standalone free hold or part of a strata title) and the price. The higher the price, the higher the risk to the bank so they might loan you less as a % of the price.

20 – 30% + Stamp Duty

As a guide, stick to 30% + stamp duty and be surprised if they will loan you 80% value. (of course it’s just as a guide)

SMSF’s sometimes need 10% of value of property in liquid cash for lender to be comfortable once settlement has gone through.

For example you may require 30% deposit + stamp duty + and additional 10% in cash in the bank after settlement.

Buying Process

Step 1. Pre-approval

If it’s inside Super, you don’t necessarily need your SMSF set up, so you could be looking but not have an SMSF.

Step 2. After pre-approval and you want to go ahead

Set up an SMSF and bare trust. The bare trust is the lending vehicle. The lead time is 1 to 2 months to be safe for an SMSF setup and what you want to make sure is that when you’re looking to buy something, you need your structure set up to be able to sign the contract in the right name.

OR

You can set up a trust which is a shorter lead time as no there are no super roll overs or third parties to deal with in the setup. Then you can fund the deposit and make an offer subject to finance.

Finally, apply for finance with the contract and if it’s accepted, go through to settlement.

Note – we’re not mortgage brokers, this information was provided by one.

SMSF

INS & OUTS

SMSF cannot borrow to buy property directly

Bare Trust sits in the middle as a “shadow’ purchasing entity

- Lender can be a bank

- Lender can be your own cash (i.e your bucket company lends to SMSF)

The bare trust sitting in the middle is like a shadow purchasing entity. You can borrow from a bank, but you can also borrow from an entity that you control as well. If you have spare cash in a bucket company doing nothing, you could lend that using the right paperwork to your own SMSF, and then to purchase a property. The loan needs to be at commercial terms with interest charged at market value to make sure we don’t breach any superannuation rules.

Buying Outright (No Loan)

It is really simple to buy a property outright with cash and you don’t need an LRBA or bare trust.

Buying Outright (No Loan) Inside and Outside of Super (i.e., $200K Super; $1o0K Personal Funds)

There is a structure that we use, a certain type of trust we can set up where there can’t be any loans on the property, but you can use some money from super and some money from outside super.

Buying In A ‘Suit’ With 2 or more Business Partners (Can Borrow)

You need two or more business partners and this is a different type of trust we use as well, and this one can borrow money from banks etc.

OUR PRICES

Set up $3K + GST

Ongoing from $250+GST/month (3000+GST/year)

- BAS

- Admin

- ESA – Electronic Service Address, It’s a requirement of SMSF where your payroll will send information to our SMSF software to connect it all up with the ATO

- Financials

- Tax Return

- Online Portal

- SMSF Support

Other things to consider

- $350+GST Annual Audit (3rd Party)

- $3-5K Optional advice to advise on set-up

- $3K+GST Bare Trust lending entity set-up

CASE STUDY

Vet from the Bush

We had a Vet from the bush who came to us and said, “Hey, I’ve got a property that I hold outside of super, it’s about $300,000.” He also had a loan outstanding of about $150,000 – which is still a pretty good loan balance at 50% of the loan value of the property.

He said, “I just want to get rid of the bank loan. I know I have enough wealth inside and outside of super to do this, how can I re-strategise the way I hold this commercial property?” Now, this commercial property that he owns, he rents it out to his vet practice. We moved the property that was held outside of super into a Self Managed Super Fund which he paid stamp duty on the transfer. Now, he had enough money to pay out that loan within super ($150k in cash from super). He paid out the loan and the stamp duty and as he also had enough money outside of super, he leant the remaining money to his SMSF as vendor finance.

Here’s the break down:

Step 1. First we moved the property that was held outside of super into a Self Managed Super Fund.

Step 2. There was a loan outstanding on the property personally, which he paid off with cash from the SMSF.

Step 3. How he got the extra funds into his SMSF was to lend from his personal self to the SMSF as vendor finance.

What that means is that he owned the property in his SMSF but the SMSF also owed around $150k to himself outside of super. Now, that’s an important bit to understand and is key to the strategy. What he was able to do was, as his vet practice paid rental income on that property (and as he made super contributions into the self managed super fund) he could repay himself back the money that was borrowed to purchase that property.

This is key because ordinarily when you put money into super, you can’t touch it until you retire. The benefit of doing this transaction was that he was able to clear his loan but also get some money back out to himself over time.

Double your Super Fund

A client’s commercial property owned outside of super was valued at $1,000,000. The client was moving into retirement and wanted to move cash and assets into super.

He did an LRBA loan with a bank, so he moved this property into his SMSF at $1,000,000 purchase price with a $300,000 deposit from super.

As he wasn’t an owner-occupier, it was purely a commercial investment property. For the next three years, the rental income received by the super fund was completely tax-free because he met the retirement conditions. After the 3rd year, he received an offer to buy the property for $1,300,000. And as he was retired and was on a 0% tax rate, he paid no tax on that $300,000 gain effectively doubling his super balance.

Keep in mind that if he bought this commercial property at $500,000 outside of super and it was worth a $1,000,000 when he transferred it in. He’s actually required to pay CGT and stamp duty on the transfer. Due to these transactional costs, we’d need to weigh up the pros and cons in each situation.

In this instance, he made an approximate gain of $300,000 tax-free. All of these case studies are anonymous and have rounded figures for obvious privacy reasons. All in all, that was a fantastic outcome for this client and his super fund was doubled in about 3 years.

IT Business in Melbourne

A client’s business was previously renting and grew through covid.

The business owner had a good opportunity to buy commercial property near home at a purchase price of around $300,000 with their SMSF. The property needed fit-outs such as partition walls and a few other bits and pieces, which were funded through 12 months of prepaid rent by the business as his super fund wasn’t flush with cash for this extra expense.

The fittings and furniture were paid by the business to access the instant asset write-off. The client was essentially paying the same amount of rent but to his own SMSF. More importantly, the capital growth made on the property could be tax-free if sold during retirement.

Home Office to Premises

A client who operates a service business in the building industry has grown through covid. Their existing home office is hitting its limit and has begun to be a bit uncomfortable with a baby on the way.

The client purchased an $800,000 property at around 75% LVR. It required renovations which were funded by their Super fund with cash and the furniture was paid for by the business with instant asset write-offs. As a result, the client now has a lovely shopfront to take him into the next stage of his business’ growth.

Four Business Partners Buying A Property

Four business partners were looking to buy an office space and all of them have self-managed super funds. What they chose to do is purchase the commercial property together equally in their SMSF. They each took $200,000 to pay as a deposit to purchase a $750,000 property plus costs.

This was done through what we refer to as an ungeared unit trust and the purchase was fully cash funded.

Each of the business partners own 25% of the property through their share of the unit trust, thus the self-managed super funds don’t own it directly.

The unit trust essentially owns it outright, so the benefit of that is every time their rent comes through, it gets split 25% each way and if they sell that property, any capital gain made is then split up each way as well.

Watch the full webinar, ‘How to buy your office, warehouse or clinic using your super fund’ on our Facebook Page

Business Structure Tax Rates

You can use a business structure for doing anything like investing in shares, separating your assets out of your personal name. You can even run a businesses out of companies and trusts. We use that a lot with our clients here at Inspire when we are structuring their businesses where we incorporate companies and trusts into their family group. This is where we take into consideration the business structures tax rates.

A reason to incorporate trusts or companies is because of the investment in cryptocurrency. One of the big reasons why you might want to do that is because of the alarming tax rate where individuals pay up to 47% tax, depending on their income.

You will learn

- the different business structure tax rates – company, trust and SMSF’s

- what is tax planning at Inspire

- what is asset protection at Inspire

The business structure tax rates:

Company

Companies are taxed at two different rates, depending on what the company does.

- 30% Tax Rate– If it’s a purely investment company. It doesn’t run a business, a business of trading cryptocurrencies, or a business of mining cryptocurrencies. 30% tax rate is a passive investment, and not an active trading.

- 25% Tax Rate– is for small business concessions. You need to have most of the company’s income to access this lower 25% tax rate. You can see 25% is almost half of the highest marginal tax rate of an individual.

We are not saying, “Everyone, just set up a company if you’re trading,” but that is something that we might consider if we were to advise you on what structure to use for your investments.

Trust

A trust doesn’t necessarily not pay tax, but a trust gives its profit to other individuals or companies or other entities in the family group, and they pay the tax on the trust’s behalf. We do have clients who invest through trusts and they have to distribute at the end of each year the profits. The people who receive that pay the tax.

SMSFs (Self Managed Super Fund)

There are two rates of taxes for SMSFs.

- 15% Tax Rate– is what we call the Accumulation Phase where you’re growing your balance in super throughout your lifetime. Majority of Australians are in the accumulation phase, and they’ll be paying 15% tax on the profit that they make in their SMSF.

- 0% Tax Rate– is for the Pension Phase. When you’re drawing on your super at a certain age or older, and you’ve met the conditions of release for super, then you have the option for your super to be taxed at 0%.

Tax Planning

Tax planning is about your ability to be flexible and proactive with tax. We don’t get a lot of room to move for individuals but we do with companies, trusts, and especially SMSFs.

Asset Protection

At Inspire, we work with a lot of business clients and so asset protection is key with what we do. we want to make sure that the business is not in their own name as a sole trader. If the entities are set up right, we get some form of protection.

Want to learn and watch more about cryptocurrency tax?

- Watch the full webinar recording ‘Cryptocurrency Tax Masterclass’ on our facebook page

- 6 Tips To Reduce Your Crypto Tax

- Tracking Crypto Transactions For Tax

- Tax Warning For Crypto Hobbyists

- Can You Delay Crypto Tax Bills?

Watch Video: Tax Rules For Business Structures

Tracking Crypto Transactions For Tax

A very common question in our webinar registration page was, “How do I track crypto transactions for tax? We want to get it right and we don’t want to pay any more tax than we need to. We want to pay the tax we legally have to, and not a cent more.”

If your affairs are simple, there are exchanges who give good reporting. Otherwise, if you’re trading or doing anything complex, then use a crypto tax specific app namely;

- Koinly.io

- CryptoTaxCalculator.io

- CoinTracker.io

We also recommend paying the fee because it’s going to be a lot cheaper than an accountant sifting through a bucket load of your transactions. You can go through APIs and plug in your exchanges of all different accounts. All your transactions are actually fed into a tracking software. So please keep in mind to use something like that to get your tax records sorted.

Watch the full webinar, ‘Cryptocurrency Tax Masterclass’ at https://fb.watch/acHFQ4OHBc/

Get Cashed Up